Bitcoin has pushed again above the $90,000 stage after a number of days of intense promoting strain, bringing a quick second of aid to a market overwhelmed by worry and uncertainty. Regardless of the rebound, bulls stay beneath strain as hypothesis of an incoming bear market continues to develop. Many traders are nonetheless digesting the sharp correction from October’s all-time excessive, and confidence has but to totally return.

Associated Studying

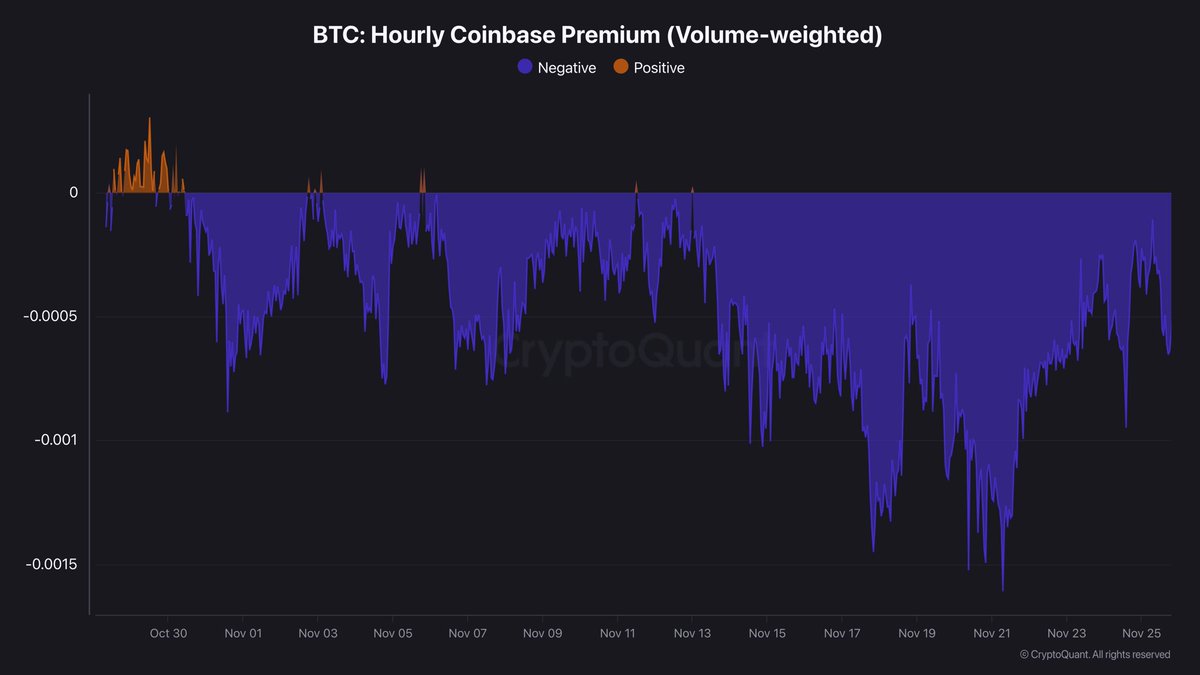

In keeping with high analyst Darkfost, one of many key indicators reinforcing this cautious surroundings is the Coinbase Premium Index, which stays adverse. This metric compares Bitcoin’s value on Coinbase — the popular alternate for US establishments {and professional} traders — with Binance, which is broadly utilized by retail merchants. When the index is adverse, as it’s now, it indicators that institutional gamers and US whales are promoting extra aggressively than retail members.

Darkfost notes that a part of this ongoing sell-side strain is tied to steady spot ETF outflows, which have weighed closely on sentiment. Though the latest bounce above $90K reveals a brief shift in momentum, Bitcoin should display robust follow-through to stop the market from slipping deeper right into a bearish part.

Institutional Promoting Strain Begins to Ease

Darkfost explains that because the peak in panic promoting on November 21, institutional and US-based promoting strain has noticeably cooled off. Throughout that interval, the Coinbase Premium Index confirmed a pointy dive into adverse territory, signaling that skilled actors had been offloading Bitcoin much more aggressively than retail members. This imbalance amplified the market’s decline, serving to push BTC towards its latest lows.

Nevertheless, over the previous a number of days, the depth of this promoting has began to fade. Whereas the Coinbase Premium Index stays adverse — that means establishments are nonetheless internet sellers — the depth of that negativity has considerably softened. Darkfost notes that though the metric has not but flipped into optimistic territory, the development is enhancing. If this continues, it might give the market some much-needed respiratory room and doubtlessly stabilize value motion.

Nonetheless, analysts stay cautious. The following few classes shall be important, as Bitcoin must display that this easing in promote strain can translate into sustained demand. A decisive transfer — both reclaiming greater ranges or breaking down once more — seems imminent. As institutional exercise continues to shift, the market could quickly reveal whether or not this was solely a brief aid bounce or the beginning of a bigger restoration.

Associated Studying

Bitcoin Makes an attempt Restoration However Faces Key Resistance Ranges

Bitcoin is displaying its first significant restoration try after the steep decline that dragged value from the $126,000 all-time excessive right down to the $80,000 zone. On the 3-day chart, BTC has bounced sharply from the 200-day shifting common (crimson line), a stage that traditionally acts as a significant dynamic assist throughout deep corrections. This rebound pushed value again towards the $91,000 space, however momentum stays fragile.

The chart reveals BTC buying and selling under each the 50-day and 100-day shifting averages, which have now turned downward—a sign of short-term development weak point. Till the value reclaims these shifting averages, significantly the 100-day close to $103,000, the broader construction stays susceptible to additional draw back.

Associated Studying

Quantity through the sell-off was considerably greater than through the bounce, suggesting that sellers had been extra aggressive than patrons. This imbalance highlights that the latest uptick could also be extra of a reactionary aid transfer than a confirmed reversal.

Nonetheless, the rejection wicks under $85,000 present clear purchaser curiosity at decrease ranges. If BTC can preserve this greater low construction and proceed closing above the 200-day MA, bullish momentum might step by step rebuild.

Featured picture from ChatGPT, chart from TradingView.com