Este artículo también está disponible en español.

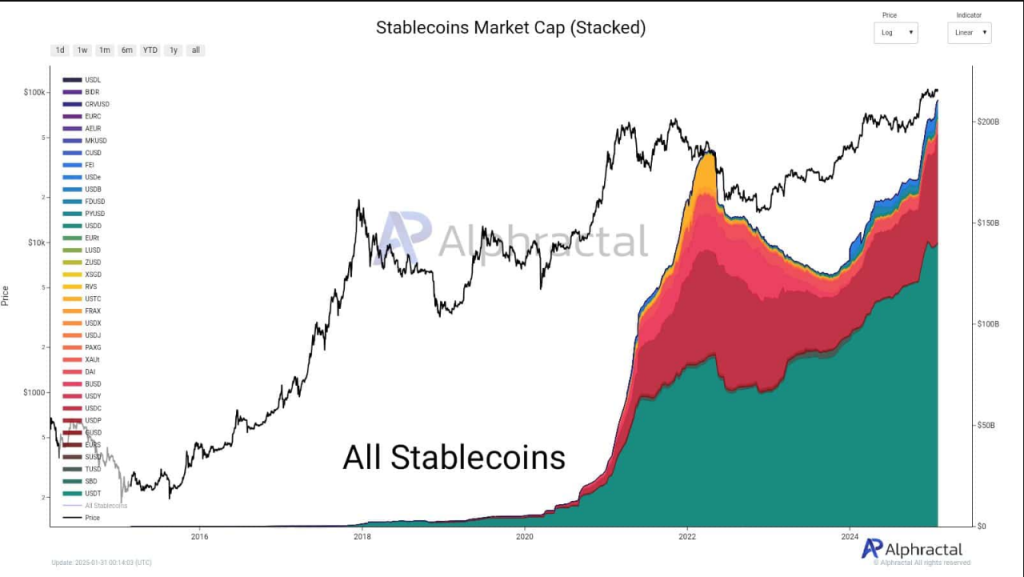

Stablecoins, typically taking the backseat from Bitcoin and different high cryptocurrencies, are actually within the highlight. In response to on-chain knowledge, the stablecoins market has surged to over $200 billion, with Tether’s USDT and USDC as the principle progress drivers.

Associated Studying

Primarily based on CryptoQuant’s knowledge, the stablecoins market elevated by $37 billion because the first week of November final yr, when Donald Trump received his second presidency. The identical CryptoQuant report shared that the stablecoin’s efficiency could spill over to Bitcoin and different cryptos.

Alphractal shared the identical knowledge; this time, it highlights the rising function of USDC within the stablecoins section. In response to Alphractal, USDC is consuming up the share of USDT, and different altcoins are fueling its rise within the trade.

USDC Nearing Its Key Resistance Degree: Alphractal

In response to Alphractal, the stablecoins market’s regular however regular enlargement, with Tether on the high, is proof of its tenacity. In response to latest market knowledge, altcoin trades are serving to USDC achieve traction. The analysis claims that altcoin gross sales ceaselessly transfer to USDC, boosting the market’s provide.

Stablecoin Market Cap Surpasses $211B – USDC Beneficial properties Momentum!

Since 2023, the stablecoin market has grown considerably, primarily pushed by USDT (Tether). Nevertheless, lately, USDC has been gaining an edge over different stablecoins.

This development is happening because of the latest drop in… pic.twitter.com/IRKrQErmCE

— Alphractal (@Alphractal) January 31, 2025

Nevertheless, this coin is nearing its resistance degree, and its replicating value actions have been final seen in 2021. In contrast to its rival, Tether’s USDT, USDC enjoys robust institutional backing and regulatory readability. These are the first causes many buyers and establishments want USDC over Tether’s USDT.

What About The Different Stablecoins?

USDC and USDT are nonetheless the most well-liked stablecoins, however smaller stablecoins haven’t been rising since 2023.

The whole market worth of those various stablecoins has stayed principally the identical, indicating there was little new growth or progress past the 2 principal cash.

The opposite cash’ perceived poor adoption and recognition elevate questions concerning the prospects of stablecoins. Like USDT, many of those “smaller stablecoin initiatives” face liquidity points, lack of institutional assist, and regulatory uncertainty. Whereas it’s good that the general stablecoin market cap is rising, it’s additionally alarming that it’s solely dominated by two cash: USDT and USDC.

Associated Studying

Bullish Or Bearish: USDC’s Brief-Time period Outlook

USDC’s present value motion is nearing a essential resistance degree, much like its all-time excessive in 2021. If it continues to dominate and transfer previous this resistance, this could translate to larger danger aversion, with capital transferring away from meme or altcoins. Briefly, it’s a bearish sign since individuals are searching for stability.

It’s additionally attention-grabbing to notice that USDC rose when altcoins crashed in value. This means that many buyers are securing their features.

Featured picture from InfoMoney, chart from TradingView