Shares of Technique ($MSTR) surged as a lot as 7% earlier right now after international index supplier MSCI concluded its long-running evaluation of digital asset treasury firms and opted to not exclude them from its flagship fairness indexes — at the least for now.

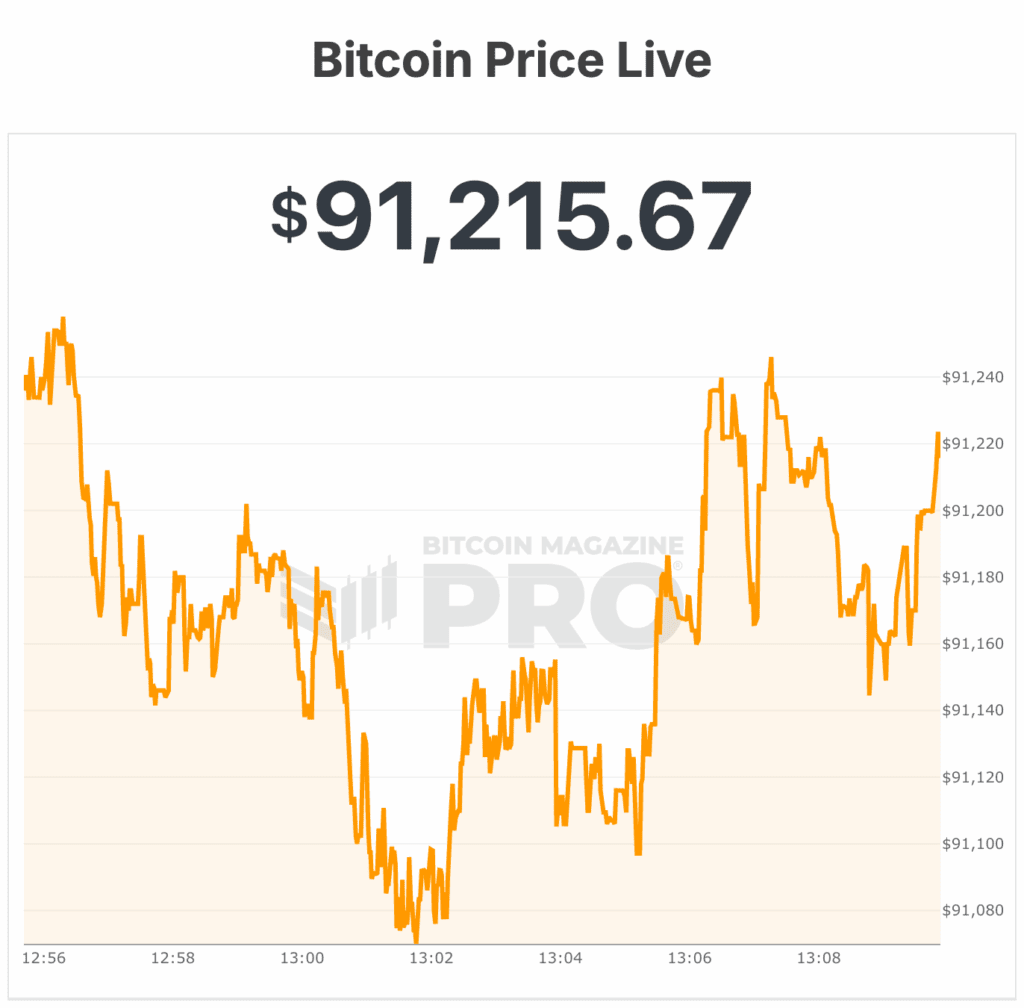

$MSTR was buying and selling above $170 per share in early market buying and selling, earlier than paring features as bitcoin pulled again into the low $91,000 vary.

By noon, $MSTR shares had dipped to round $165, up solely 4%, monitoring weak point within the broader crypto market however nonetheless holding a strong advance on the day.

The rally adopted affirmation from MSCI that it’s going to preserve the present remedy of digital asset treasury firms (DATCOs), together with Technique, that means companies already included in MSCI indexes will stay eligible as long as they proceed to satisfy present necessities.

The choice alleviated months of uncertainty that had weighed on Technique’s inventory and fueled issues over compelled promoting tied to index rebalancing.

MSCI had been reviewing whether or not firms holding a majority of their belongings in bitcoin or different digital belongings ought to be labeled as “investment-oriented” entities reasonably than working firms — a shift that might have rendered them ineligible for inclusion in extensively tracked benchmarks such because the MSCI All Nation World Index and MSCI Rising Markets Index.

That proposal sparked fierce pushback from Technique and the broader bitcoin trade. Technique argued that excluding firms based mostly solely on steadiness sheet composition was arbitrary and undermined index neutrality.

Business teams warned that eradicating DATCOs might set off billions of {dollars} in passive outflows, destabilizing each fairness and crypto markets.

Analysts had estimated that Technique alone might have confronted as a lot as $2.8 billion in compelled promoting if MSCI proceeded with exclusion, with broader selloffs throughout bitcoin treasury companies doubtlessly far bigger. MSCI’s determination successfully defuses that speedy threat.

$MSTR’s conditional regulatory aid

Nonetheless, the result was not an unqualified win. MSCI acknowledged issues from institutional buyers that some digital asset-heavy companies resemble funding funds and mentioned additional analysis is required to tell apart between working firms and investment-oriented entities.

As a part of its interim strategy, MSCI mentioned it is not going to improve index weightings to mirror new share issuance by DATCOs — a transfer that would restrict Technique’s capability to increase its index footprint because it points fairness to purchase extra bitcoin.

MSCI additionally signaled that exclusion stays a chance sooner or later, noting that its indices are designed to trace working firms and {that a} broader session on non-operating companies is forthcoming.

For now, markets targeted on the aid. Technique ($MSTR), which holds almost $63 billion value of bitcoin and stays the biggest publicly traded company holder, noticed speedy shopping for curiosity because the specter of index elimination light.

On the time of writing, bitcoin was buying and selling within the low $91,000 vary.