Dogecoin is grinding alongside a technical fault line across the low-$0.10s, with merchants flagging a decent assist band that would outline whether or not DOGE stabilizes or slips right into a structurally weaker regime.

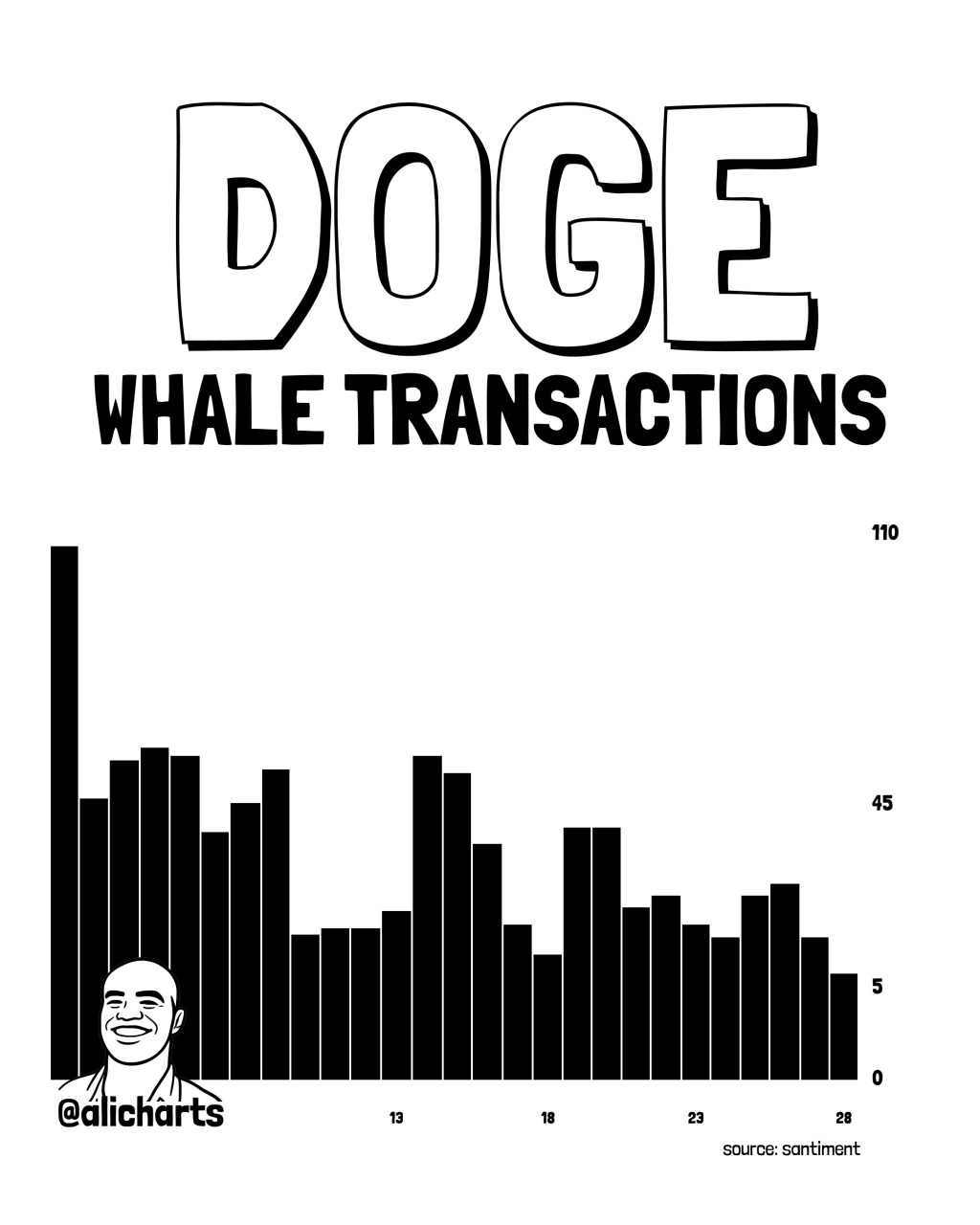

The instant setup is being framed as a high-conviction “line within the sand” by chart-focused accounts, whilst on-chain whale exercise seems to be fading quick. Ali Charts stated transactions bigger than $1 million on the Dogecoin community “dropped by 94.6%, from 109 to simply 6, over the previous 4 weeks,” pointing to a pointy pullback in large-ticket exercise throughout the identical interval DOGE has been probing assist.

This Wants To Be The Dogecoin Backside

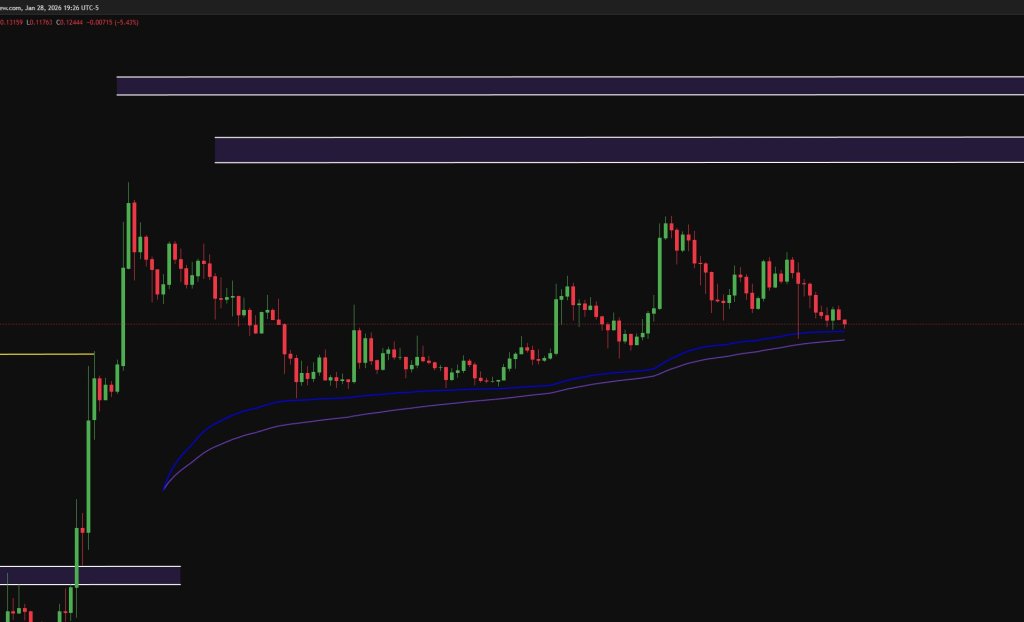

Kevin (@Kev_Capital_TA) argued that DOGE is now sitting on prime of longer-term development assist that sometimes attracts systematic consideration. “You need to see an important chart? Dogecoin is presently sitting on prime of its 2W 200 ema/sma and likewise a serious structured assist zone. The .12-.10 zone is the whole lot,” he wrote.

Associated Studying

“If there was ever a spot you wished to see a backside are available it’s in that zone in any other case issues get structurally very harmful. Efficiency can be utterly BTC dependent as ordinary.”

That framing issues as a result of it ties the commerce to 2 separate circumstances: DOGE holding an outlined worth shelf, and Bitcoin avoiding a broader risk-off transfer that would power correlation trades to unwind. In different phrases, even a “clear” DOGE degree could not maintain in isolation if BTC breaks decrease.

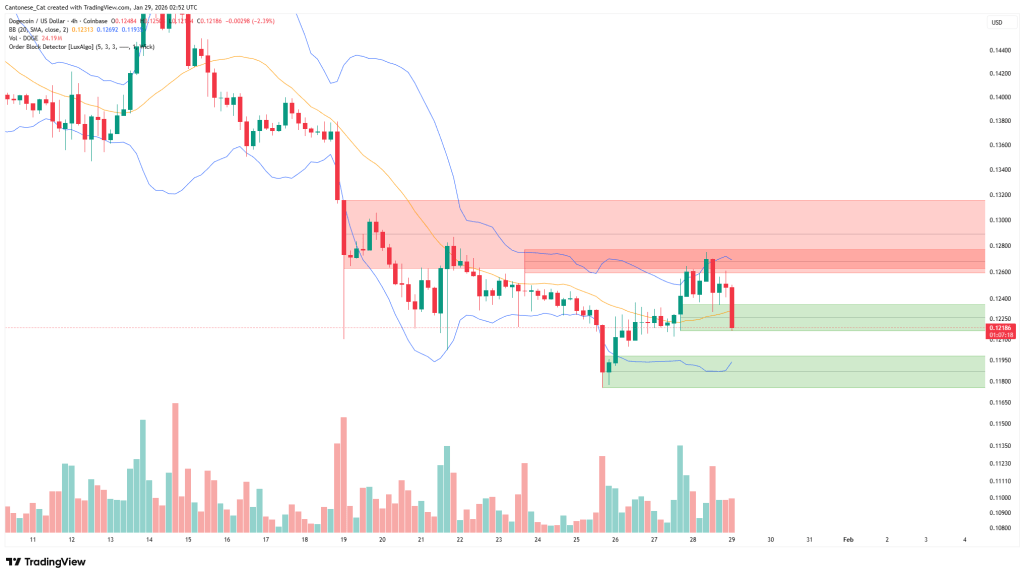

Shorter-term charts shared by Cantonese Cat (@cantonmeow) lean into the identical battleground. Posting a 4-hour Bollinger Band view, the account highlighted a push by way of native ranges into what it described as a buy-side zone: “Piercing by way of into purchase order block beneath on low quantity,” Cantonese Cat wrote at present, including, “Suppose I’m gonna purchase some DOGE tonight.”

The chart reveals DOGE falling beneath the 4-hour Bollinger Band midline. Thus, worth might drift again towards the decrease band close to $0.12, an space that overlaps with the assist zone Kevin flagged. A clear break beneath that cluster would shift the setup from “defending assist” to “danger of continuation decrease,” placing deeper draw back again on the desk.

Associated Studying

Cantonese Cat additionally posted a DOGE-versus-DXY macro comparability on Jan. 28, suggesting the broader backdrop might nonetheless assist a reflexive transfer larger if circumstances line up. “Macroenvironment favors DOGE to run up,” the account wrote. “So both DOGE doesn’t ever run up once more as a result of it doesn’t have utility, or that historical past will repeat itself.”

It’s a stark binary, but it surely captures the strain DOGE merchants are navigating: meme cash can commerce as pure liquidity beta when macro circumstances loosen, but the market can even punish property that wrestle to maintain contemporary demand as soon as the speculative impulse fades.

The subsequent transfer is more likely to be dictated by whether or not DOGE can defend the $0.10–$0.12 band whereas participation returns, both by way of renewed large-holder flows or broader danger urge for food led by BTC. If that flooring holds, merchants are positioning for a bottoming course of and a squeeze again into overhead provide.

At press time, DOGE traded at $0.121.

Featured picture created with DALL.E, chart from TradingView.com