Este artículo también está disponible en español.

The stagnation of the Bitcoin worth regardless of the primary fee lower by the US Federal Reserve since 2020 has perplexed many traders and merchants throughout the market. In a brand new submit on X, Andrew Kang, CEO of Mechanism Capital addressed the disproportionate emphasis that market individuals have positioned on Federal Reserve fee cuts and financial stimulus in China.

Why Is Bitcoin Stagnating?

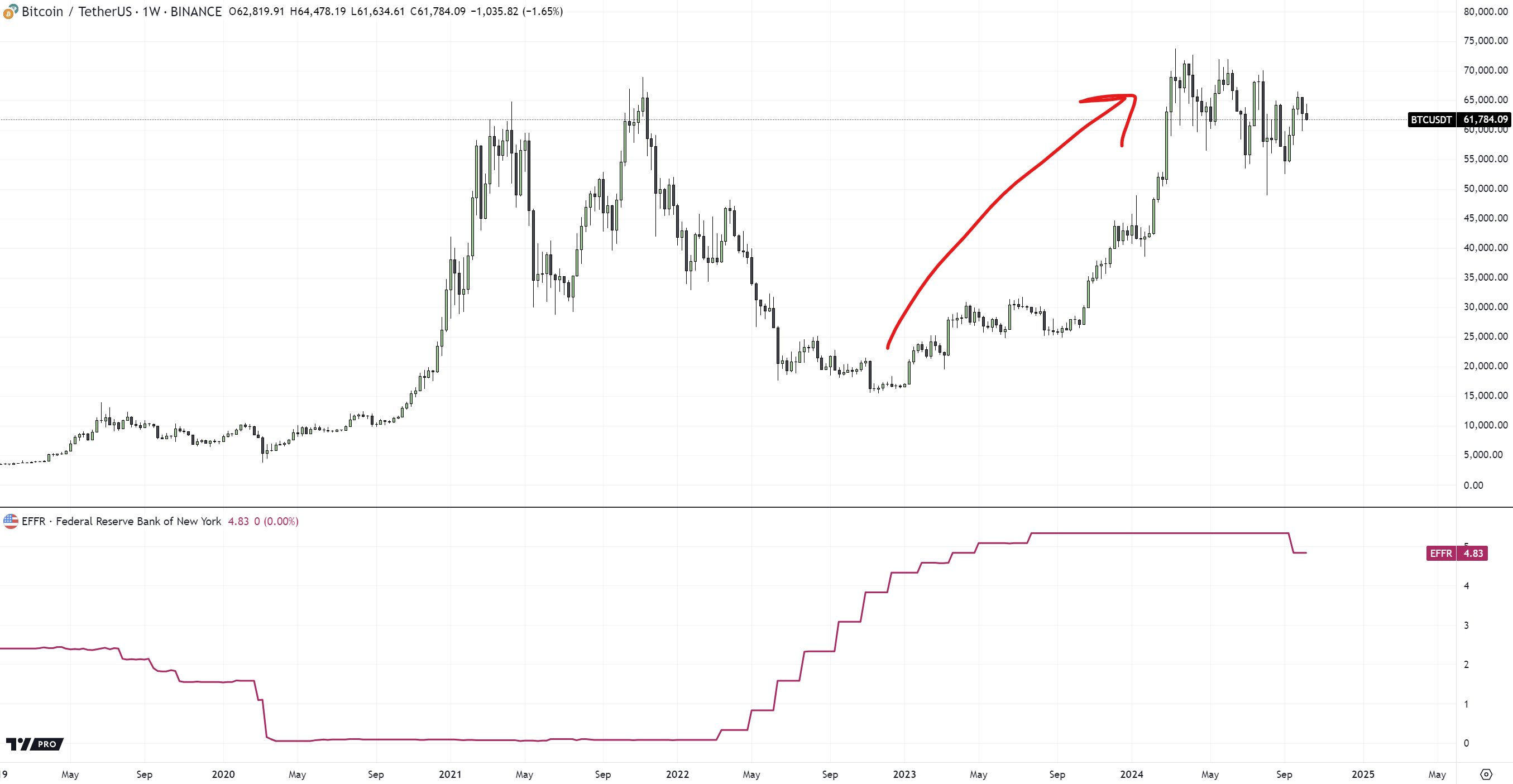

Kang challenges the prevalent market perception that rate of interest cuts by the Federal Reserve will considerably increase Bitcoin and crypto costs. “Fed charges are solely one of many components that influence world liquidity, and world liquidity itself is simply one of many components that affect crypto costs,” he acknowledged. Kang finds it “nonsensical to see BTC rally 4.5x throughout a interval the place charges had been going to and at multi-decade highs—displaying little correlation between charges and BTC—after which anticipate a robust inverse correlation to current itself as quickly as charges begin taking place.”

Associated Studying

He acknowledges that some argue future fee modifications are already priced into the market however counters that this logic ought to apply equally to fee hikes and cuts. “This isn’t to say that charges are usually not essential, however moderately that they’re properly overweighted by most market individuals,” Kang added. He notes that equities have a stronger tie to rates of interest as a result of components like low cost charges utilized in valuing money flows and mature company debt markets used to finance progress.

Addressing China’s latest financial stimulus, Kang observes that its influence on Bitcoin and crypto is even much less vital than many imagine. “It’s not stunning to see that the individuals extrapolating China stimulus as being extraordinarily bullish for crypto are primarily non-Chinese language,” he commented. In line with Kang, these inside China have famous a shift from crypto investments to A-shares within the inventory market.

Supporting his declare with knowledge, Kang identified, “Since Chinese language stimulus was introduced, USDT has traded to a reduction to CNY. Nonetheless at 3% as of latest.” This implies a decreased demand for the premier stablecoin Tether (USDT) in China, aligning with a transfer in direction of conventional equities.

Regardless of his critiques, Kang clarifies that he’s not bearish on Bitcoin. “I simply assume that some individuals have gotten over their skis a bit,” he remarked. Kang anticipates Bitcoin buying and selling inside a spread of $50,000 to $72,000 till a major new catalyst emerges.

Associated Studying

Nevertheless, he stays optimistic about alternatives throughout the market, stating, “The fixed rotation of capital and new initiatives being developed means there’ll nonetheless be cash to purchase to generate returns as a bull.” Nonetheless, Kang warns of potential volatility as a result of leveraged positions: “The market will nonetheless be liable to smaller corrections if leverage will get too excessive (decently excessive proper now).”

Participating with the neighborhood, X person Jakubko (@erkousti) urged that Bitcoin’s 2023 worth improve is extra related to anticipation of an ETF launch than rates of interest. Kang concurred, responding, “That’s precisely my level. Rates of interest are solely a small piece of the puzzle. Though they had been destructive for BTC, different components just like the ETF had been in a position to drive BTC worth increased. Different components may drive it increased or decrease right here. We’re not assured infinity costs simply due to fee cuts.”

Echoing this sentiment, crypto analyst Astronomer (@astronomer_zero) commented, “I imagine rates of interest (and yield inversion) solely have a negligible influence on worth. They’re moderately a holistic metric essential for bond market gamers. However the zero-effect on shares or crypto is confirmed already.”

One other analyst, Res (@resdegen), highlighted the correlation between Bitcoin and financial provide: “BTC is extra correlated to the amount of cash than rates of interest. It began to rise because the RRP decreased, which ended up in internet optimistic liquidity, no matter rates of interest, which had been certainly near the highest.”

At press time, BTC traded at $60,903.

Featured picture created with DALL.E, chart from TradingView.com