An analyst has defined when Bitcoin might probably attain a backside, primarily based on the historic sample adopted by its value throughout cycles.

Bitcoin Has Tended To Take 364 Days From Main Tops To Bottoms

In a brand new thread on X, analyst Ali Martinez has mentioned about what historical past might trace about when Bitcoin would possibly attain a backside within the present cycle. “Bitcoin $BTC main cycles have adopted a surprisingly constant rhythm, each in timing and depth,” famous Martinez.

Under is a chart shared by the analyst that highlights among the similarities that the previous couple of BTC cycles have shared.

As is seen within the graph, the quarterly value of Bitcoin has taken roughly 1,064 days to succeed in the highest from the underside of the earlier bear market over the past three cycles. That is naturally assuming that the cryptocurrency’s excessive above $126,000 was the highest for the present cycle.

The space from the highest to the following backside was additionally related within the 2017 and 2021 cycles on the cryptocurrency’s quarterly chart, coming at about 364 days. “If this sample holds, Bitcoin $BTC is now inside that 364-day correction window, which factors to a possible backside round October 2026,” defined Martinez.

Within the chart, the analyst has additionally highlighted a potential backside goal for Bitcoin, primarily based on, as soon as once more, the sample from the earlier cycles. The 2018 bear market reached its low after a drawdown of 84.22% from the bull market high, whereas the 2022 bear concerned a decline of 77.57%.

Martinez has drawn a drawdown of 70% for the present cycle, which might put the worth goal on the $37,500 stage. It now stays to be seen whether or not this cycle will observe a trajectory something just like the final cycles or if the asset will go a unique path this time round.

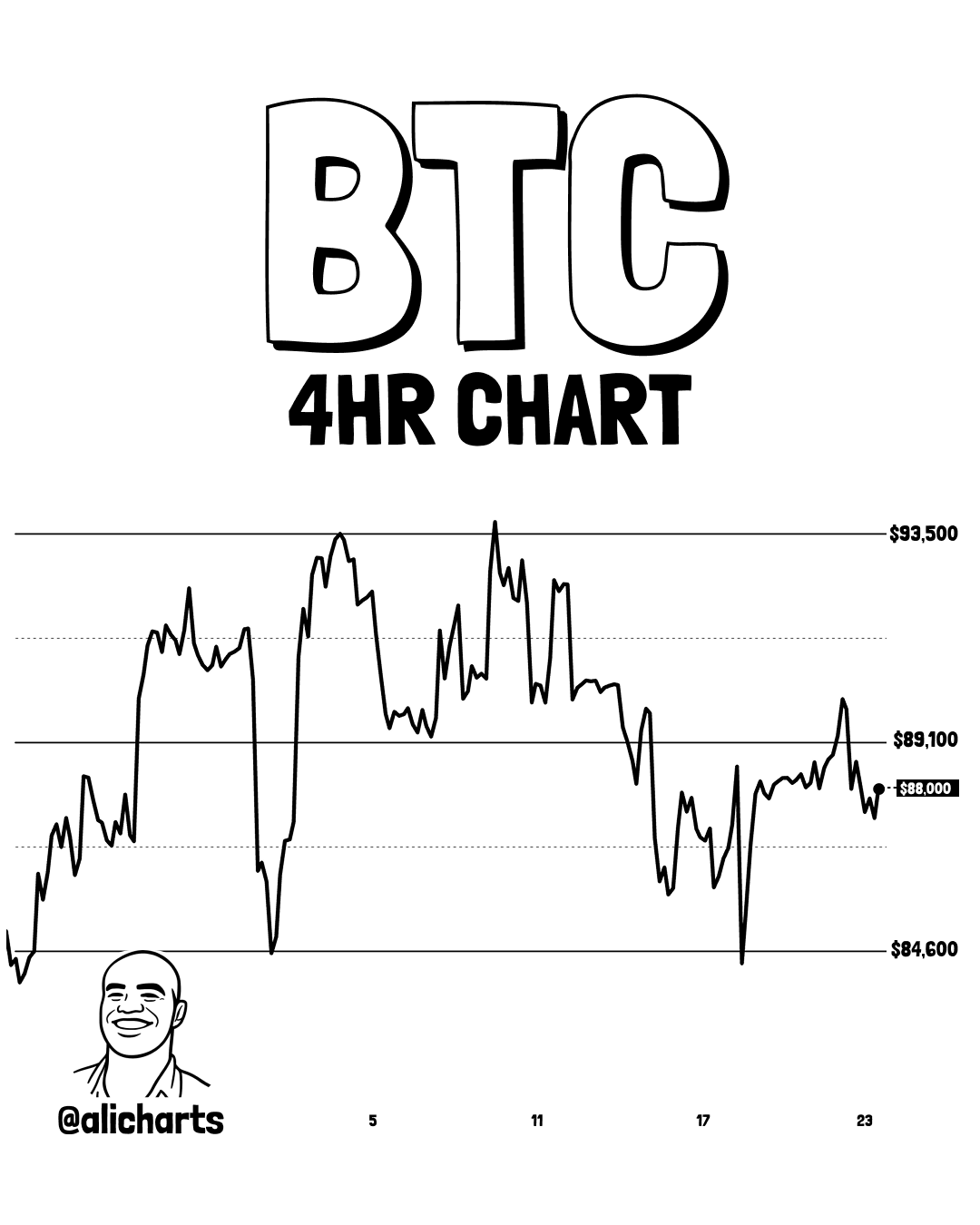

The chart for the Bitcoin cycles is showcasing the long-term development of the asset utilizing its quarterly value, however what in regards to the short-term path? In one other X publish, the analyst has shared the 4-hour chart for BTC, highlighting a technical evaluation (TA) sample forming on a brief scale.

As displayed within the above chart, Bitcoin has probably been following a Parallel Channel on its 4-hour value throughout the previous couple of weeks. A Parallel Channel seems at any time when an asset observes consolidation between two parallel trendlines, with the decrease stage appearing as assist and higher one as resistance.

The cryptocurrency retested the decrease line of this Parallel Channel final week, which led to a rebound as assist held up. The asset has since returned to the center zone of the sample, suggesting there isn’t any clear bias in both path proper now.

BTC Value

On the time of writing, Bitcoin is floating round $87,300, up 0.7% within the final seven days.