Purpose to belief

Strict editorial coverage that focuses on accuracy, relevance, and impartiality

Created by trade specialists and meticulously reviewed

The best requirements in reporting and publishing

Strict editorial coverage that focuses on accuracy, relevance, and impartiality

Morbi pretium leo et nisl aliquam mollis. Quisque arcu lorem, ultricies quis pellentesque nec, ullamcorper eu odio.

Este artículo también está disponible en español.

Solana is exhibiting indicators of energy because it pushes above a key resistance degree, suggesting that bulls are starting to regain some management after weeks of weak spot. The broader crypto market stays risky, pushed by ongoing macroeconomic uncertainty and heightened commerce tensions between the US and China. Regardless of these dangers, investor sentiment seems to be bettering barely, fueling hopes that Solana and different altcoins might enter a restoration rally.

Associated Studying

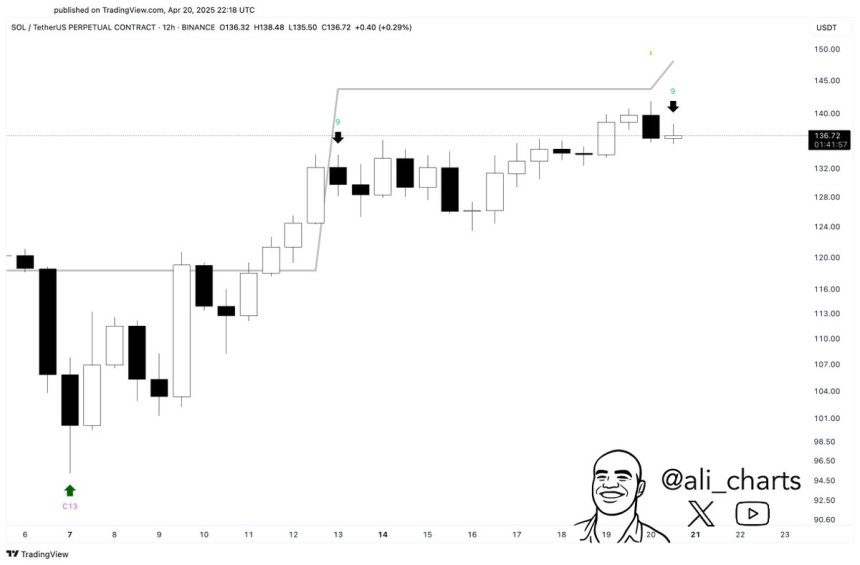

Nonetheless, warning stays warranted. High analyst Ali Martinez shared a technical sign that tempers the latest optimism—in keeping with his evaluation, Solana could also be due for a short-term pullback. A promote sign has flashed on the 12-hour chart utilizing the TD Sequential indicator, which has traditionally marked native tops and value exhaustion phases.

Whereas Solana’s latest breakout is encouraging, the presence of this bearish sign suggests the rally could also be dropping steam within the close to time period. Buyers might be watching intently to see whether or not SOL can maintain assist above the reclaimed ranges or if it retreats underneath promoting stress. For now, the market is caught between early indicators of restoration and the ever-present danger of one other leg down.

Solana Faces Key Resistance As Brief-Time period Pullback Sign Emerges

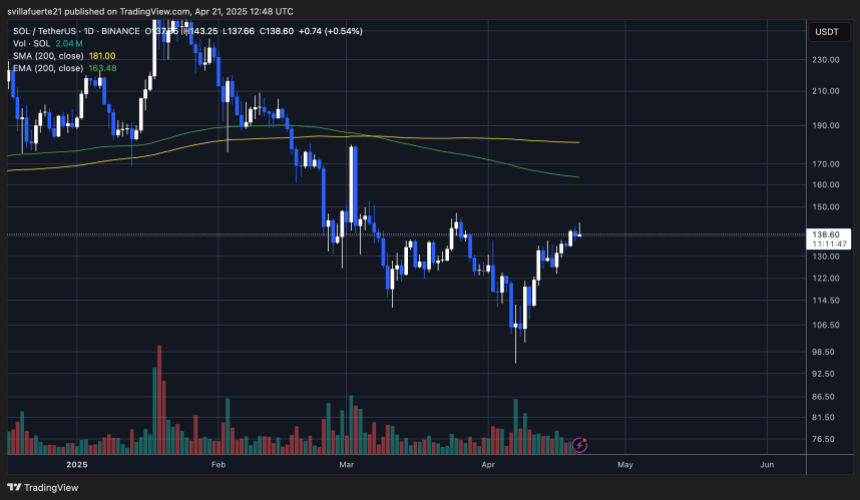

Solana has surged over 48% since April 7, signaling renewed momentum after a protracted interval of intense promoting stress. Bulls at the moment are dealing with a essential check as value approaches the $150 degree—a key resistance zone that has held again additional advances previously.

Regardless of the latest restoration, Solana stays some of the affected property through the 2025 downtrend, having misplaced greater than 65% of its worth since its January peak. This underscores the importance of the present transfer and the significance of holding increased ranges to substantiate a real reversal.

Nonetheless, warning is warranted. Martinez shared knowledge on X highlighting a TD Sequential promote sign on the 12-hour chart—a technical indicator that always precedes short-term development exhaustion or reversals. The TD Sequential works by figuring out a sequence of value actions that may point out overbought or oversold circumstances. If the sign performs out, Solana might face a short lived pullback earlier than any sustained upside continues.

Macroeconomic elements stay in play, with ongoing commerce tensions between the US and China nonetheless shaping sentiment throughout world markets. Nonetheless, hopes for a possible settlement between the 2 international locations and increasing world liquidity are giving bulls some optimism, particularly throughout the altcoin sector.

Associated Studying

SOL Value Hovers At Pivotal Zone: What’s Subsequent?

Solana (SOL) is at the moment buying and selling at essential ranges, testing the important thing $150 resistance zone after a pointy restoration from latest lows. Bulls should reclaim and maintain above this degree to substantiate a breakout and validate the beginning of a sustained uptrend. A decisive transfer above $150 would doubtless set off additional shopping for momentum, probably resulting in a retest of upper targets not seen since early March.

Nonetheless, if SOL fails to interrupt above this barrier within the quick time period, a interval of consolidation between the $130 and $120 ranges might nonetheless sign energy. Holding this zone would recommend that bulls are constructing a base for continued upward value motion and absorbing promoting stress and not using a vital retrace. Such consolidation phases are sometimes thought of wholesome in bullish market buildings, permitting momentum to rebuild earlier than the following leg increased.

Associated Studying

On the draw back, failure to carry the $120 assist degree might expose SOL to deeper losses, with the $100 zone as the following vital space of demand. A break beneath this degree would invalidate the present bullish outlook and probably reignite a broader downtrend. For now, all eyes are on SOL’s response across the $150 mark.

Featured picture from Dall-E, chart from TradingView