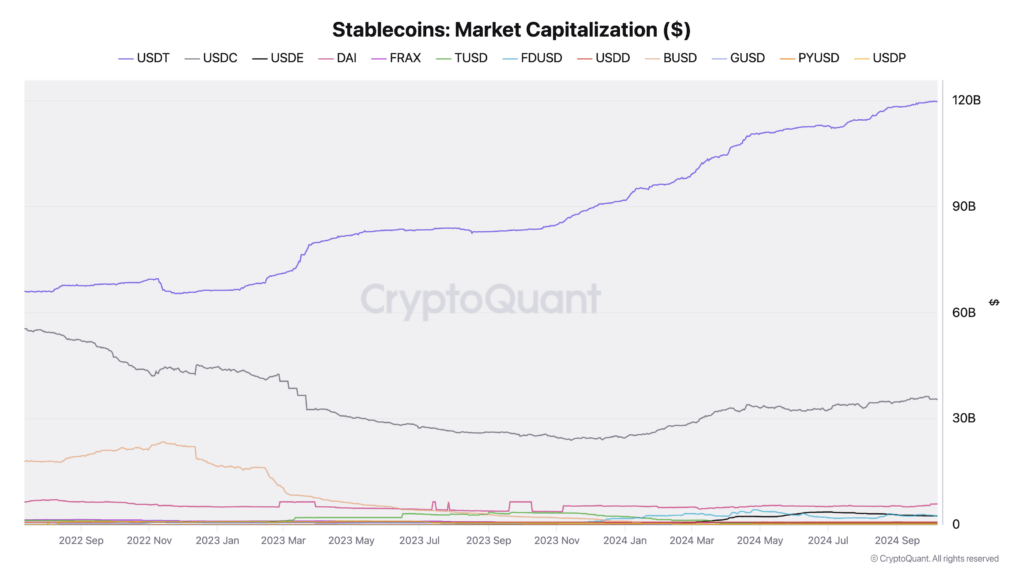

CryptoQuant knowledge reveals that crypto market liquidity has reached unprecedented ranges, with the full market capitalization of main USD-backed stablecoins hitting $169 billion in late September—a 31% improve year-to-date. This surge is primarily pushed by Tether’s USDT, which has seen important development in balances on centralized exchanges.

USDT (ERC20 on Ethereum) balances on exchanges rose to 22.7 billion in October, marking a 54% improve of $8 billion because the starting of the yr. Centralized exchanges additionally maintain roughly $8.5 billion of USDT issued on the TRON community. These elevated stablecoin balances are positively correlated with increased Bitcoin and crypto costs, though Bitcoin’s worth has remained comparatively flat regardless of a 20% development in USDT balances since August.

For the reason that bull cycle started in January 2023, USDT (ERC20) on exchanges elevated from $9.2 billion to $22.7 billion, a 146% rise. The inflow of stablecoins into exchanges suggests elevated liquidity and potential for market motion.

In the meantime, Ripple has entered the stablecoin market with the launch of RLUSD, its US dollar-backed stablecoin launched in late September. RLUSD has reached a market capitalization of $47 million and operates on each the XRP Ledger and Ethereum networks. This transfer positions Ripple within the increasing marketplace for remittances and cash transfers.

The elevated liquidity from stablecoins like USDT and the emergence of recent gamers like Ripple’s RLUSD might sign upcoming shifts within the crypto market panorama.