Bitcoin has opened December 2025 on the again foot, and market construction across the new month-to-month candle is already drawing shut scrutiny from merchants.

How Will Bitcoin Carry out In December?

Sharing a year-to-date chart on X, dealer Daan Crypto Trades highlighted a recurring sample in 2025: Bitcoin typically units its month-to-month excessive early. “We all know by now that the primary transfer does typically create the month-to-month excessive or low throughout the first ~12 days,” he wrote. “This occurs about 80% of the months.” His chart marks how February’s low, March’s excessive, April’s low, Could’s low, July’s inflection, and the important thing October and November pivots all occurred inside that window, with June and August flagged as exceptions.

December, to date, is conforming in type if not but in consequence. “Worth has taken a fast dive straight from the candle open to date in December, leaving no wick above both,” Daan famous. “This doesn’t make for the strongest excessive.” That form of rapid one-sided transfer, he argues, is usually revisited: “Good to observe carefully within the 1–2 weeks forward. Typically these prompt strikes from the open, do finish getting retested. October was an excellent instance of that lately.”

Zooming in, Daan’s second chart units out the important thing ranges. After bottoming close to $80,714 on November 21, Bitcoin staged roughly a +15% aid rally right into a thick prior support-turned-resistance zone within the low-$93,000s. That first take a look at failed, with worth rejected and rolling again over.

“BTC rejecting from the earlier help & resistance space,” he wrote. “Not one thing you need to see as a bull. Worth noticed an honest +15% aid rally however has misplaced steam once more after every week already.” On that very same chart he plots a short-term Fibonacci retracement from the $93,175 native excessive all the way down to the $80,714 low. The 0.786 retracement degree sits round $83,381, shut to identify on the time of posting.

“It’s early within the week/month,” he added, “and we do typically see sharp strikes straight from that new month-to-month candle. These typically aren’t the strongest highs/lows set straight at first of a brand new month. So good to observe within the days forward. (You guys additionally know I really like my .786 fib retests so watching carefully round this space).”

That leaves a transparent tactical map: rapid draw back ranges across the 0.786 retrace and the prior low, with upside conviction solely returning if worth can re-enter and reclaim the mid-to-high-$80,000s former help zone.

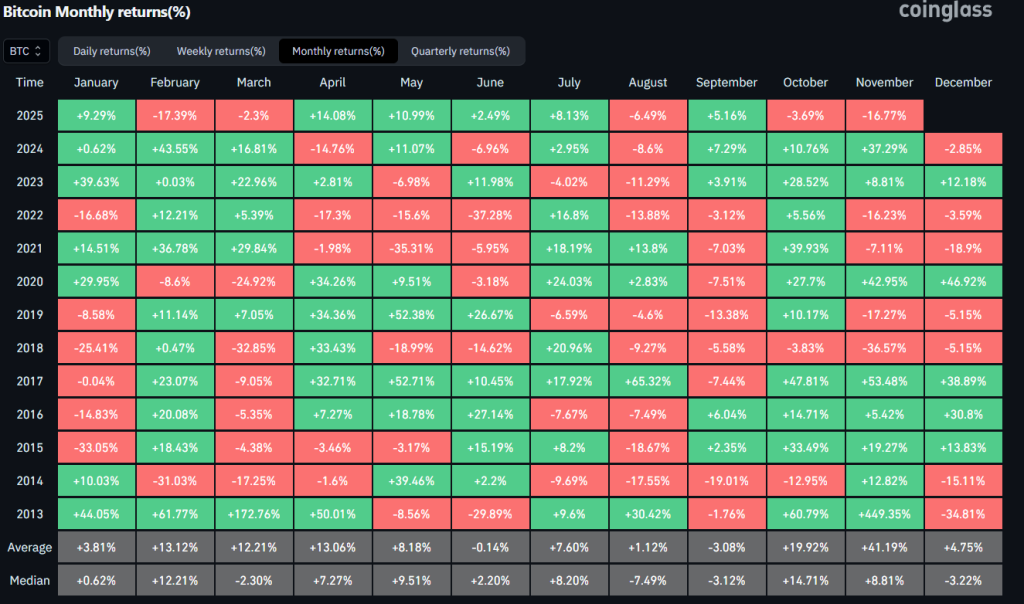

A separate publish from Daan situates this setup inside December’s broader historic profile. Sharing a Coinglass desk of Bitcoin’s month-to-month returns from 2013 onward, he described December as “fairly blended however [one that] has seen some massive outliers with a number of volatility.”

The information help that: previous Decembers vary from massive features above 30–40% to deep drawdowns exceeding -30%. The typical December return sits in modest optimistic territory (+4.75%), whereas the median is barely unfavourable (-3.22%), underscoring that there isn’t a easy “Santa rally” impact; as an alternative, dispersion and volatility dominate.

For Daan, a part of that behaviour is structural. “Don’t be shocked in case you see some bizarre flows on the finish and begin of the 12 months,” he warned. “Usually it is a interval the place massive holders/funds and such rebalance their books. We’d additionally see the impact of tax loss harvesting in some unspecified time in the future.” These portfolio changes and tax-driven trades can enlarge strikes in each instructions, significantly in an asset that also trades with pockets of skinny liquidity.

His sensible takeaway is intentionally conservative: “Good to simply be allotted in a manner that feels snug for you. Regardless of the finish of 2025 and begin of 2026 will carry.”

At press time, BTC traded at $87,323.