Este artículo también está disponible en español.

After 4 months of declining transaction volumes from retail buyers, Bitcoin (BTC) retail on-chain exercise reveals indicators of resurgence.

Will Bitcoin Profit From Rising Retail Participation?

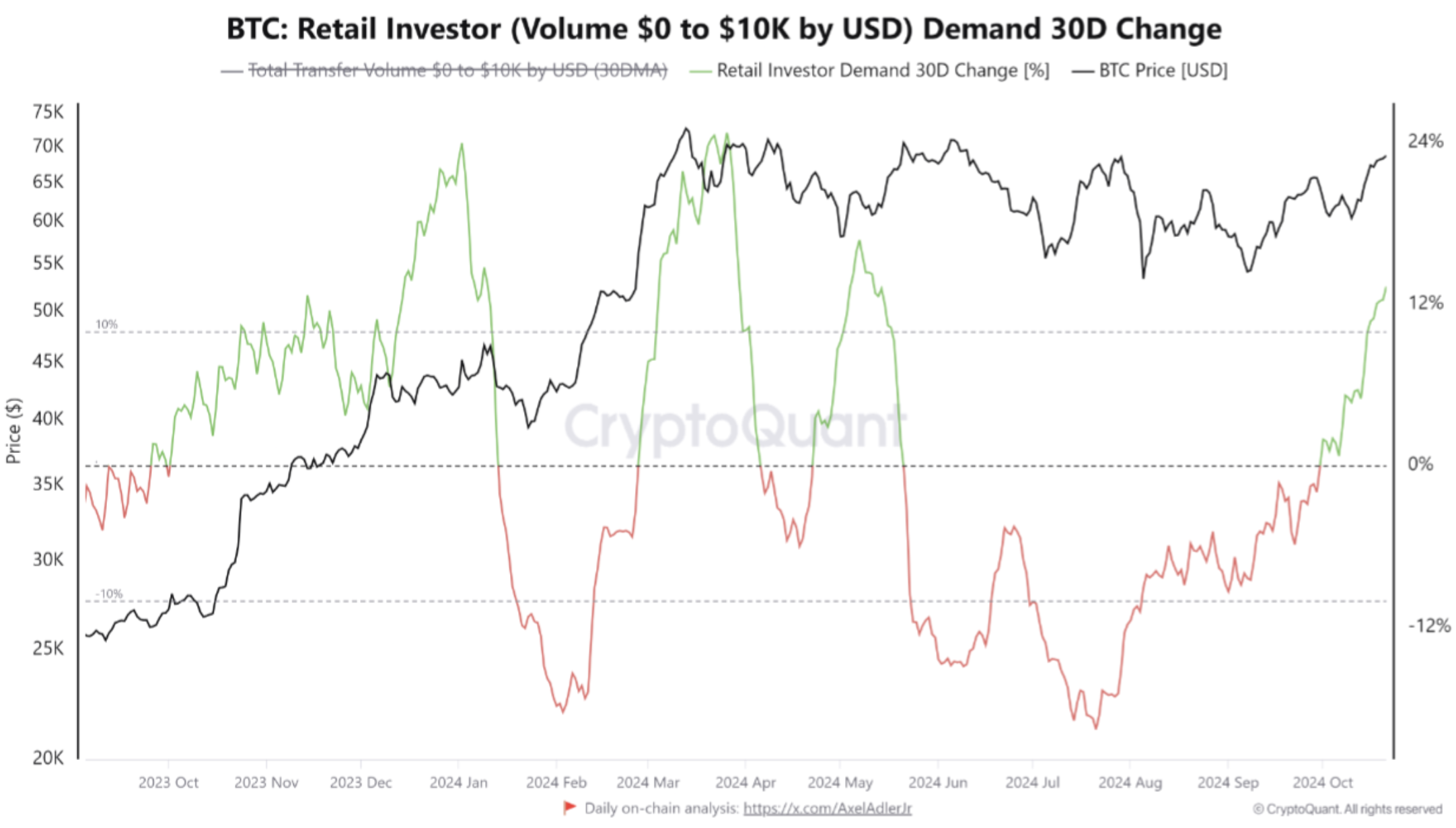

In line with a latest evaluation by on-chain analytics platform CryptoQuant, BTC transactions value lower than $10,000 are rising, reflecting a shift out there’s sentiment from risk-averse to risk-on.

Associated Studying

Monitoring transactions underneath $10,000 helps gauge retail exercise. Not like institutional transactions pushed by fundamentals and long-term outlooks, market sentiment and information typically affect retail exercise.

Per the evaluation, Bitcoin’s retail demand struggled to rebound after the cryptocurrency’s all-time excessive (ATH) in March 2024. Nonetheless, retail demand has surged 13% up to now 30 days with room for additional progress.

Throughout this similar interval, BTC gained roughly 7%, rising from $63,142 on September 22 to $67,346 by October 22. Each rising retail on-chain exercise and value recommend a possible upside for BTC in This fall 2024.

The swift restoration of BTC and different cryptocurrencies following Iran’s offensive towards Israel earlier this month additionally alerts a return to risk-on conduct within the digital asset market.

It’s value noting that though retail on-chain exercise diminished during the last 4 months, institutional buyers continued to keep up “a excessive quantity of transactions and absorption of cash.” The evaluation reads partly:

This latest rise in bitcoin is inflicting small buyers to return to buying and selling, signaling the start of a sample of decrease threat aversion.

Is A This fall 2024 Rally On The Horizon?

The return of Bitcoin retail on-chain exercise is an encouraging signal that implies renewed curiosity amongst retail buyers towards the main digital asset. Nonetheless, with the looming US presidential elections, there could possibly be extra volatility forward for BTC value.

Associated Studying

In line with a number of crypto analysts and buying and selling companies, the probability of a crypto This fall 2024 rally hinges on the outcomes of the US presidential elections.

Bitwise CIO Matt Hougan lately remarked that “something apart from a Democratic sweep” would profit BTC propel to $80,000 in This fall 2024.

Bitcoin dominance, a metric that measures BTC’s share of the general crypto market, lately hit 58.9%, a brand new cycle-high. Whereas that is promising for BTC’s future value, an extra surge in dominance might hurt altcoins’ efficiency. Consequently, This fall 2024 might deliver a brand new ATH for BTC however muted returns for altcoins.

It is usually value contemplating that the renewed retail demand for digital property is perhaps geography-specific, and never uniform worldwide.

As an example, in South Korea, BTC is buying and selling at barely decrease costs than international costs as a consequence of a destructive ‘kimchi premium,’ hinting low home investor sentiment towards digital property. BTC trades at $67,346 at press time, down 1.4% up to now 24 hours.

Featured picture from Unsplash, charts from CryptoQuant and Tradingview.com