Fast Take

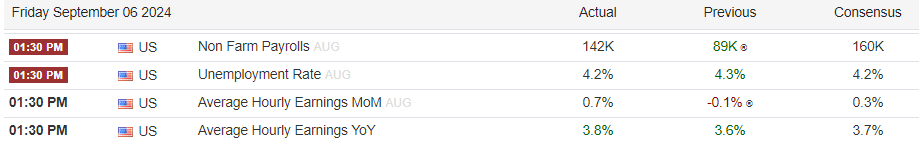

On Sept. 6, the US launched its newest jobs knowledge, revealing that non-farm payrolls elevated by 142,000, falling in need of the consensus estimate of 160,000. In the meantime, the unemployment fee held regular at 4.2%, which aligned with expectations. Nevertheless, wage development shocked on the upside, with common hourly earnings rising 0.7% month-over-month and three.8% year-over-year, exceeding forecasts, in line with Buying and selling Economics.

Following the report, Bitcoin noticed a slight uptick, climbing above $56,000. On the identical time, the US greenback index (DXY) dropped to 100, reflecting a softer greenback. Resulting from a comparatively sturdy jobs report, this elevated market expectations for a 25 foundation level fee minimize on the upcoming Federal Reserve assembly to a 57% likelihood. This heightened chance of a fee minimize comes because the Fed goals to stability financial development with managing inflationary pressures.