Este artículo también está disponible en español.

Solana (SOL) is dealing with extreme promoting stress because it checks key demand ranges, with bears gaining management after a failed breakout above all-time highs. The value has struggled to keep up momentum, and traders at the moment are looking forward to essential assist ranges that might decide Solana’s subsequent transfer.

Associated Studying

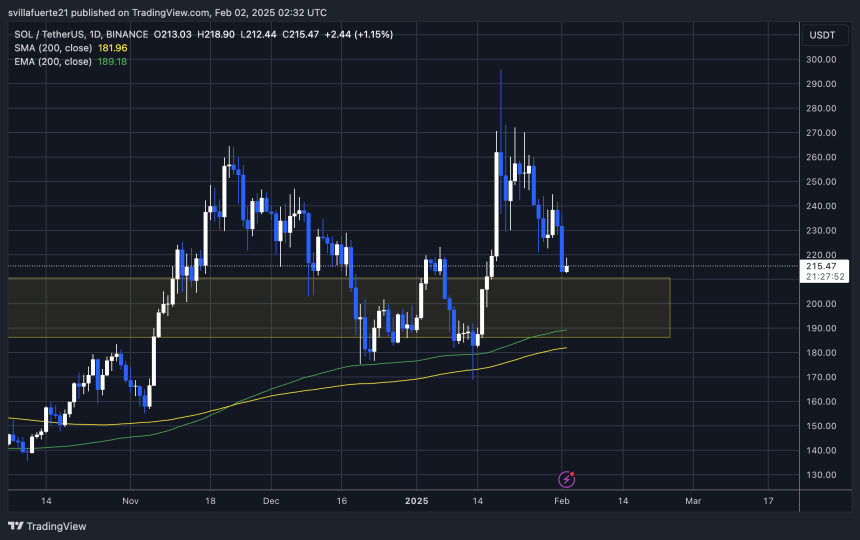

After an explosive rally earlier this 12 months, SOL is now susceptible to breaking decrease as market sentiment turns unsure. High analyst Carl Runefelt shared a technical evaluation on X, revealing that Solana would possibly retest a horizontal resistance if it breaks down a bearish flag sample. This key degree will likely be essential in figuring out whether or not SOL can maintain its floor or if it will likely be dragged right into a deeper correction.

If the bearish flag confirms a breakdown, SOL might drop to check decrease demand zones, resulting in additional draw back stress. Nonetheless, if bulls handle to reclaim key resistance ranges, a possible restoration could possibly be on the desk. The approaching days will likely be essential for Solana as merchants search for indicators of a development reversal or continued bearish momentum.

Solana Enters A Important Section

Solana is at an important part, with the following few days set to outline whether or not it should proceed its downtrend or set up a structural value change. After failing to maintain its bullish momentum above all-time highs, bears have taken management, pushing SOL into key demand ranges. The value has now dropped to $220, and analysts are warning that decrease ranges might come within the following weeks.

High analyst Carl Runefelt shared a technical evaluation on X, highlighting that Solana would possibly retest horizontal resistance round $222 if it breaks down a day by day bearish flag. If this bearish sample performs out, SOL might drop even additional to check the $211 degree, a serious demand zone that can possible determine the development’s destiny.

Nonetheless, if bulls handle to defend present ranges, a push above provide zones might result in a value restoration. Step one for a reversal could be breaking again above $222 and reclaiming it as assist. If that occurs, Solana might regain power and problem greater resistance ranges within the coming weeks.

Associated Studying

The approaching days will likely be decisive, as SOL stands at a turning level between a deeper correction or the start of a restoration part.

Value Struggles Under Key Degree

Solana is buying and selling at $216 after shedding the essential $220 demand degree, a serious assist that bulls wanted to carry. Now, bears are in management, and each second SOL spends beneath this degree will increase the chance of additional draw back. If the value fails to get better shortly, the following important demand zone to check will likely be round $200, a degree that might decide whether or not SOL continues its correction or finds a robust bounce.

Nonetheless, bulls will not be out of the sport but. If SOL manages to reclaim $220 as assist, it might invalidate the bearish breakdown and arrange for a possible development reversal. A powerful transfer above this degree would point out renewed shopping for stress and will enable Solana to problem greater resistance zones within the coming days.

Associated Studying

For now, SOL stays in a fragile place, and merchants ought to carefully watch value motion round $220 and $200. A continued downtrend beneath $200 would verify a deeper correction, whereas a swift restoration above $220 might reignite bullish momentum. The following few periods will likely be essential in figuring out Solana’s short-term path.

Featured picture from Dall-E, chart from TradingView