Relating to pensions and retirement, we now have a transparent pensions adequacy concern in a lot of the world on condition that the inhabitants resides longer and lots of people have insufficient financial savings for a cushty retirement. Bitcoin fixes this – partly – by providing a type of financial savings which might’t be debased and may maintain its worth into the long run. Reducing our collective time choice as a society additionally wouldn’t damage, as we’d prioritise our later years greater than we achieve this at current.

It’s typically remarked although that Bitcoin doesn’t resolve all the issues on the earth, solely half of them, and there may be one enormous facet Bitcoin can not assist with by way of retirement planning. Particularly, none of us know the way lengthy we’re going to stay for, and if we stay “too lengthy” we face the chance of working out of cash in previous age. This can be a downside which the pensions and insurance coverage world defines as “longevity danger”.

I wrote an article for Bitcoin Journal in 2022 on one resolution, which could be seen right here. In brief, it proposed a easy annuity product priced in Bitcoin and that might pay policyholders a Bitcoin revenue for all times, permitting individuals to pool their longevity danger in retirement.

Remarkably, there may be now a product coming to market that permits bitcoiners to pool their longevity danger right into a Bitcoin based mostly belief and be paid an revenue for all times, however with extra transparency and sure the next revenue than an annuity. Enter the Bitcoin Tontine by Tontine Belief.

Let’s run via the fundamentals.

What’s a Tontine and the way does it work?

A Tontine is historically often known as an funding linked to a dwelling person who operates to pay them an revenue for so long as they stay. Every participant pays into their very own segregated belief. Every belief designates a Tontine Class because the beneficiary of their belief upon their dying. The Tontine Class is comprised of numerous others of comparable age and intercourse. A various revenue is then paid to every member out of their very own account. When a member of the Tontine Class dies, the entire worth leftover of their belief will get allotted proportionately into the person belief accounts of all of the remaining class members, thus serving to to spice up their retirement revenue over time. This course of continues till the second final member dies.

The revenue paid is constantly up to date, and is calculated to make sure an revenue for all times for all individuals based mostly upon the next elements –

a) the members life expectancy which is basically based mostly upon age / intercourse

b) the present worth of their funding fund

c) the anticipated annual return on their fund

This technique means the revenue might typically go down in addition to up nevertheless it’s this flexibility which in flip mathematically ensures that members won’t ever run out of revenue in retirement. The Tontine Belief cowl the prices of working the tontine by way of a flat annual trustee charge of 1% levied on every belief account.

How does this differ to an Annuity?

An annuity ensures a set revenue (or an revenue with outlined will increase, e.g. 3% each year) for all times at outset. If members stay far longer than anticipated, it’s going to fall on the insurer to soak up that value (and conversely, they are going to revenue if members die younger). Because of this requirement, insurers have strict necessities to carry extra capital to cowl all eventualities, and have a tendency to cost their annuities based mostly on the return on fastened revenue authorities bonds. Their income are opaque and are realised over a few years.

Against this the tontines provided by the Tontine Belief work in an especially clear and intuitive method, and because of their nature can supply a spread of trustee accepted asset lessons for the underlying investments. Furthermore, members can change their funding technique over time. Alongside a pure allocation to Bitcoin, they provide funding methods for various danger appetites & circumstances, together with a “Daring” fund (mixture of Bitcoin and Gold), index funds, and cash market funds.

The upper returns of underlying investments together with the mechanisms of a tontine ought to make sure that individuals get pleasure from the next revenue all through retirement because of this, vs an annuity. The principle trade-off is that revenue paid can fall in addition to rise because of funding returns.

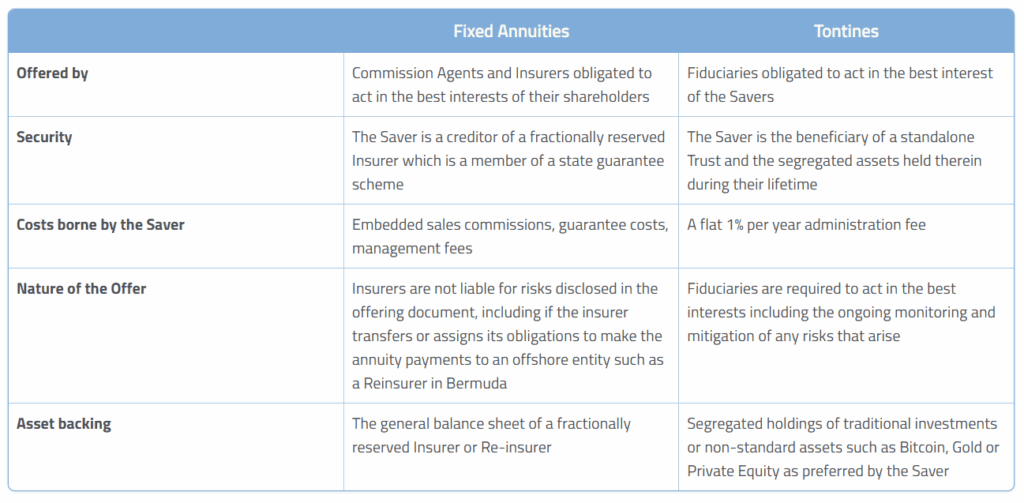

A comparability of Tontines and Fastened Annuities. Supply: Tontine Belief Web site

What are the downsides of Tontines?

In a Tontine the longevity of members will straight impression on the payouts to the remainder of the group (reasonably than in an annuity, the place how lengthy members stay for will impression on the income of an insurer). Because of this, arguably the principle danger for tontine fiduciaries is the potential for fraud, and kinfolk of members pretending they’re nonetheless alive after their dying (after all, insurers additionally bear this danger).

Tontine Belief has provide you with a brand new technological method to fight the potential for fraud, patenting a brand new proof of life technique whereby members show they’re nonetheless alive by way of the Tontine Belief app to validate funds to them. As well as, as every member has their very own segregated account, the Tontine Belief are capable of comply with a proof of reserves system, utilizing blockchain to assist transparency and replicate all funds and prices out and in of members accounts.

It might be {that a} public relations marketing campaign is required to coach the general public on this new sort of Tontine product. Tontines have a wealthy and different historical past, courting again to the seventeenth century. The place lined in fiction, Tontines have usually concerned cloak and dagger tales of personal Tontine preparations, usually whereby the final surviving member of a small group will inherit the lot. In actuality, the fashionable day Tontine swimming pools will function at scale and with anonymity.

Grampa Simpson and Monty Burns – the final two survivors in a Tontine to wholly inherit stolen art work within the Simpsons episode Raging Abe Simpson and His Grumbling Grandson in “The Curse of the Flying Hellfish” – see clip right here

As well as, Tontines have been restricted from sale in the US on sure life insurance coverage insurance policies following the Armstrong investigation of 1905, because the phrases of those insurance policies led to sure types of malpractice by lots of the insurance coverage corporations of the time. There have been some questionable phrases for shoppers with these merchandise, resembling a default on the coverage for lacking a single common cost, and excessive fee charges payable to gross sales brokers. These points as summarised within the paper right here have been particular to the merchandise and practices of the time, reasonably than a basic downside with a retirement Tontine as listed above.

How do Tontines sit with present regulation?

Tontines are very long run merchandise managed in the very best pursuits of members by fiduciaries and as such are just like pensions and different trustee providers. They don’t fall underneath insurance coverage regimes, for the reason that maintencance of a separate capital reserve isn’t wanted to insulate towards members dwelling for a very long time. Crucially, there have been latest developments in favour of Tontines but once more being launched as a product.

In 2022, the OECD (Organisation for Financial Co-operation and Improvement) printed a authorized instrument recommending that Outlined Contribution pension plans (which are actually the norm in most nations) guarantee safety towards longevity danger in retirement. This may very well be achieved by offering Lifetime revenue which “could be offered by annuities with assured funds or by non-guaranteed preparations the place longevity danger is pooled amongst individuals”. They be aware that the selection made will rely upon the stability required between the price of ensures (i.e. annuities give a assure of an revenue, however could also be worse worth) and stability of retirement revenue (i.e. preparations resembling tontines could typically see revenue lower over time from opposed funding returns).

Additional to this, Donald Trump lately signed an government order in August 2025 in search of to democratise entry to various belongings, which not solely outlines entry to incorporate “holdings in actively managed funding automobiles which are investing in digital belongings”, but additionally to “lifetime revenue funding methods together with longevity risk-sharing swimming pools”. This primarily paves the way in which for Tontines as a retirement possibility, and for the underlying funding to be Bitcoin.

Arguably, that is the social safety system of the longer term. Nationwide Tontines backed by Bitcoin might shortly turn into essentially the most safe approach for governments to make sure that their populations have an inflation proof revenue to maintain them in previous age. The “pay as you go” mannequin for state pensions as employed in lots of nations will proceed to return underneath pressure because of demographic shifts. Though a shift to a funded mannequin is a big one, it then solves for inter generational equity and comes at zero value to the state.

Abstract

17 years after the unique Bitcoin whitepaper, we’re about to see a pure retirement possibility launched for bitcoiners – a long life danger sharing pool with the advantages of bitcoin returns and which permits bitcoiners to mathematically assure an revenue for all times. This appears more likely to pay a a lot larger revenue than an annuity can supply. A selection going through these in search of a lifetime retirement revenue shall be from a) an annuity priced by returns on fastened revenue authorities debt, and b) a tontine powered by Bitcoin returns.

Over time, the market will resolve.

This can be a visitor submit by BitcoinActuary. Opinions expressed are completely their very own and don’t essentially replicate these of BTC Inc or Bitcoin Journal. Not one of the content material on this article needs to be construed as monetary recommendation. The writer owns shares in Tontine Belief.