Bitcoin’s newest pullback has little to do with crypto-native flows and all the things to do with the greenback, in accordance with chief crypto analyst at Actual Imaginative and prescient Jamie Coutts.

Sharing two charts on X, Coutts argued {that a} rebound within the US Greenback Index (DXY) is briefly tightening international liquidity and pressuring threat belongings throughout the board. “Bitcoin’s dip isn’t mysterious — it’s macro,” he wrote.

Why Is Bitcoin Down?

“The greenback’s rebound is tightening international liquidity. DXY is retesting 100–101 — a key resistance and pure mean-reversion zone after one of many sharpest declines in many years in 1H25. Positioning had grow to be crowded on the quick aspect, so a bounce was at all times seemingly. The actual query: is that this the beginning of a brand new greenback cycle or simply the setup for the following leg decrease? Base case: liquidity tailwinds and an enhancing enterprise cycle hold the outlook for threat belongings bullish into mid-2026,” he added.

Associated Studying

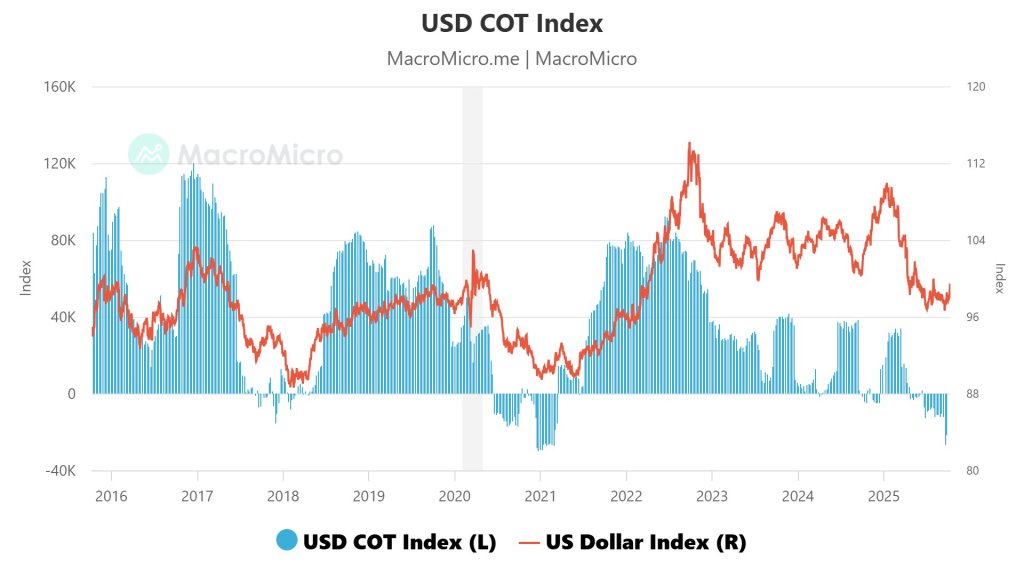

The primary chart he shared juxtaposes the USD COT Index with the US Greenback Index. After a chronic slide in 1H25, speculative positioning flipped aggressively towards the greenback, with the COT index sinking into damaging territory in mid-2025.

That capitulative stance created fertile circumstances for a counter-trend squeeze. The value panel exhibits DXY clawing again towards the 100-101 space—a zone that strains up with prior congestion and the underside of this yr’s breakdown—whereas the COT bars stay beneath zero, according to short-covering dynamics somewhat than a totally rebuilt long-dollar consensus.

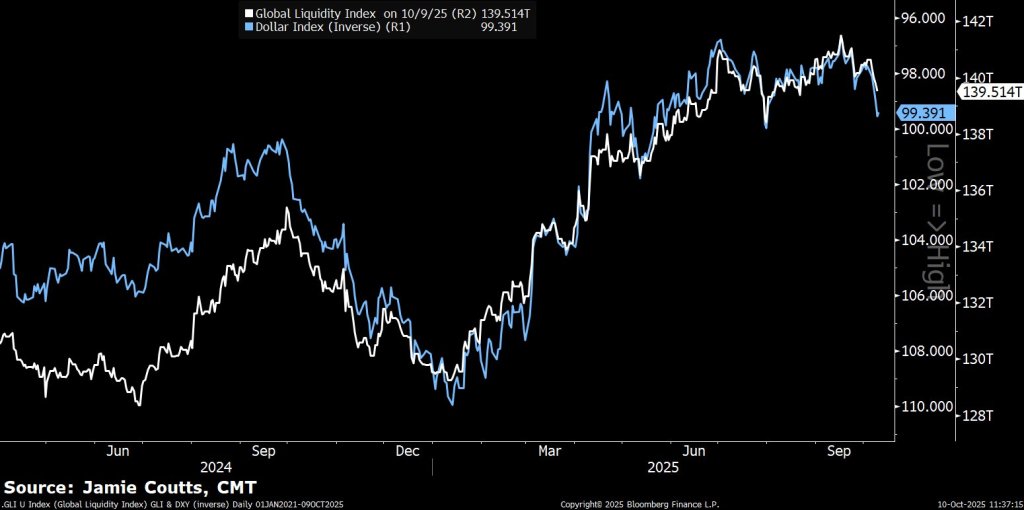

Coutts’ second chart overlays the International Liquidity Index with the inverse of DXY. The sequence monitor one another carefully: when the greenback weakens (inverse DXY rises), the worldwide liquidity proxy rises too, traditionally coinciding with stronger efficiency for duration-sensitive threat belongings similar to equities and crypto.

Associated Studying

Over current weeks, the white liquidity line has rolled over modestly because the blue inverse-DXY line has executed the identical, illustrating the transmission mechanism Coutts highlights: a firmer greenback equals tighter international greenback liquidity on the margin, which in flip dents threat urge for food and crypto beta.

What This Means For BTC Value

Framed this fashion, Bitcoin’s slip is a simple operate of FX imply reversion and futures positioning, not a breakdown in crypto’s structural flows. The “crowded quick” in greenback futures telegraphed vulnerability to a bounce, and the mean-reversion goal round 100–101 provided a logical waypoint for that transfer.

If DXY stalls and resumes decrease from that band—according to the broader 2025 downtrend—liquidity circumstances would seemingly ease once more, restoring the bid underneath high-beta belongings. If, as a substitute, the index pushes by means of and holds above that zone, Bitcoin could be contending with a extra sturdy greenback impulse and a slower return of constructive liquidity momentum.

Coutts’ “base case” stays constructive regardless of the near-term headwind: an enhancing international enterprise cycle and continued liquidity tailwinds into mid-2026. In that framework, Bitcoin’s drawdowns on greenback power look cyclical, not secular. The instant pivot level sits in plain view on his charts: the DXY’s 100–101 retest, born from stretched speculative shorts and traditional imply reversion, is dictating BTC’s temperature for now.

At press time, Bitcoin traded at $121,703.

Featured picture created with DALL.E, chart from TradingView.com