Bitcoin has been exploring new all-time highs (ATHs) just lately, however Technique nonetheless appears to be in accumulation mode because it has introduced one other massive buy.

Technique Has Purchased 4,225 Bitcoin In Newest Acquisition

As introduced by Technique Chairman Michael Saylor in an X publish, the corporate has made a recent Bitcoin acquisition, persevering with its chain of 2025 buys. With the newest buy, the agency has added 4,225 BTC to its holdings.

In response to the US Securities and Trade Fee (SEC) submitting, the purchase occurred between July seventh and July thirteenth, and concerned a median BTC value foundation of $111,827. This implies the 4,225 tokens had been acquired for about $472.5 million.

Associated Studying

In the identical interval because the acquisition, BTC witnessed a breakout to new ATHs. If the acquisition is to go by, it appears Technique remains to be fascinated with shopping for even at these excessive costs. “Quick Bitcoin in the event you hate cash,” stated Saylor in an earlier X publish.

After the newest purchase, the overall holding of the agency has hit 601,550 BTC. The corporate spent round $42.87 billion to assemble this stack and in the present day, its worth stands at $72.25 billion, implying a major revenue of 68.5%.

Earlier within the day, one other Bitcoin treasury firm added to its holdings: Metaplanet. In response to the X publish by CEO Simon Gerovich, the corporate has added 797 BTC to its reserve, taking the overall to 16,352 BTC. Not like Technique, although, the agency’s common coin value foundation is on the upper aspect, standing at $100,191 proper now.

In another information, whereas the massive gamers out there have been shopping for BTC for some time now, knowledge from the on-chain analytics agency Glassnode suggests retail buyers have lastly joined in.

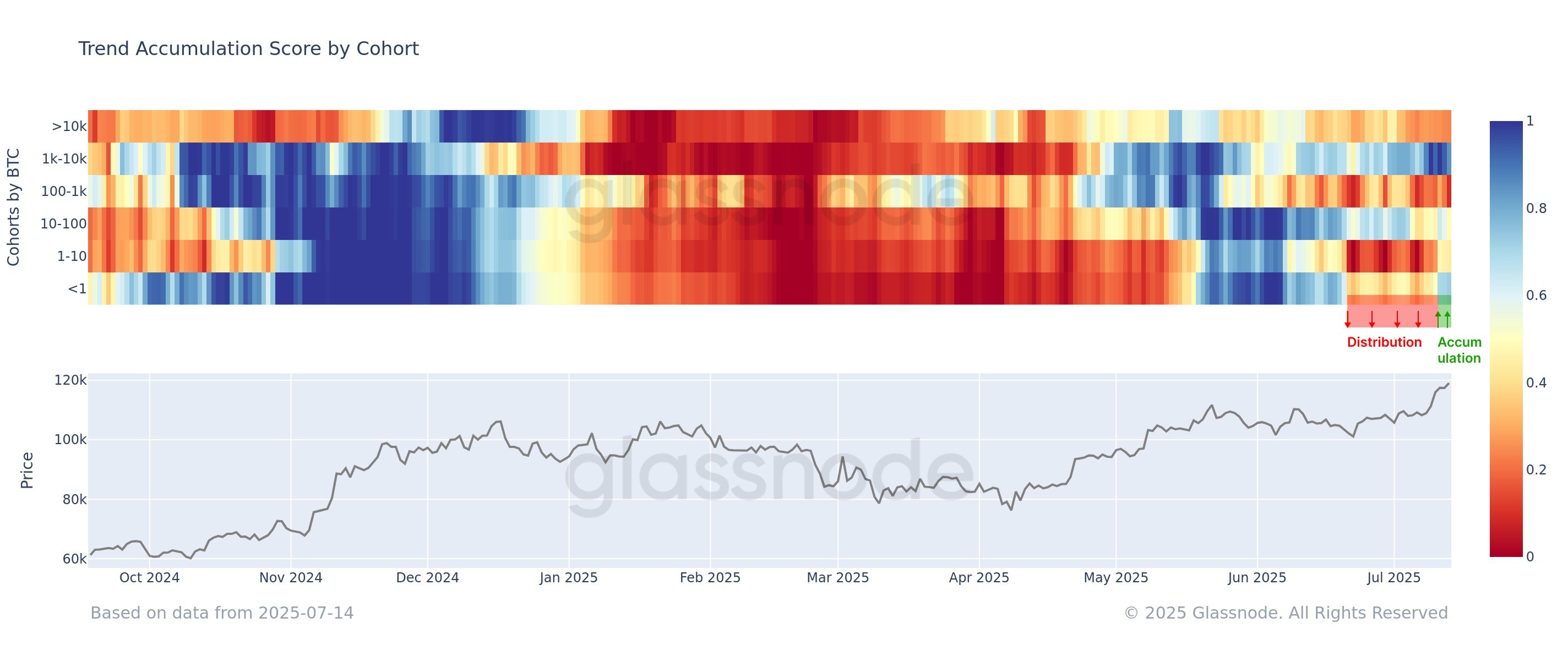

Within the chart, the info of the Accumulation Development Rating is proven for the totally different segments of the Bitcoin userbase. The “Accumulation Development Rating” is an indicator that tells us about whether or not the BTC buyers are accumulating or distributing.

From the graph, it’s seen that the rating has just lately been fairly near 1 for the 1,000 to 10,000 BTC cohort. Which means that these massive fingers, popularly often called the whales, have been exhibiting a near-perfect accumulation development. The newest rally within the cryptocurrency could also be a product of this conviction.

Whereas the whales have been shopping for, the remainder of the Bitcoin market has been exhibiting conduct that tends extra towards distribution. The mega whales, carrying greater than 10,000 BTC, have remained in promoting mode with an Accumulation Development Rating round 0.3.

Associated Studying

Till just lately, the fingers with lower than 1 BTC, the retail, had been in a part of distribution, nevertheless it appears the newest rally has induced them to vary their tune, as they’ve began shopping for.

BTC Worth

Bitcoin went as much as $123,000 earlier, nevertheless it appears the asset has since seen a setback as its worth is all the way down to $119,900.

Featured picture from Dall-E, Glassnode.com, chart from TradingView.com