Simply if you thought the year-end could not get any extra intriguing, a major choices expiry is ready to shake issues up on this extremely levered-up market.

Choices are by-product contracts that give the purchaser the suitable to purchase or promote the underlying asset at a preset value at a later date. A name offers the suitable to purchase, and a put confers the suitable to promote.

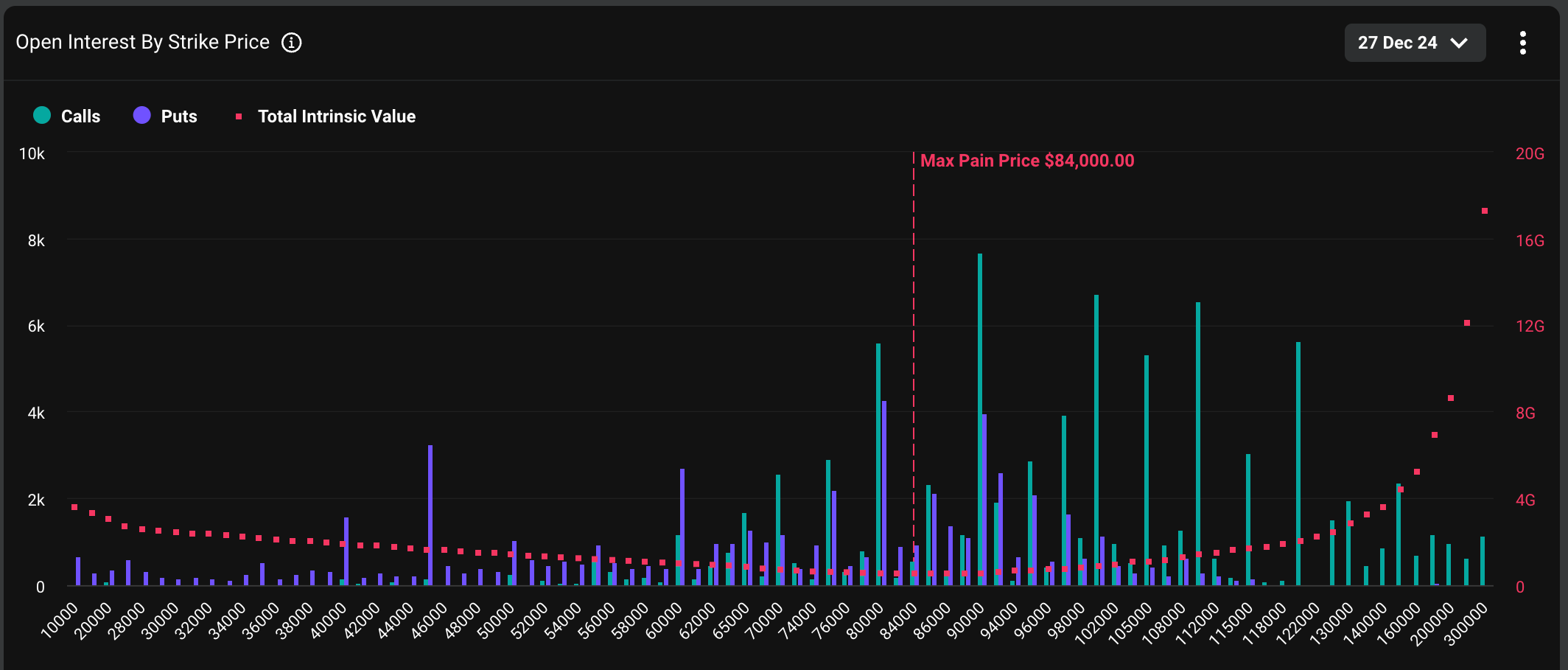

On Friday at 8:00 UTC, 146,000 bitcoin choices contracts, valued at almost $14 billion and sized at one BTC every, will expire on the crypto trade Deribit. The notional quantity represents 44% of the entire open curiosity for all BTC choices throughout completely different maturities, marking the most important expiry occasion ever on Deribit.

ETH choices price $3.84 billion will expire as nicely. ETH has dropped almost 12% to $3,400 for the reason that Fed assembly. Deribit accounts for over 80% of the worldwide crypto choices market.

Vital OI to run out ITM

As of writing, Friday’s settlement seemed set to see $4 billion price of BTC choices, representing 28% of the entire open curiosity of $14 billion, expire “within the cash (ITM),” producing a revenue for patrons. These positions could also be squared off or rolled over (shifted) to the subsequent expiry, doubtlessly inflicting market volatility.

“I think a good bit of open curiosity in BTC and ETH might be rolled into Jan. 31 and Mar. 28 expiries as the closest liquidity anchors at the beginning of the brand new 12 months,” Simranjeet Singh, portfolio supervisor and dealer, at GSR stated.

It must also be famous that the put-call open curiosity ratio for Friday’s expiry is 0.69, which means seven put choices are open for each 10 calls excellent. A comparatively larger open curiosity in calls, which gives an uneven upside to the client, signifies that leverage is skewed to the upside.

The problem, nonetheless, is that BTC’s bullish momentum has run out of steam since final Wednesday’s Fed resolution, the place Chairman Jerome Powell dominated out potential Fed purchases of the cryptocurrency whereas signaling fewer fee cuts for 2025.

BTC has since dropped over 10% to $95,000, in response to CoinDesk indices information.

Which means that merchants with leveraged bullish bets are liable to magnified losses. In the event that they determine to throw within the towel and exit their positions, it might result in extra volatility.

“The beforehand dominant bullish momentum has stalled, leaving the market extremely leveraged to the upside. This positioning will increase the chance of a fast snowball impact if a major draw back transfer happens,” Deribit’s Chief Govt Officer Luuk Strijers informed CoinDesk.

“All eyes are on this expiry, because it has the potential to form the narrative heading into the brand new 12 months,” Strijers added.

Directional uncertainty lingers

Key options-based metrics present there’s a noticeable lack of readability out there relating to potential value actions because the report expiry nears.

“The much-anticipated annual expiry is poised to conclude a outstanding 12 months for the bulls. Nonetheless, directional uncertainty lingers, highlighted by heightened volatility of volatility (vol-of-vol),” Strijers stated.

The volatility of volatility (vol-of-vol) is a measure of fluctuations within the volatility of an asset. In different phrases, it measures how a lot the volatility or the diploma of value turbulence within the asset itself fluctuates. If an asset’s volatility modifications considerably over time, it has a excessive vol-of-vol.

A excessive vol-of-vol usually means elevated sensitivity to information and financial information, resulting in fast modifications in asset costs, necessitating aggressive place adjustment and hedging.

Market extra bearish on ETH

How choices due for expiry are at the moment priced reveals a extra bearish outlook for ETH relative to BTC.

“Evaluating the vol smiles of the [Friday’s] expiration between right this moment and yesterday, we see that BTC’s smile is nearly unmoved, whereas ETH’s implied vol of calls has dropped considerably,” Andrew Melville, analysis analyst at Block Scholes.

A volatility smile is a graphical illustration of the implied volatility of choices with the identical expiration date however completely different strike costs. The drop in implied volatility for ETH calls means decreased demand for bullish bets, indicating a subdued outlook for Ethereum’s native token.

That is additionally evident from the choices skew, which measures how a lot buyers are keen to pay for calls providing an uneven upside potential versus places.

“After greater than every week of poorer spot efficiency, ETH’s put-call skew ratio is extra strongly bearish (2.06% in favour of places in comparison with a extra impartial 1.64% in the direction of requires BTC),” Melville famous.

General, end-of-year positioning displays a reasonably much less bullish image than we noticed going into December, however much more starkly for ETH than BTC,” Melville added.