Cause to belief

Strict editorial coverage that focuses on accuracy, relevance, and impartiality

Created by business consultants and meticulously reviewed

The best requirements in reporting and publishing

Strict editorial coverage that focuses on accuracy, relevance, and impartiality

Morbi pretium leo et nisl aliquam mollis. Quisque arcu lorem, ultricies quis pellentesque nec, ullamcorper eu odio.

Este artículo también está disponible en español.

Costs for bitcoin skyrocketed to the $97,000 degree in the present day, rising greater than 2% and shutting in on the symbolic $100,000 degree. The cryptocurrency is in its persevering with surge that has gotten buyers enthusiastic to date in 2025.

Associated Studying

Market Previous Timer Forecasts Important Worth Goal

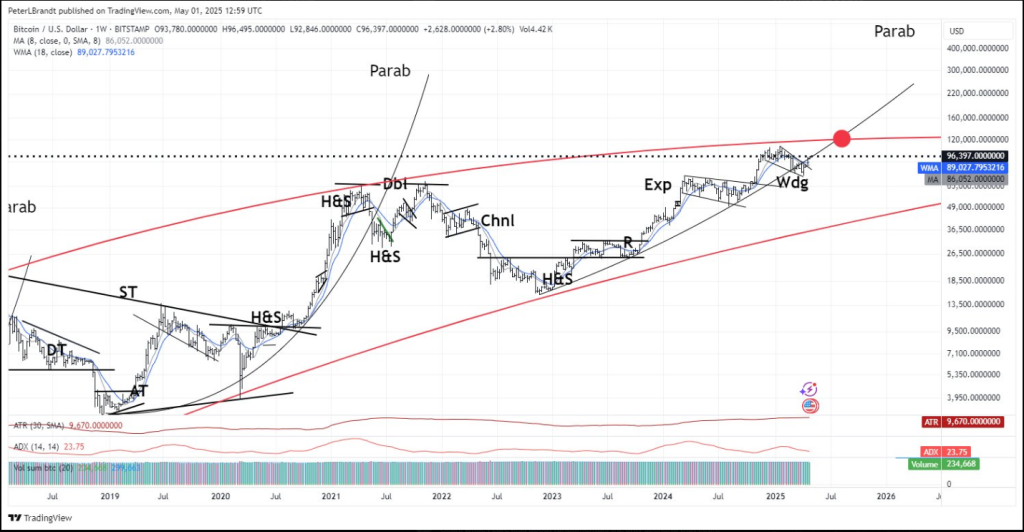

In response to buying and selling analyst Peter Brandt, Bitcoin might rise to $125,000 to $150,000 come late summer time or early autumn. His forecast, made in social media posts a number of hours previous to this report, is that the rise might happen in August or September 2025.

That is based mostly on Bitcoin efficiently re-taking what Brandt refers to as its “parabolic trendline” – a technical chart sample which demarcated earlier value cycles.

The potential transfer from the current ranges close to $96,000 to Brandt’s increased goal of $150,000 would quantity to a 56% return for consumers at in the present day’s costs.

Hey @scottmelker

If Bitcoin can regain the damaged parabolic slope then $BTC is on track to achieve the bull market cycle high within the $125k to $150K degree by Aug/Sep 2025, then a 50%+ correction pic.twitter.com/WUUzxl0ckn— Peter Brandt (@PeterLBrandt) May 1, 2025

Technical Evaluation Signifies A number of Patterns

In response to Brandt’s weekly chart evaluation, Bitcoin is presently rising inside what he sees as a bullish wedge formation. The cryptocurrency can be nonetheless inside a long-term rising channel that has been holding value in examine over the previous few years.

His chart additionally reveals sure technical patterns that preceded Bitcoin value actions in historical past reminiscent of Head and Shoulders, Channels, and Increasing Triangles-all fundamental traits amongst technical merchants.

Timing In Accordance With Historic Halving Cycles

The expected excessive peak for Bitcoin in 2025 from August to September is in accordance with what has taken place after these previous halving occasions. These halvings – decreasing the speed of recent Bitcoins created – have been at all times adopted by value highs 12-18 months later.

With the final halving occurring in April 2024, Brandt’s prediction is effectively inside this doubtless timeframe. This affiliation with Bitcoin’s provide dynamics makes some merchants consider the forecast.

Associated Studying

Warning Of Extreme Correction Following Peak

Curiously, the market skilled has not merely predicted a excessive. Brandt believes Bitcoin might plunge dramatically, by greater than 50%, after the highest of its cycle, probably taking costs all the way in which again all the way down to $60,000-$75,000.

Whereas Bitcoin’s present value actions present sturdy upward momentum, seasoned buyers know the market can change route fairly shortly; 24/7 buying and selling and worldwide participation has typically contributed to hurry of execution and fast value adjustments that will take unprepared merchants abruptly.

For the second, nevertheless, Bitcoin’s race towards $100,000 continues to be attracting consideration from longer-term believers and first-timers alike, hoping to money in on what could possibly be yet one more historic run in cryptocurrency markets.

Featured picture from Unsplash, chart from TradingView