The Bitcoin Coverage Institute’s government director, Matthew Pines, says the Trump administration’s silence on a Strategic Bitcoin Reserve (SBR) is calculated, not complacent. In a brand new interview with Natalie Brunell, he argues Washington is intentionally learning easy methods to graft Bitcoin—“digital gold”—onto the greenback system whereas geopolitical and monetary situations ripen. “Chekhov’s gun has been placed on the desk and we’re in Act One,” he mentioned, implying the coverage will stay quiet till occasions pressure a call.

Pines frames the intention bluntly: counter China’s gold accumulation by elevating Bitcoin contained in the US reserve combine. “A intelligent counter transfer could be pivoting to digital gold whereas China anchors on legacy gold,” he mentioned, noting Bitcoin is roughly “10 p.c of gold’s market cap.” He believes a 10x–20x path to parity inside about 5 years is believable if coverage catalyzes adoption.

Why The Quiet On Bitcoin?

Interagency alignment has not but crystallized. Pines says the Treasury, the White Home, the Pentagon, the intelligence neighborhood, and key Hill committees should agree earlier than an SBR can transfer. Till then, the precedence is a market-structure bundle CLARITY, which he nonetheless sees as “extra seemingly than not” to cross, although timing has slid into winter. He desires the Blockchain Regulatory Certainty Act folded in to guard open-source builders from money-transmitter guidelines. “If market construction will get handed, then extra political consideration will be dropped at bear on the Strategic Bitcoin Reserve,” he mentioned.

On acquisition mechanics, Pines factors to a “budget-neutral” route by way of the Change Stabilization Fund—created by the Gold Reserve Act—as legally believable however depending on Treasury issuing supportive opinions. “It’s important to construction the transaction in the fitting solution to purchase Bitcoin,” he mentioned. For now, officers are in “examine” mode slightly than execution.

Stablecoins are the bridge on this technique, not the vacation spot. Pines describes their rise as a market phenomenon later harnessed by policymakers: with issuer reserves held in short-term Treasuries, stablecoins grow to be a structural purchaser of US debt whereas deepening world greenback utilization. The sector is just too small at this time to shoulder that position, he mentioned, however might scale into the trillions below an on-shore regime—shopping for time to modernize the reserve combine with Bitcoin.

Personnel alerts level to a national-security lens. Pines highlights Patrick Witt’s transfer to steer the President’s Working Group on Digital Belongings after serving on the Pentagon’s Workplace of Strategic Capital, which has authority to deploy massive sums into vital applied sciences. He expects much less public signaling and extra behind-the-scenes planning: “I’m not anticipating huge acquisitions… imminently. However the Overton window has now dramatically shifted.”

Implausible dialog with Matthew Pines. We cowl:

– International forex chess

– What to anticipate from D.C. on Bitcoin

– China’s embrace of gold settlement for commerce

– Are we in a simulation?Timecodes:

00:00 U.S. Authorities & Bitcoin Replace

8:49 Recreation Concept and Stablecoins

12:50… pic.twitter.com/SdIYCYP1PJ— Natalie Brunell (@natbrunell) October 7, 2025

Notably, hypothesis round US intent continues. In an October 8 put up on X, CleanSpark’s Matthew Schultz mentioned he mentioned the Market Construction invoice and the SBR with senior officers.

Through X, he revealed, “Simply completed a small dinner with Secretary Bessent and Chairman Scott. We talked concerning the Market Construction invoice. We talked concerning the economic system. We talked concerning the 11 finalists for the Chair of the Fed, and we talked concerning the Strategic Bitcoin Reserve. The US holds about $17B of Bitcoin and ‘is not going to promote’ and plans to proceed to build up. […] no different ‘crypto’ or AI people have been right here.”

Simply completed a small dinner with Secretary Bessent and Chairman Scott. We talked concerning the Market Construction invoice. We talked concerning the economic system. We talked concerning the 11 finalists for the Chair of the Fed, and we talked concerning the Strategic Bitcoin Reserve.

The US holds about…

— S Matthew Schultz (@smatthewschultz) October 8, 2025

In the meantime, US Senator Lummis confirmed the continued effort for a SBR earlier this week. “Legislating is a slog and we proceed to work towards passage. However, because of President Trump, the acquisition of funds for an SBR can begin anytime,” Lummis posted on X.

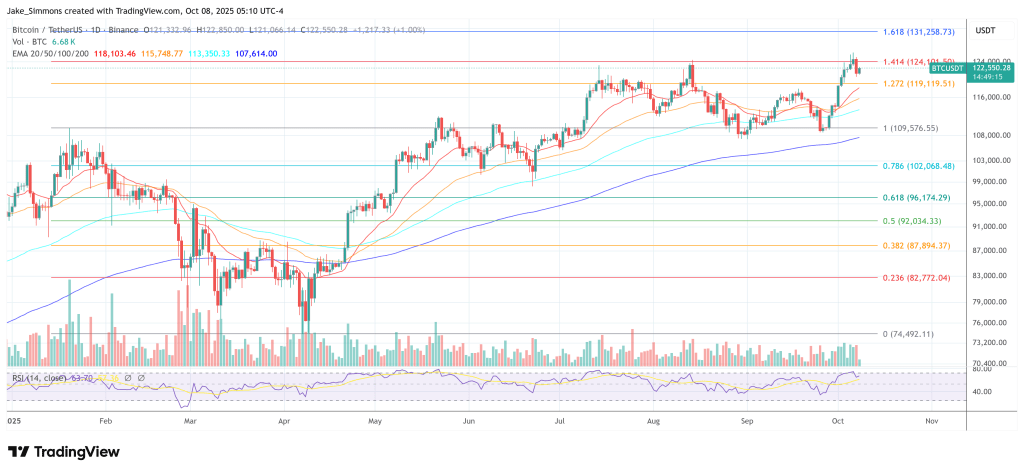

At press time, BTC traded at $122,550.

Featured picture created with DALL.E, chart from TradingView.com

Editorial Course of for bitcoinist is centered on delivering totally researched, correct, and unbiased content material. We uphold strict sourcing requirements, and every web page undergoes diligent overview by our group of high expertise consultants and seasoned editors. This course of ensures the integrity, relevance, and worth of our content material for our readers.