Heavy deleveraging throughout derivatives markets drags XRP decrease earlier than consumers defend the $2.40 zone, organising a key assist retest heading into Asia buying and selling.

Information Background

- XRP traded sharply decrease via the October 14–15 session as macro strain and broad crypto deleveraging despatched open curiosity down 50% to $4.22 billion.

- Regardless of the washout, spot volumes jumped 40%, signaling institutional re-entry.

- Ripple’s newly introduced partnership with Immunefi — a $200,000 XRP Ledger safety take a look at operating Oct. 27–Nov. 24 — helped anchor sentiment after an early-session slide.

Worth Motion Abstract

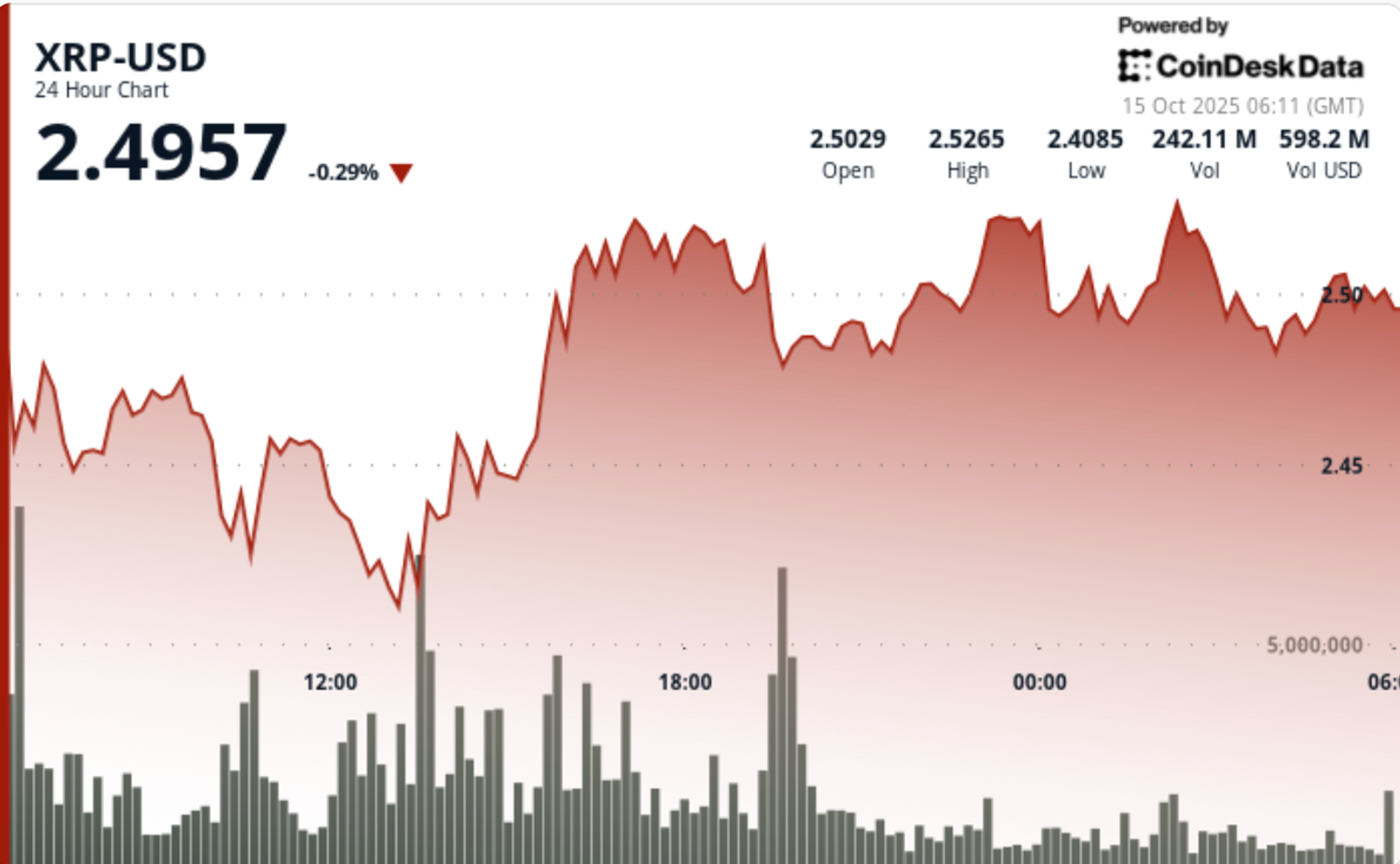

- XRP fell 1.97%, sliding from $2.54 to $2.49 whereas swinging via a $0.16 band ($2.55–$2.39) — roughly 6% intraday volatility.

- Consumers stepped in repeatedly at $2.40–$2.42, defending key assist after a noon capitulation.

- Quantity exploded to 179.4 M at 13:00, practically double the 24-hour common, validating accumulation on the lows.

- Sellers capped rebounds close to $2.53, the place constant distribution shaped a near-term ceiling.

- Late-session commerce noticed XRP get better modestly to $2.50 as dip-buying stabilized order books.

Technical Evaluation

- The $2.40–$2.42 space stays the essential pivot for bulls. A number of rebounds verify institutional protection, however momentum stays fragile under the $2.53–$2.55 resistance cluster.

- A sustained break under $2.40 would open draw back targets at $2.33 and $2.25, whereas reclaiming $2.53 might re-establish an advance towards the broader $2.65 breakout line.

- Quantity-weighted metrics level to accumulation amid pressured unwinds — a basic short-term base-building section if funding normalizes.

What Merchants Are Watching

- Whether or not $2.40 continues to carry via Monday’s Asia open.

- Re-leveraging indicators after open curiosity halved on derivatives exchanges.

- Quantity follow-through above $2.50 confirming accumulation.

- Macro headlines tied to trade-war rhetoric and Fed coverage as volatility drivers.