- ETH plunged more durable than BTC regardless of ‘anticipated’ ETF catalyst by mid-July

- Combined views by analysts on how the market will obtain the ETH ETF amidst destructive sentiment.

Ethereum [ETH] wasn’t spared within the ongoing market rout regardless of a possible ETF launch by mid-July.

The second-largest digital asset shed over $500 because the 1st of July, dropping from $3.4K to a low of $2.8K, erasing all positive aspects netted after partial ETF approval in Could.

Nonetheless, Ethereum educator Sassal claimed that there was ‘no bearish’ issue other than doable outflows from Grayscale’s ETH belief, ETHE.

“This whole run has now been retraced because the ETFs received authorised on Could twenty third…The primary overhang for ETH proper now, in my view, is the doable Grayscale ETHE outflows.”

He added that there have been “basic causes to be bearish going ahead” and cited doable tailwinds from rising regulatory readability and sure Fed charge cuts in later 2024.

ETH dropped more durable than BTC

Regardless of Sassal’s optimistic view, the latest dump hammered ETH greater than BTC. On the weekly entrance, as of press time, BTC was down about 11%, whereas ETH declined 14%.

Supply: ETH vs. BTC weekly drawdowns, TradingView

The unproportionate decline was unprecedented and baffled some merchants, given the anticipated ETH ETF launch in two weeks.

Some market observers claimed that ETH’s laborious dump was as a result of an absence of a powerful narrative. One other person, Evans, steered that the market was risk-off and that potential ETHE outflows may dent the ETH ETF’s expectations.

“Everybody fears grayscale unlock (extra impactful in low-volume summer season). The market is risk-off, and everybody expects little to no demand for ETH out of the gate.”

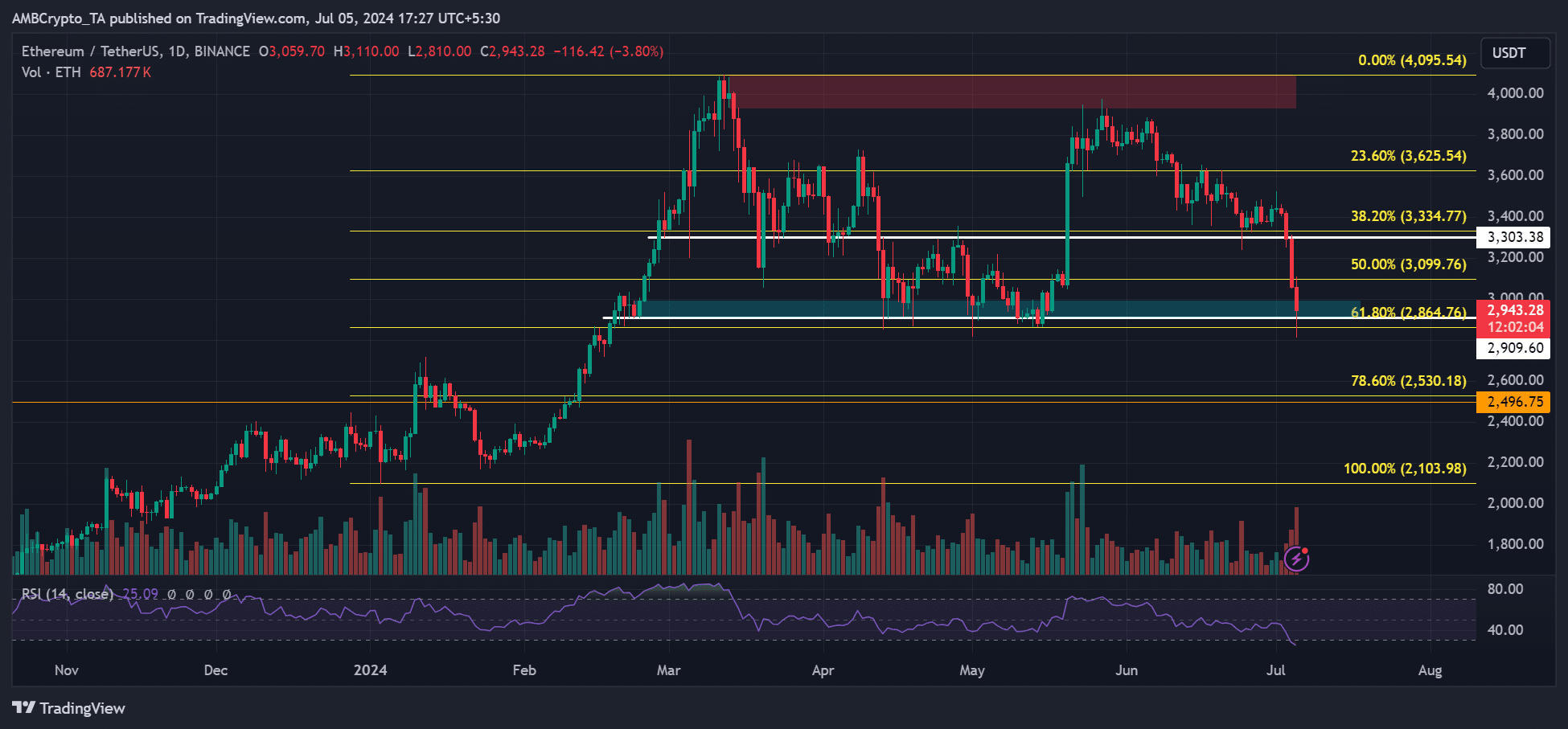

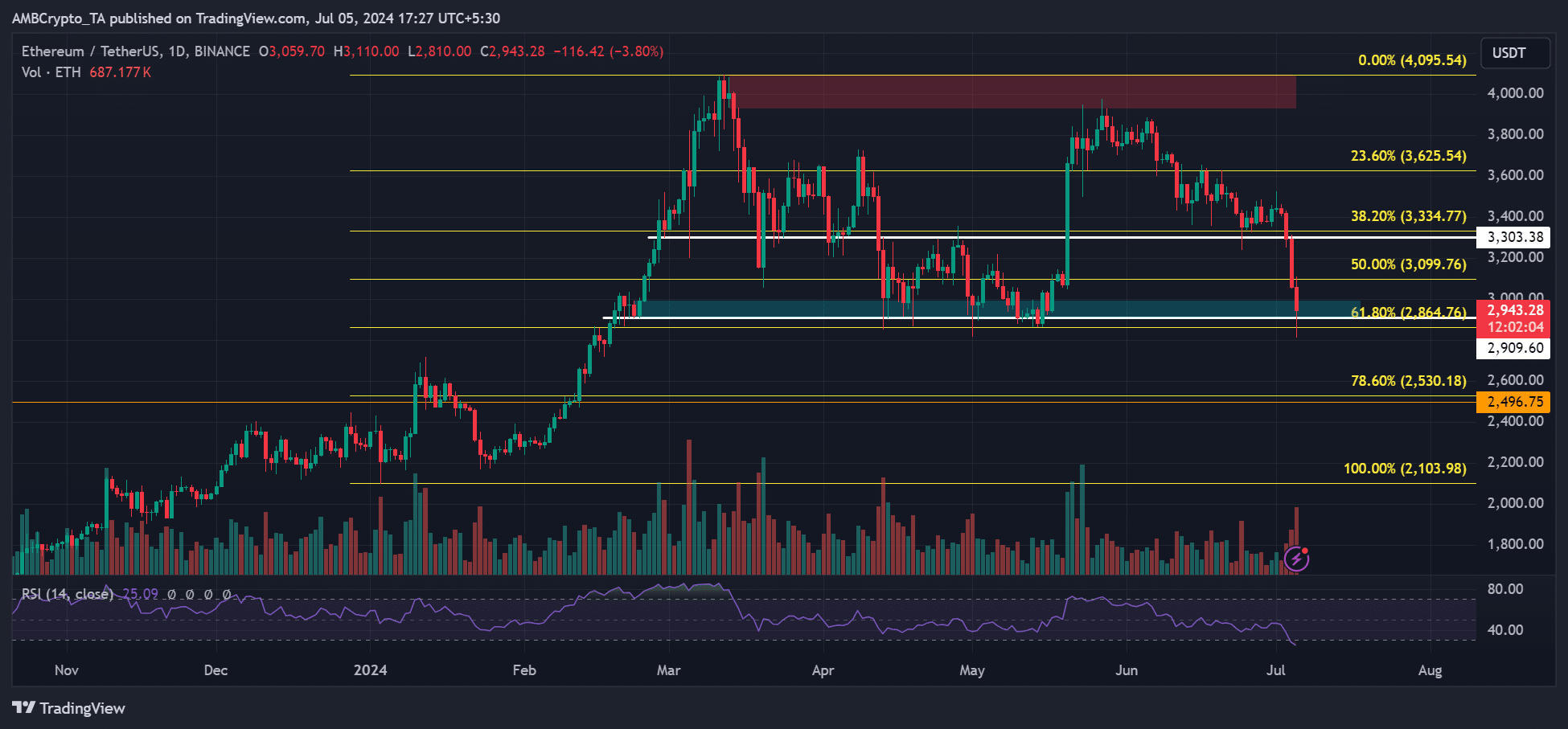

Within the meantime, ETH pullback hit the golden zone at 61.8% Fibonacci retracement degree, based mostly on the 2024 lows and highs.

Supply: ETH/USDT, TradingView

The 61.8% Fib degree ($2.8k) doubled as a each day order block (marked cyan) and has been an important assist within the first half of 2024. Whether or not the assist maintain may depend upon Bitcoin’s [BTC] subsequent transfer.

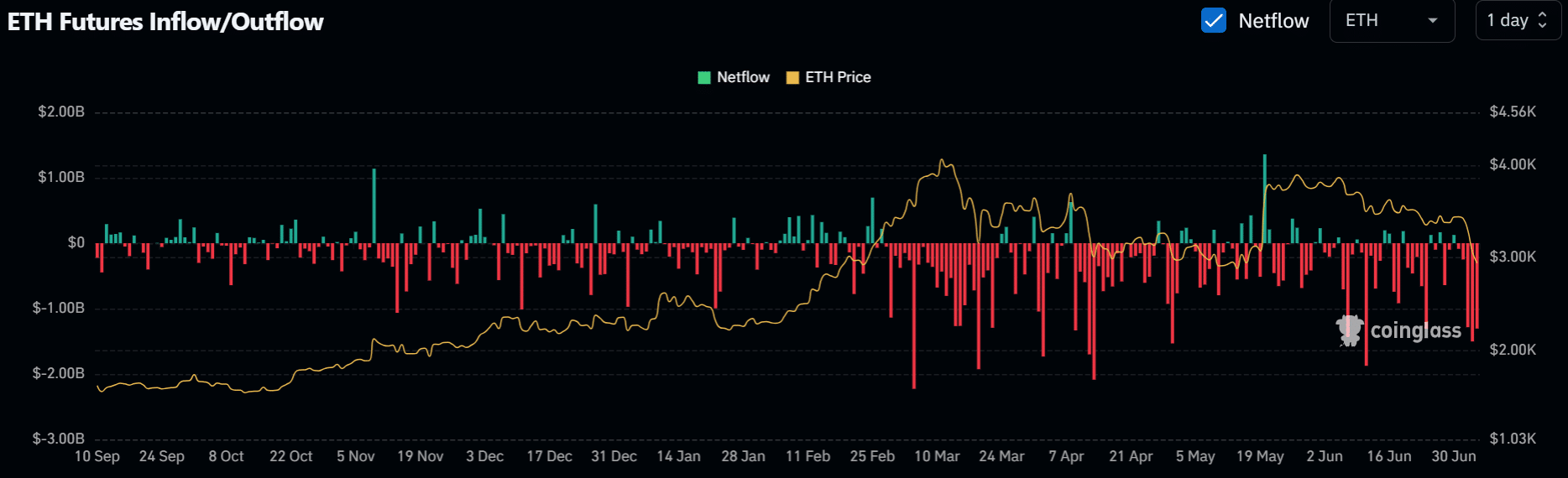

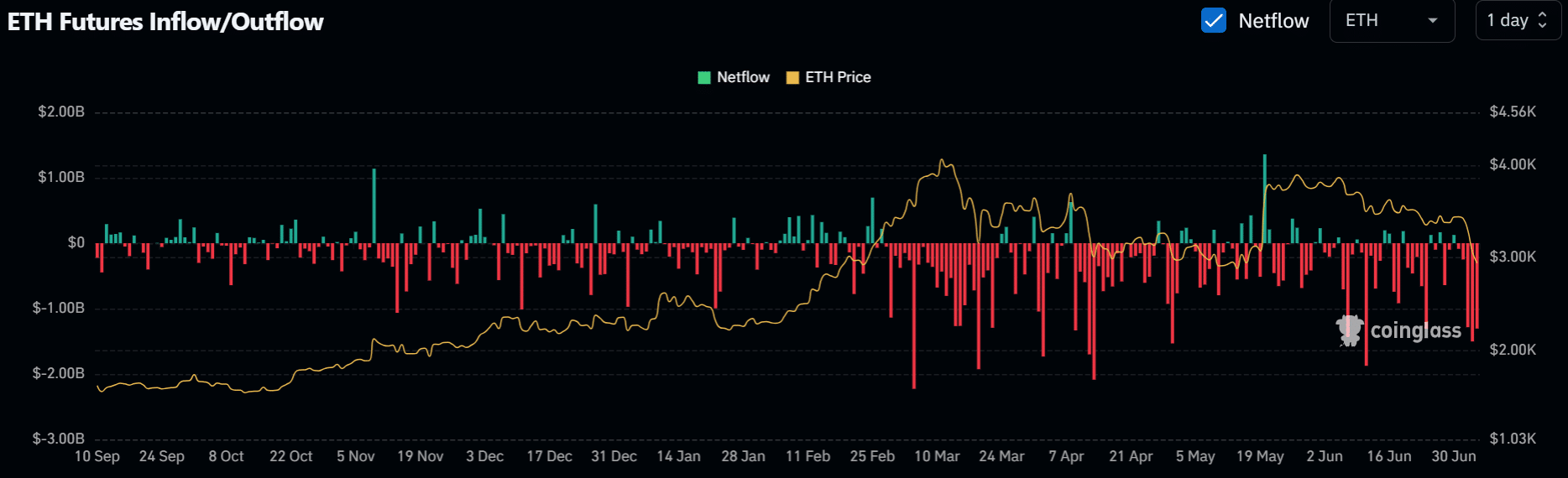

Nonetheless, traders’ risk-off strategy was additional reiterated by destructive outflows within the derivatives market.

Because the 1st of July, ETH has seen internet outflows totaling $4.5 billion, per Coinglass knowledge, underscoring the bearish sentiment and doable lukewarm reception to the ETF launch.

Supply: Coinglass

Nonetheless, a latest Bloomberg report famous that crypto market sentiment may solely enhance if the Fed turns dovish and presents “one or two curiosity cuts.”