Stablecoin protocol Degree raised a recent spherical of enterprise capital to develop its $80 million yield-paying stablecoin as yield-generating digital asset choices are more and more in demand with a cooldown in crypto costs.

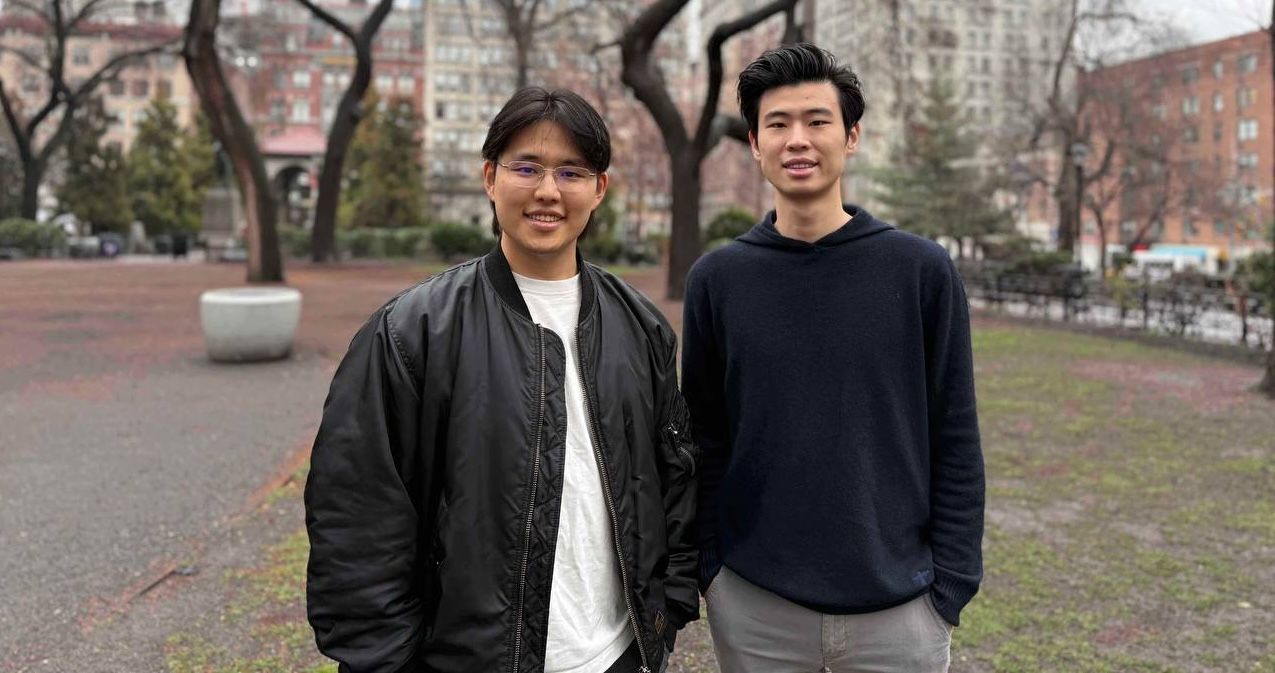

Peregrine Exploration, the event agency behind Degree, obtained one other $2.6 million led by early backer Dragonfly Capital with Polychain additionally collaborating, founders David Lee and Kedian Solar instructed CoinDesk in an interview. New buyers embrace Flowdesk, Echo syndicates Native Crypto and Feisty Collective by Path, and angel buyers Sam Kazemian of Frax and Albert Chon of Injective.

The most recent spherical adopted a $3.4 million elevate in August, bringing whole enterprise capital funding to $6 million so far.

Degree, with its lvlUSD token, is competing within the fast-growing stablecoin asset class, one of many hottest sectors in crypto and a darling amongst enterprise capital investments. Stablecoins—cryptocurrencies with a hard and fast value, predominantly tied to the U.S. greenback—are a key piece of infrastructure for buying and selling and transactions on blockchains. Nonetheless, the most important issuers don’t usually supply yield to customers earned on belongings within the backing reserve. Tether, for instance, reported $13 billion earnings final 12 months, partly from the U.S. Treasury yield backing its $143 billion USDT token.

That is why a brand new technology of yield-earning stablecoins is getting more and more standard amongst crypto buyers. Ethena’s USDe, which generates yield on a market-neutral carry commerce technique harvesting futures funding charges, zoomed to above $5 billion provide in little greater than a 12 months. In the meantime, tokenized variations of cash market funds and Treasury payments, one other stablecoin various, hit a $4.6 billion market capitalization.

Degree’s stablecoin gives buyers yield from placing the backing belongings to work on decentralized finance (DeFi) lending protocols like Aave, whereas automating its reserve administration. Customers can mint lvlUSD by depositing Circle’s USDC or USDT stablecoins and lock up (stake) the tokens to lend out to generate yield on-chain. As of final week, annualized yield for staked model of lvlUSD stood at 8.3%, increased than tokenized cash market fund yields. In the meantime, lvlUSD has been built-in with DeFi protocols comparable to Pendle, Spectra and LayerZero, and can be utilized as collateral on Morpho.

“Their absolutely on-chain, clear method to yield technology units them other than rivals counting on opaque, centralized strategies,” stated Sven Wellmann of Polychain, one of many buyers within the protocol.

In keeping with Degree’s calculation, the protocol outpaced rival stablecoins’ yield choices over the previous month, which has helped its provide surpass $80 million in 5 months since its beta launch.

With the most recent funding, Degree plans to develop their workforce and advertising and marketing efforts whereas persevering with to develop utility for lvlUSD past staking it, Kedian Solar defined. The protocol additionally plans to faucet into Morpho to generate yield within the subsequent few weeks.

With these efforts, lvlUSD might probably push in the direction of a $200-$250 million market cap, a key milestone the workforce desires to attain, Solar stated.