Bitcoin crashed by means of the important thing psychological degree of $100,000, taking the remainder of the crypto market with it.

Abstract

- Bitcoin fell under the important thing psychological degree of $100k

- This was the bottom level for the BTC worth since June

- Shares of Technique have been down 6%, mirroring the BTC worth

Why? Concern is as soon as once more operating the crypto markets. Towards the backdrop of a authorities shutdown, merchants are fleeing from threat belongings.

For the primary time since July, Bitcoin plunged under $100,000, triggering a broader crypto market sell-off. The decline got here after worsening macro circumstances triggered a wave of liquidations and ETF flows.

On Tuesday, Nov. 4, the BTC worth reached a day by day low of $99,954, the bottom degree in a number of months. The worth has since rebounded to $100,269, with Bitcoin registering a 6% day by day decline. The drop triggered a big decline, with the crypto market cap shedding 6.4% — or over $300 billion in worth.

$100,000 served a key psychological degree for BTC, particularly because the token held above it for months. The final time the BTC worth was under $100,000 was on June 23, when it reached a day by day low of $99,705.

Why did Bitcoin plummet?

The decline occurred after macro circumstances worsened, decreasing urge for food for threat belongings. Threats of latest tariffs, in addition to the possible pause to new Federal Reserve fee cuts, made crypto belongings much less engaging to buyers.

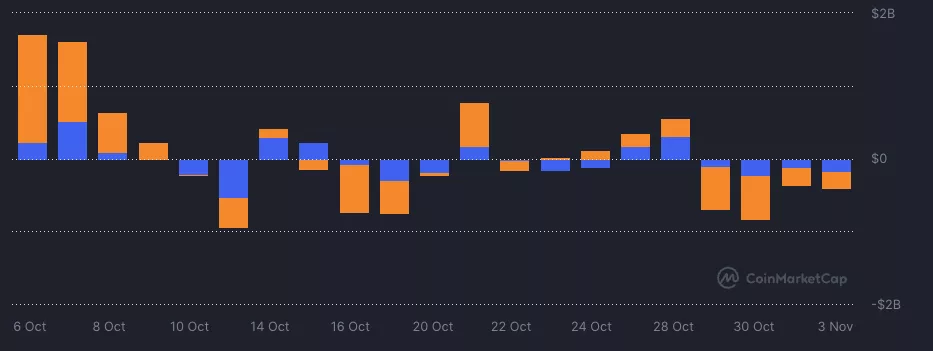

This outlook then brought on a cascade of results that culminated in constant ETF outflows and a spike in liquidations.

For one, Bitcoin (BTC) and Ethereum (ETH) ETFs are on monitor to register their fifth consecutive day of adverse flows. On the similar time, 24-hour liquidations reached $1.4 billion on Nov. 4, with longs dominating with $1 billion.

After Bitcoin’s worth fell under this key degree, additional breakdown is feasible. Merchants might be wanting on the $98,000 assist degree, which is each the low finish and a high-liquidity zone.

In the meantime, the U.S. greenback has rebounded barely because the Fed minimize rates of interest in September.