TRX is displaying exceptional power because the broader crypto market accelerates, with Bitcoin testing a brand new all-time excessive and altcoins following intently behind. Amid this renewed momentum, prime analyst Darkfost shared key insights highlighting that TRX’s underlying pattern now not wants affirmation — it stays clearly constructive. The asset has maintained a gentle bullish construction even by durations of consolidation, suggesting a powerful basis for the following transfer.

Associated Studying

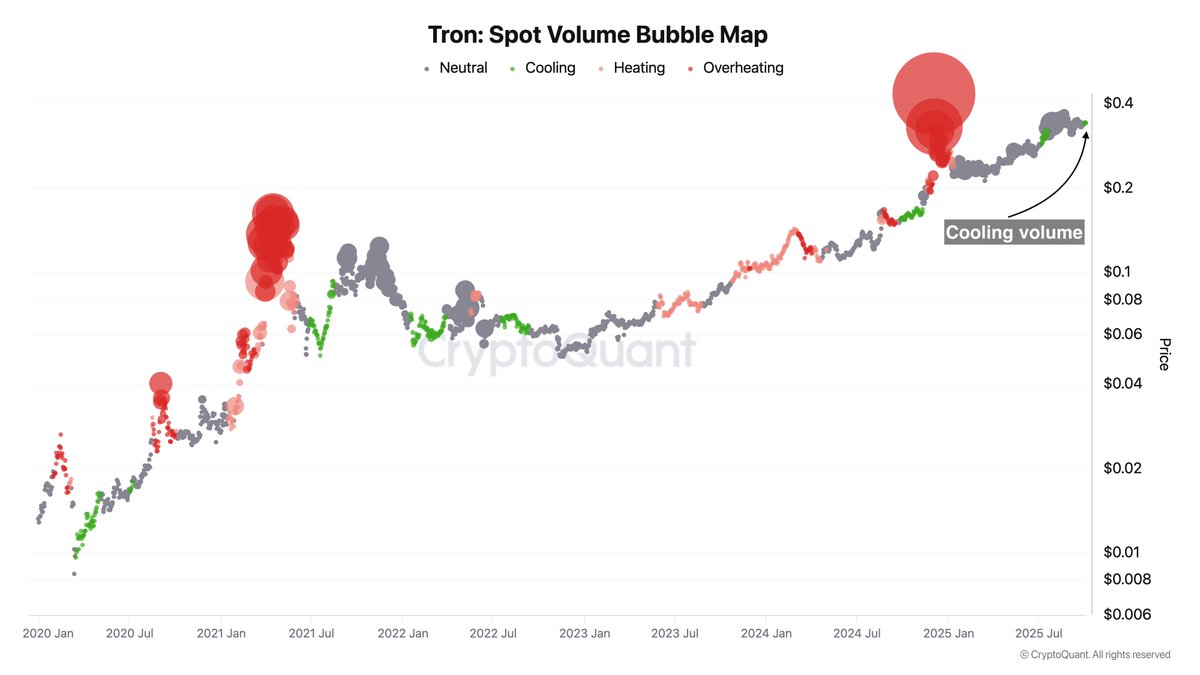

Darkfost additionally identified {that a} notably fascinating sign has now appeared — one which traditionally precedes a brand new part of acceleration for TRX. This sign, based mostly on buying and selling quantity dynamics, displays a cooling-off interval that usually marks the calm earlier than a significant breakout. Earlier occurrences of comparable setups have led to substantial rallies, reinforcing rising optimism amongst merchants.

Because the market regains momentum, TRX stands out for its constant resilience and regular efficiency. The mix of a strong long-term uptrend and favorable onchain metrics is fueling expectations of a potential breakout within the days forward. With Bitcoin main sentiment and altcoins gaining traction, TRX might be positioning itself as one of many strongest performers on this part of the crypto market.

TRX Market Construction: Cooling Volumes Trace at a Potential Breakout

In accordance with Darkfost, the Spot Quantity Bubble Map — a instrument that visualizes durations of buying and selling quantity enlargement and contraction — is presently flashing a notable cooling sign for TRX. The indicator exhibits that spot volumes have dropped considerably over the previous few periods, a sample that usually precedes renewed volatility. Whereas low exercise may seem to be a scarcity of market curiosity, historical past suggests in any other case for TRX.

Darkfost notes that related circumstances have often preceded main bullish strikes. As an illustration, in July 2021, when TRX’s volumes cooled sharply, the value quickly surged from $0.05 to $0.12. A comparable setup occurred once more in October 2024, adopted by a formidable rally from $0.15 to $0.43. In each instances, a decline in buying and selling exercise was not an indication of weak point — it was the setup part for accumulation by long-term gamers positioning forward of the following breakout.

The present cooling part, due to this fact, may symbolize a consolidation interval fairly than the tip of momentum. As worth motion stabilizes and volatility compresses, TRX is forming a powerful assist base, permitting good cash to quietly accumulate positions. If market liquidity returns with Bitcoin and altcoins pushing increased, this construction might function the springboard for a short-term rebound — or doubtlessly the beginning of a brand new acceleration part for TRX.

Associated Studying

TRX Value Evaluation: Consolidation Earlier than Potential Upside

TRX is presently buying and selling round $0.344, displaying resilience because it consolidates close to short-term resistance. The chart reveals a gentle restoration from late September lows close to $0.32, with worth now stabilizing above each the 50-day and 200-day transferring averages, signaling a wholesome medium-term construction.

The 50-day MA (blue) is beginning to curve upward, suggesting renewed momentum, whereas the 200-day MA (crimson) continues to offer a powerful long-term assist base. This setup mirrors a number of earlier consolidation phases the place TRX constructed power earlier than breaking increased. The inexperienced 100-day MA additionally aligns intently with present worth motion, forming a convergence zone that usually precedes volatility enlargement.

Associated Studying

Resistance stays at $0.35–$0.36, a key stage that has repeatedly capped upside makes an attempt since early September. A confirmed breakout above this zone might open the door towards $0.38–$0.40, resuming the broader bullish pattern seen earlier within the 12 months. On the draw back, speedy assist lies close to $0.33, adopted by $0.32, which has held agency by a number of retests.

Featured picture from ChatGPT, chart from TradingView.com