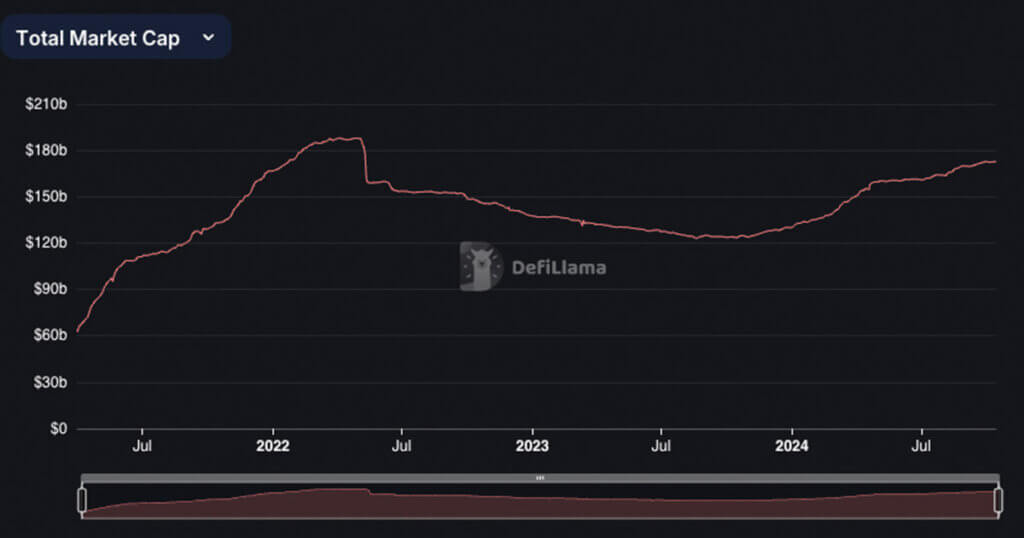

Stablecoin market capitalizations have shifted throughout a number of blockchains over the previous week. The full market cap throughout all chains has reached $172 billion, simply $15 billion away from its all-time excessive of $187 billion recorded in 2022. The full market cap dropped to $157 billion following the collapse of UST.

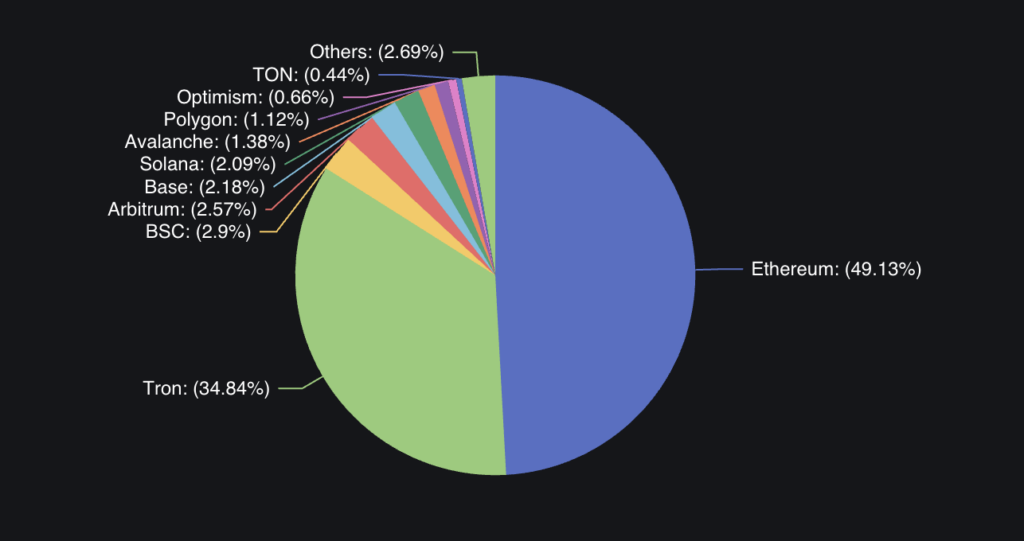

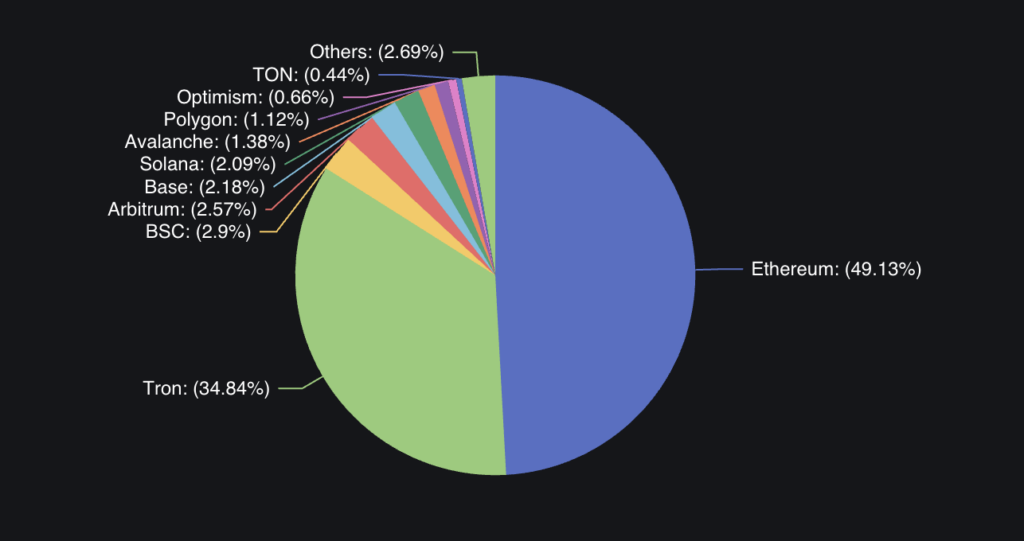

Based on DefiLama, Ethereum’s stablecoin cap rose by 0.69% to $84.869 billion, with USDT comprising 55.49% of its stablecoin dominance. Tron noticed a 0.39% enhance to $60.184 billion, dominated by USDT at 98.26%.

Binance Sensible Chain’s stablecoin cap grew by 0.34% to $5.014 billion, with USDT dominating at 79.39%. Arbitrum skilled a slight lower of 0.67%, bringing its stablecoin cap to $4.433 billion, with USDT accounting for 63.67%. Base’s stablecoin cap elevated by 0.97% to $3.758 billion, predominantly in USDC at 92.69%.

Solana confronted a decline of three.30% in stablecoin cap, now at $3.607 billion, with USDC making up 66.35%. Avalanche noticed a major rise of 4.60% to $2.39 billion, dominated by USDT at 65.43%. Polygon’s stablecoin cap elevated by 2.15% to $1.928 billion, with USDC holding 52.30% dominance.

Optimism’s stablecoin cap decreased by 5.32% to $1.142 billion, whereas Close to noticed a modest enhance of 0.17% to $669.38 million. Aptos skilled a notable rise of 9.35% to $254.54 million, with USDC comprising 58.75%.

These shifts point out altering tendencies in stablecoin distribution throughout chains. Components similar to whole market capitalization issued on-chain versus bridged belongings and the ratio of stablecoin market cap to whole worth locked (TVL) spotlight liquidity actions and person preferences.

Stablecoin issuance vs bridged belongings

Stablecoin issuance throughout blockchains additionally reveals nuanced tendencies when evaluating the entire market capitalization issued on-chain versus bridged belongings. On Ethereum, a considerable $95.40 billion in stablecoins have been issued straight on-chain, whereas solely $5.69 million are bridged, emphasizing Ethereum’s position as a major hub for stablecoin liquidity. Its stablecoin-to-TVL ratio stands at 1.9, reflecting a balanced integration of stablecoins into its DeFi infrastructure.

Tron, in contrast, demonstrates a higher reliance on stablecoins, with $62.36 billion issued and no vital bridged belongings, leading to the next stablecoin-to-TVL ratio of 8.28. Tron’s concentrate on environment friendly stablecoin transactions, notably for USDT, signifies a extra stablecoin-centric use case on the community.

Avalanche, with $2.30 billion in stablecoins issued on-chain and $94.98 million bridged, noticed a rise in stablecoin market cap. Its stablecoin-to-TVL ratio of two.4 displays average reliance on stablecoins inside its DeFi ecosystem. In the meantime, Solana, regardless of a stablecoin market cap of $3.60 billion and $9.21 million bridged, has a considerably decrease ratio of 0.69, signaling lowered stablecoin exercise in its DeFi panorama.

Base with $3.76 billion in stablecoins, $134.99 million bridged, and a stablecoin-to-TVL ratio of 1.67, suggesting regular progress in utilization. In distinction, Optimism, regardless of a stablecoin cap of $1.142 billion, has the next ratio of 1.82, indicating a bigger relative presence of stablecoins inside its ecosystem regardless of the latest decline in market cap.