Bitcoin’s pullback to $90,000 prompted fairly a stir available in the market. Though its restoration to above $96,000 on Jan. 14 supplied some aid, many on-chain indicators revealed underlying stress in market well being.

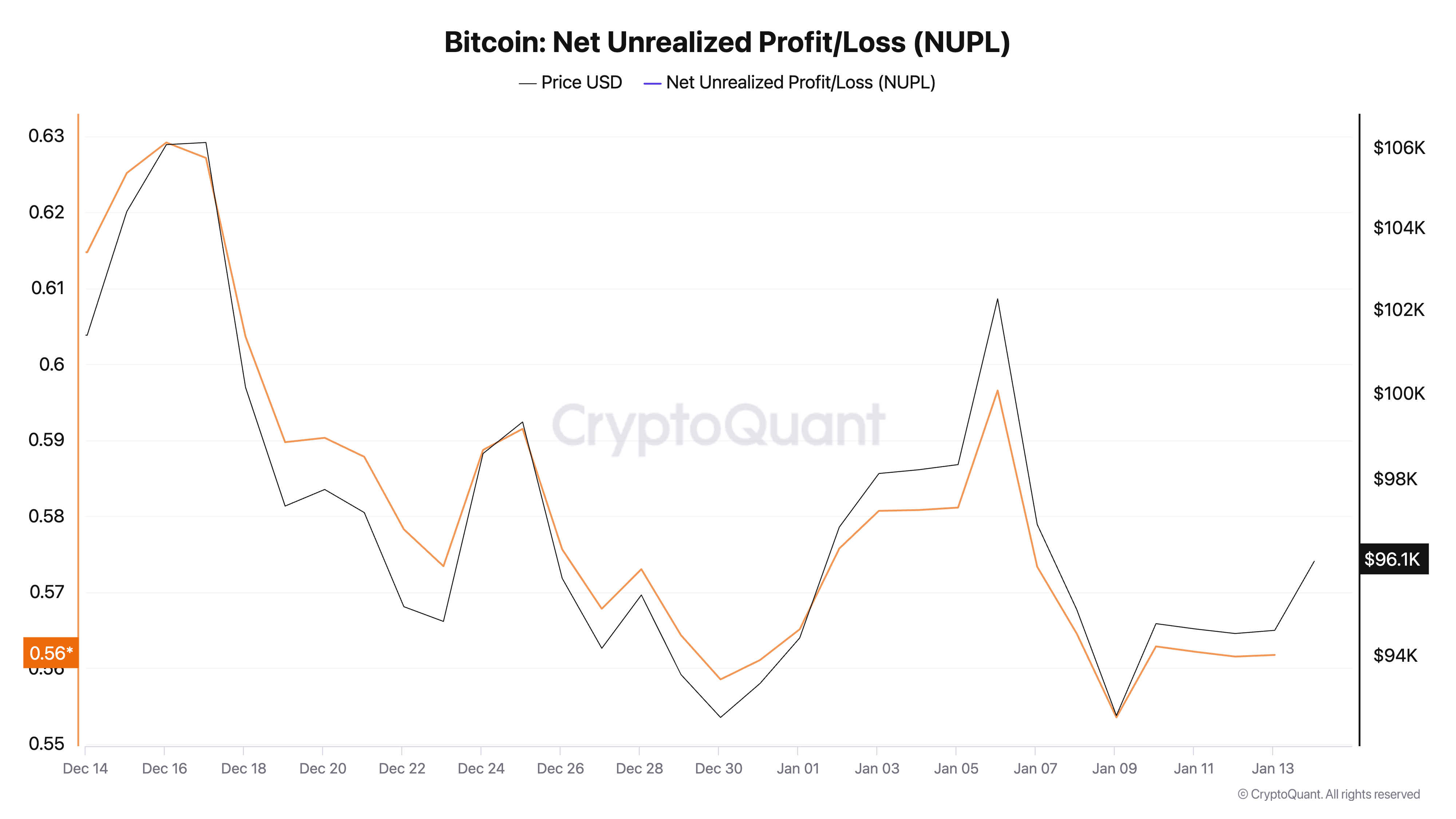

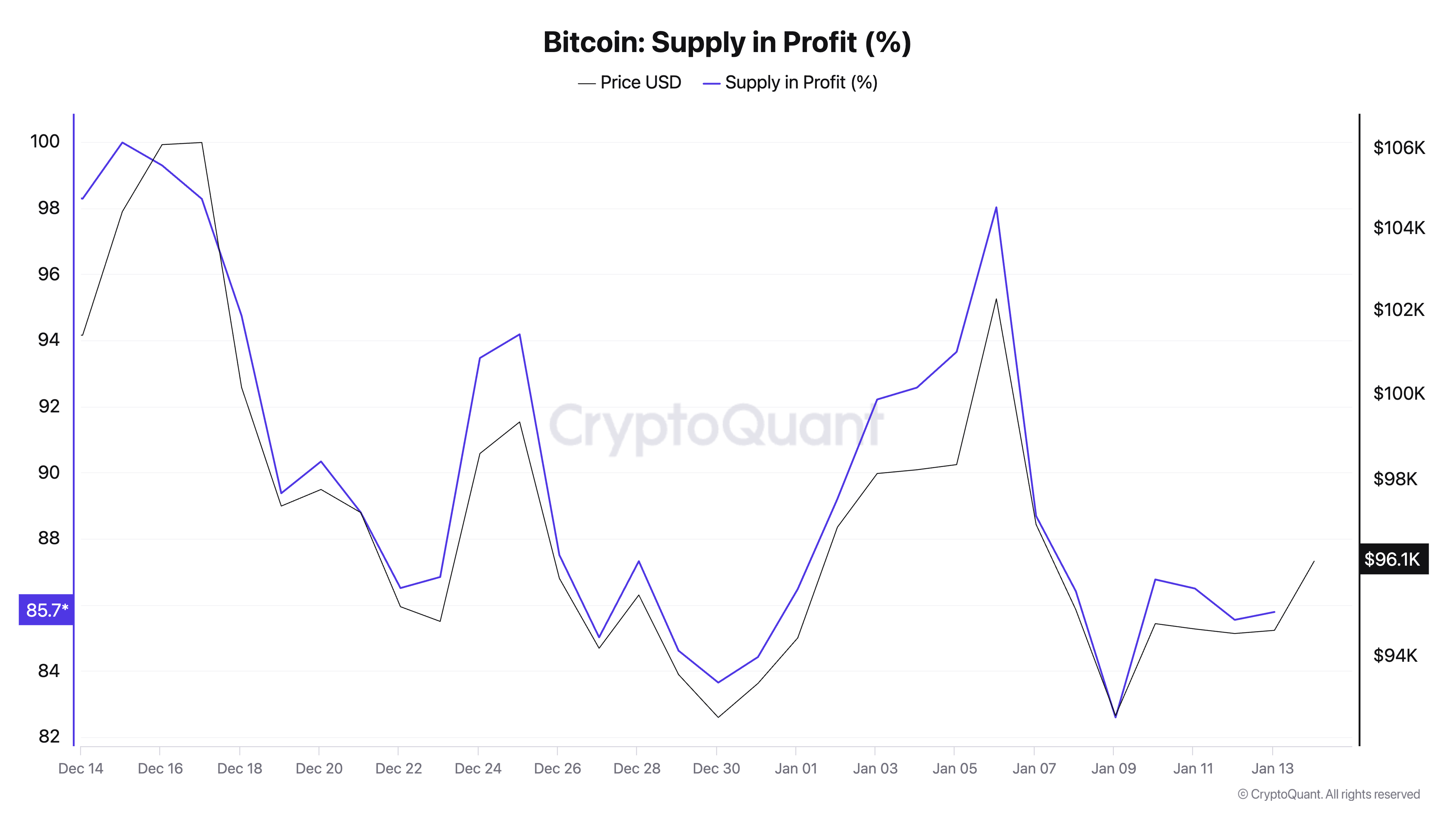

Key metrics like Web Unrealized Revenue/Loss (NUPL) and the proportion of provide in revenue confirmed important declines over the previous week, reflecting shifts available in the market’s unrealized positive factors and losses.

NUPL, a metric calculated because the distinction between unrealized earnings and unrealized losses divided by the overall market worth, serves as a barometer for market sentiment. A constructive NUPL signifies that the market is in a state of unrealized revenue, suggesting optimism amongst holders.

Over the previous week, NUPL dropped from 0.615 to 0.562, signaling a reasonable discount in combination unrealized positive factors. This lower displays a cooling of market exuberance, however the NUPL’s place firmly in constructive territory means that important unrealized earnings nonetheless assist the market construction. A drop of this magnitude (–0.053) signifies a softening in sentiment reasonably than a basic shift.

The proportion of Bitcoin’s provide in revenue is calculated by evaluating the acquisition price of cash with present market costs. It dropped sharply from 98.52% to 85.78% over the previous week, revealing {that a} substantial portion of Bitcoin’s provide moved from unrealized revenue to unrealized loss attributable to worth fluctuations.

On Jan. 13, 85.78% of Bitcoin’s provide was nonetheless in revenue, indicating that almost all holders acquired their Bitcoin at costs beneath the present market worth. This reveals that regardless of the market being extremely delicate to cost volatility, a big proportion of it nonetheless stays resilient.

These metrics are essential in understanding Bitcoin’s cost-basis distribution and total market well being. NUPL and provide in revenue collectively spotlight the financial positioning of Bitcoin holders. Whereas 14.2% of Bitcoin’s provide now has a value foundation above the present worth, the information signifies sturdy underlying assist for Bitcoin’s worth to stay above $90,000. This additional confirms that the market has not entered a chronic distribution part.

Provide in revenue and NUPL measure the connection between historic acquisition prices and present costs however don’t account for precise buying and selling exercise or habits. As an example, whereas a decline in unrealized earnings would possibly counsel elevated promoting stress, these indicators can’t verify whether or not holders are actively promoting or just holding by means of volatility.

These metrics supply a macro-level view of the market’s price foundation, appearing as a “thermometer” for Bitcoin’s financial positioning. The info reinforces the view that almost all Bitcoin holders are nonetheless in revenue, an element that may present stability in instances of worth turbulence.

Whereas the sharp drop in unrealized earnings would possibly elevate issues about elevated promoting stress, the resilience within the proportion of provide in revenue suggests a powerful base of holders who stay optimistic about Bitcoin.

The submit The market continues to be in revenue regardless of Bitcoin’s worth droop appeared first on CryptoSlate.