Motive to belief

Strict editorial coverage that focuses on accuracy, relevance, and impartiality

Created by business consultants and meticulously reviewed

The very best requirements in reporting and publishing

Strict editorial coverage that focuses on accuracy, relevance, and impartiality

Morbi pretium leo et nisl aliquam mollis. Quisque arcu lorem, ultricies quis pellentesque nec, ullamcorper eu odio.

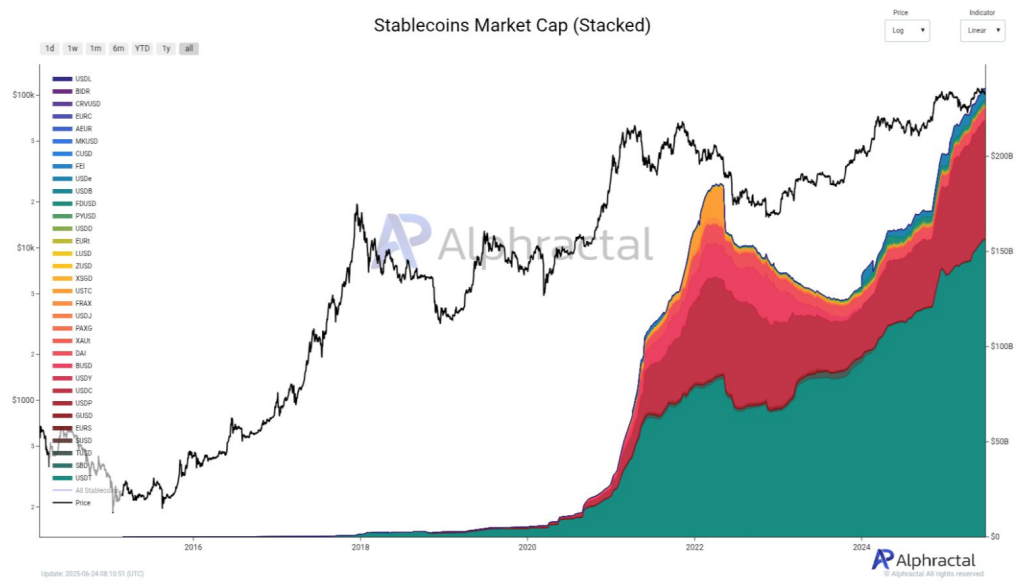

Based mostly on stories, stablecoin issuance has saved climbing for the previous 90 days, with billions of {dollars} flowing in every week. Buyers look like ready for a transparent signal earlier than transferring capital.

Proper now, USDT holds over 66% of that market, whereas USDC and DAI share the remainder. In complete, stablecoins account for about $250 billion, or nearly 8% of all crypto property.

Associated Studying

Stablecoin Provide Hitting New Highs

Demand for a trusted greenback peg is driving this progress. Tether leads by a large margin as a result of many merchants belief its stability. Stablecoin reserves have swelled, at the same time as different segments keep quiet. This factors to loads of money on the sidelines.

Billions in Stablecoins are issued weekly, and the 90-day change for all Stablecoins exhibits a considerable amount of liquidity obtainable available in the market.

Tether (USDT) stands out, representing 66.2% of the complete Stablecoin market.

At present, the Stablecoin market cap is near $250B… pic.twitter.com/DugpqDiEPl

— Alphractal (@Alphractal) June 24, 2025

Bitcoin And Stablecoin Dominance

Bitcoin and stablecoins collectively make up roughly 74% of the overall crypto market. That’s an enormous quantity. In previous cycles, as soon as these balances peak, cash usually strikes into smaller tokens. Proper now, Bitcoin’s value is steadying after current swings. Stablecoin balances continue to grow.

I can’t promise something, however there’s a robust probability {that a} highly effective Altcoin Season will take maintain within the third quarter of 2025.

I had already talked about this in some posts earlier than, about June and July, and I nonetheless stand by that evaluation.

The principle causes are the big quantity of… https://t.co/TjRyxBxSKs

— Joao Wedson (@joao_wedson) June 24, 2025

Altcoin Season On The Horizon

Based mostly on forecasts from analyst Joao Wedson, altcoins may see a carry in Q3 2025. He factors to the massive quantity of stablecoin liquidity and chronic doubt amongst retail and large gamers. That stage of doubt has come earlier than in different cycles, and it often marks a turning level. When confidence returns, altcoins are inclined to surge.

Buyers Poised On The Sidelines

Many holders appear able to hit purchase. They’re holding onto stablecoins till charts, on-chain information or macro information clear up. A lift in stablecoin flows to exchanges could possibly be one early trace that rotation is beginning. Massive strikes by whale wallets into low-cap tokens might observe.

In current weeks, inflows of stablecoins into buying and selling platforms have ticked greater. That’s a key sign to observe. If weekly inflows rise sharply—say above $5 billion—it might present critical urge for food constructing. Previous cycles noticed comparable spikes simply earlier than altcoin rallies started.

Market observers may even be monitoring Bitcoin’s consolidation vary intently. If it stays above current lows for a couple of weeks, that will give confidence a lift in all places. Then we may see smaller cryptocurrencies transfer greater on new liquidity.

Based mostly on these alerts, it appears to be like like we’re in a ready recreation. Stablecoin provides are at file ranges, Bitcoin is settling, and altcoin sentiment stays low. When all that strains up excellent, funds are prone to rotate. Then the altcoin sector may see new life.

Featured picture from Imagen, chart from TradingView