Within the aftermath of a hack that noticed attackers steal 44.5 billion received (roughly $30 million) from a Solana sizzling pockets, Upbit has begun shifting practically all buyer property into chilly storage, a transfer that now locations it among the many most conservative platforms globally when it comes to on-line asset publicity.

This transition marks one of many strongest safety pivots by a significant trade, signaling a broader trade dialog about balancing fast withdrawals with the necessity to cut back assault surfaces.

As digital asset markets proceed to broaden, Upbit’s response supplies a real-time glimpse into how platforms steadiness operational liquidity towards systemic cyber dangers.

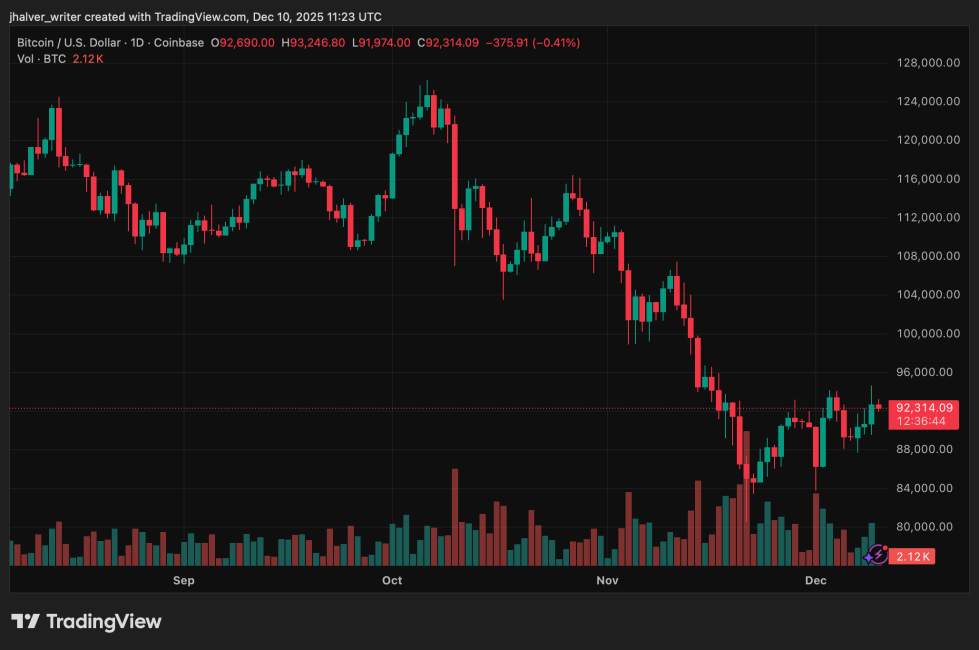

BTC's value data some small features on the day by day chart. Supply: BTCUSD on Tradingview

Upbit Pushes Scorching Pockets Utilization Towards Zero

Following its inner assessment and system overhaul, Upbit confirmed that it now shops roughly 99% of person property in chilly wallets, with sizzling pockets publicity lowered to about 1% and anticipated to lower additional.

As of late October, the trade held 98.33% of buyer funds offline, a price already effectively above the 80% minimal required beneath South Korea’s Digital Asset Person Safety Act.

This shift follows a sample of rising warning. The latest breach was Upbit’s second important assault, occurring on November 27, mirroring a 2019 incident that noticed greater than 342,000 ETH drained from its methods.

This 12 months’s Solana-based assault resulted in withdrawals throughout 24 tokens inside lower than an hour, prompting an instantaneous shutdown of sizzling pockets operations and emergency transfers to chilly storage. Upbit has pledged to totally reimburse affected customers from company reserves.

Home knowledge means that the trade already leads the market in chilly storage utilization, sustaining the bottom sizzling pockets ratio amongst native opponents, whose chilly pockets shares vary from 82% to 90%.

Safety Benchmark Units Strain on World and Native Exchanges

Upbit’s near-99% chilly pockets ratio surpasses the requirements of main international exchanges. Coinbase shops about 98% of its funds offline, whereas Kraken’s ratio sits between 95% and 97%.

A number of Asian exchanges, together with OKX and Gate.io, keep related ranges. With Upbit’s newest replace, the platform now stands on the forefront of world chilly storage practices.

Business observers word that the transfer aligns with broader regulatory momentum. South Korea’s Monetary Providers Fee is contemplating new guidelines that will require exchanges to compensate customers for losses ensuing from hacks, no matter fault, just like the requirements imposed on banks.

Liquidity Questions Linger in a Restricted Market

Whereas safety is on the heart of Upbit’s restructuring, analysts warning that operating with minimal sizzling pockets reserves might gradual withdrawals during times of heightened market volatility.

South Korea’s crypto market is basically closed to overseas contributors, limiting arbitrage and creating circumstances the place delays can exacerbate value discrepancies, generally often called the “Kimchi premium.”

Throughout final month’s momentary withdrawal suspension, liquidity was successfully trapped, leading to sharply widening value gaps between the Korean and international markets. Nonetheless, Upbit maintains that its rebuilt methods and predictive fashions will guarantee adequate liquidity beneath regular buying and selling circumstances.

Cowl picture from ChatGPT, BTCUSD chart from Tradingview

Editorial Course of for bitcoinist is centered on delivering completely researched, correct, and unbiased content material. We uphold strict sourcing requirements, and every web page undergoes diligent assessment by our workforce of prime know-how specialists and seasoned editors. This course of ensures the integrity, relevance, and worth of our content material for our readers.