Este artículo también está disponible en español.

The Bitcoin worth has hit a brand new All-Time Excessive (ATH), marking a historic milestone within the crypto market. With a outstanding rally surpassing $75,000, Bitcoin is experiencing appreciable momentum, pushed primarily by market sentiment surrounding the US elections. A crypto analyst who had precisely predicted Bitcoin’s rise to $75,000 has now set a brand new worth goal for the pioneer cryptocurrency, anticipating additional bullish motion.

Analyst Set $170,000 Worth ATH For The Bitcoin Worth

TradingShot, a crypto analyst on TradingView, has launched a short Bitcoin evaluation report, referencing historic developments to foretell a brand new all-time excessive of $170,000 for Bitcoin. Sharing a worth chart depicting Bitcoin’s worth actions from 2022 to the current, the analyst disclosed that on August 5, Bitcoin was testing the 1-week Shifting Common (MA50), a degree that has by no means been reached since March 12, 2003.

Associated Studying

In earlier market cycles, this significant degree was absolutely the supporting trendline that signaled a possible bull market. TradingShot revealed that after virtually 20 years, the Bitcoin worth was lastly in a position to maintain this key trendline not as soon as however twice, resulting in its last-week rally that noticed its worth testing the $73,800 mark.

The analyst additionally highlighted that this worth surge was an extremely bullish transfer, indicating a powerful marketplace for Bitcoin. Furthermore, the $73,800 Bitcoin worth improve occurred simply two days earlier than the US Presidential elections, a interval traditionally identified to set off explosive rallies for Bitcoin.

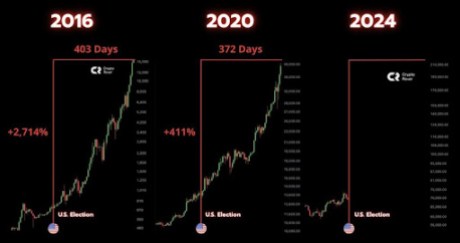

Market skilled Crypto Rover on X (previously Twitter) notes that Bitcoin has skilled a complete common worth pump of 1,563% following the earlier US elections. In 2016, Bitcoin rallied 2,714%, exceeding $15,000 after the US Presidential elections. Equally, in 2020, the cryptocurrency soared over 400%, surpassing $40,000 after the elections. Now, Bitcoin is clearly on a major uptrend after the just-concluded US presidential elections on November 4.

Given the timing of those rallies, TradingShot has advised {that a} comparable sample could also be repeating, implying that Bitcoin might be getting into a interval of explosive development. Based mostly on chart evaluation and Fibonacci ranges, the analyst has projected a brand new goal of $170,000 for Bitcoin, representing roughly 1.618 Fibonacci extensions from its present ATH.

With the Bitcoin worth presently buying and selling at $73,715, having given up some positive factors, a surge to $170,000 would signify a 130,55% improve.

BTC Lastly Hits Anticipated Worth Discovery

With Bitcoin lastly reaching a brand new ATH after months of hypothesis and anticipation, crypto analyst Ali Martinez has disclosed that this surge alerts the cryptocurrency’s entry into its worth discovery.

Associated Studying

A Bitcoin worth discovery refers to how the market determines the present worth or worth based mostly on provide and demand dynamics. Regardless of the brand new achievement, Martinez has revealed that traders try to quick Bitcoin by liquidating their holdings and cashing out earnings.

In consequence, the analyst predicts that if Bitcoin goes again to the $75,550 worth excessive, $210 million might be liquidated from the market.

Featured picture created with Dall.E, chart from Tradingview.com