The bitcoin value is at a really fascinating level in its present market cycle. With plenty of totally different opinions and never a lot motion in value, it’s exhausting to know what’s coming subsequent. However after we take a look at the necessary information, issues get quite a bit clearer. These indicators don’t simply inform us what would possibly occur within the instant future, however can make clear what the approaching weeks and months may deliver.

The Brief-Time period Holder Realized Worth and Bitcoin Worth Assist

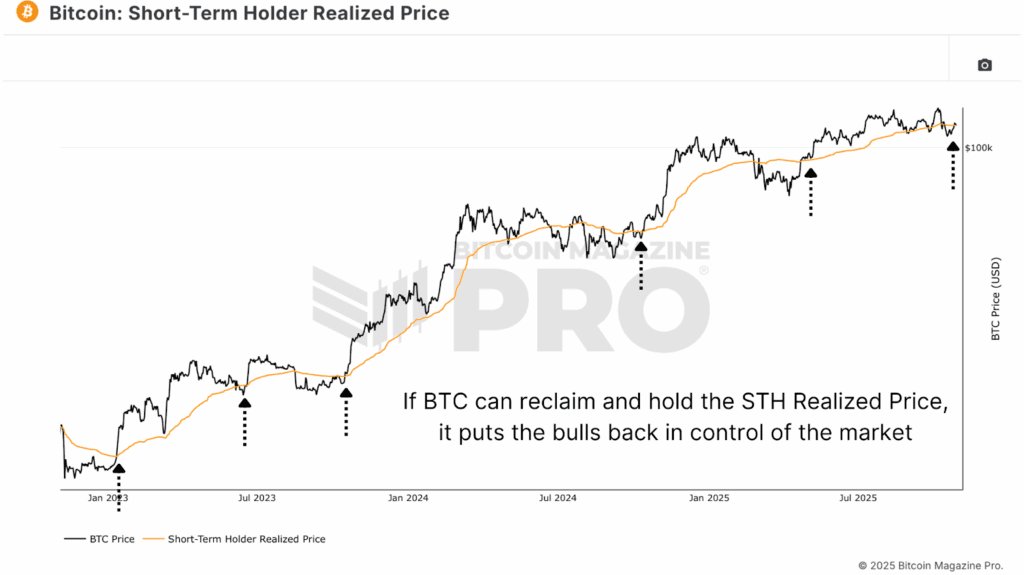

We start with the Brief-Time period Holder Realized Worth, successfully the common value foundation for brand new market contributors. This stage has traditionally acted as a dynamic zone of assist and resistance all through every cycle. At current, the STH realized value sits round $113,000, near the place Bitcoin is at the moment buying and selling. Regardless of the sharp liquidation occasion earlier this month, the market has rebounded and stabilized round this stage.

When Bitcoin holds above the short-term holder realized value, it indicators that the common latest purchaser is both at breakeven or in slight revenue. This usually will increase investor confidence and encourages extra capital rotation into the market. In previous cycles, resembling in 2017, each retest of this line offered a super accumulation alternative earlier than the subsequent leg greater. Sustaining assist above this might as soon as once more mark the inspiration for the subsequent section of the bull cycle.

Understanding The MVRV Ratio and Bitcoin Worth Valuation

Past the realized value itself, we flip to the Brief-Time period Holder Market Worth to Realized Worth (MVRV) Ratio, which measures the connection between Bitcoin’s present market value and its combination realized value. This ratio helps establish over- or undervalued circumstances.

Throughout prior cycles, clear patterns emerge, with Bitcoin persistently discovering assist across the 0.66 stage throughout giant down strikes, prime zones for accumulation. On the upside, notable resistance has traditionally appeared round 1.33, 1.43, and 1.64, equivalent to profit-taking factors the place new contributors attain 33%, 43%, or 64% unrealized features, respectively.

Utilizing these multiples, we are able to estimate future targets. By multiplying the present STH Realized Worth at ~$113,000 by these MVRV thresholds, we are able to mission potential resistance zones for this cycle. The 1.33 zone generates a projected value of roughly $160,000 for the top of the 12 months. The halfway 1.43 zone equates to a projection of ~$170,000, and the higher zone of 1.64 extrapolates to round $200,00. These ranges align remarkably properly with historic resistance zones, suggesting the $160k–$200k vary may act as a serious value ceiling if Bitcoin continues to carry above its realized base.

Lengthy-Time period Holder MVRV and Bitcoin Worth Peaks

Subsequent, we flip to the Lengthy-Time period Holder MVRV Ratio, which measures unrealized revenue and loss among the many market’s most skilled traders. This cohort’s habits supplies key insights into macrocycle dynamics. Within the 2017 bull run, LTH MVRV peaked at 36.2. Within the 2021 cycle, it peaked at 12.58, roughly a 2.9x discount, demonstrating the diminishing return construction that has outlined Bitcoin’s maturation.

Making use of that very same diminishing issue (÷2.88) suggests a possible peak round 4.37 for this present cycle. Provided that the Lengthy-Time period Holder Realized Worth sits close to $37,400, a 4.37x a number of implies a possible goal of roughly $163,000–$165,000, overlapping with the higher targets derived from short-term holder information and ranges we’ve already reached this cycle in LTH MVRV phrases.

The Rolling MVRV Framework and Bitcoin Worth Dynamics

Because the Bitcoin market evolves, conventional MVRV metrics should additionally adapt. One of the efficient approaches is to view these ratios on a rolling foundation, which accounts for dynamic adjustments in market circumstances.

When modeled on a 2-12 months Rolling foundation, the MVRV Z-Rating eliminates among the “diminishing peaks” seen in static fashions. Peaks round 3.0 and troughs close to –1.0 have persistently aligned with market tops and bottoms. Intriguingly, present readings are nearer to the purchase zone than the promote zone, implying that Bitcoin remains to be in an accumulation-friendly vary.

To achieve extra granularity, we are able to additionally assess the MVRV ratio on a 100-day rolling foundation, which captures intra-cycle fluctuations. On this mannequin, spikes above +2 correlate with native tops, whereas dips under –2 align with native bottoms and optimum DCA zones. Throughout Bitcoin’s whole historical past, this rolling 100-day MVRV framework has recognized among the most correct short-term accumulation and distribution factors, even inside broader cycle traits.

Conclusion

At the same time as Bitcoin’s market matures and institutional involvement deepens, these core on-chain valuation frameworks stay among the many strongest instruments for cycle evaluation. The realized value fashions, significantly these tied to particular cohorts, present perception into market conviction, displaying when contributors are in revenue and when behavioral shifts are more likely to set off the subsequent transfer. Extra importantly, adapting conventional metrics to rolling frameworks ensures our fashions evolve alongside Bitcoin itself, capturing new investor habits, liquidity cycles, and the rising institutional affect that defines this market’s future.

If Bitcoin can proceed holding above the STH realized value, the info suggests there may be ample room to the upside, with believable cycle targets within the $160,000–$200,000 area.

For a extra in-depth look into this subject, watch our most up-to-date YouTube video right here: Bitcoin: This On-Chain Information Tells Us The place Worth Goes Subsequent

For deeper information, charts, {and professional} insights into bitcoin value traits, go to BitcoinMagazinePro.com.

Subscribe to Bitcoin Journal Professional on YouTube for extra knowledgeable market insights and evaluation!

Disclaimer: This text is for informational functions solely and shouldn’t be thought-about monetary recommendation. At all times do your individual analysis earlier than making any funding choices.