Solana’s worth retreated for 2 consecutive days on Monday, reaching its lowest level since January 3, as risk-off sentiment unfold throughout monetary markets after Donald Trump threatened new tariffs on key NATO members.

Abstract

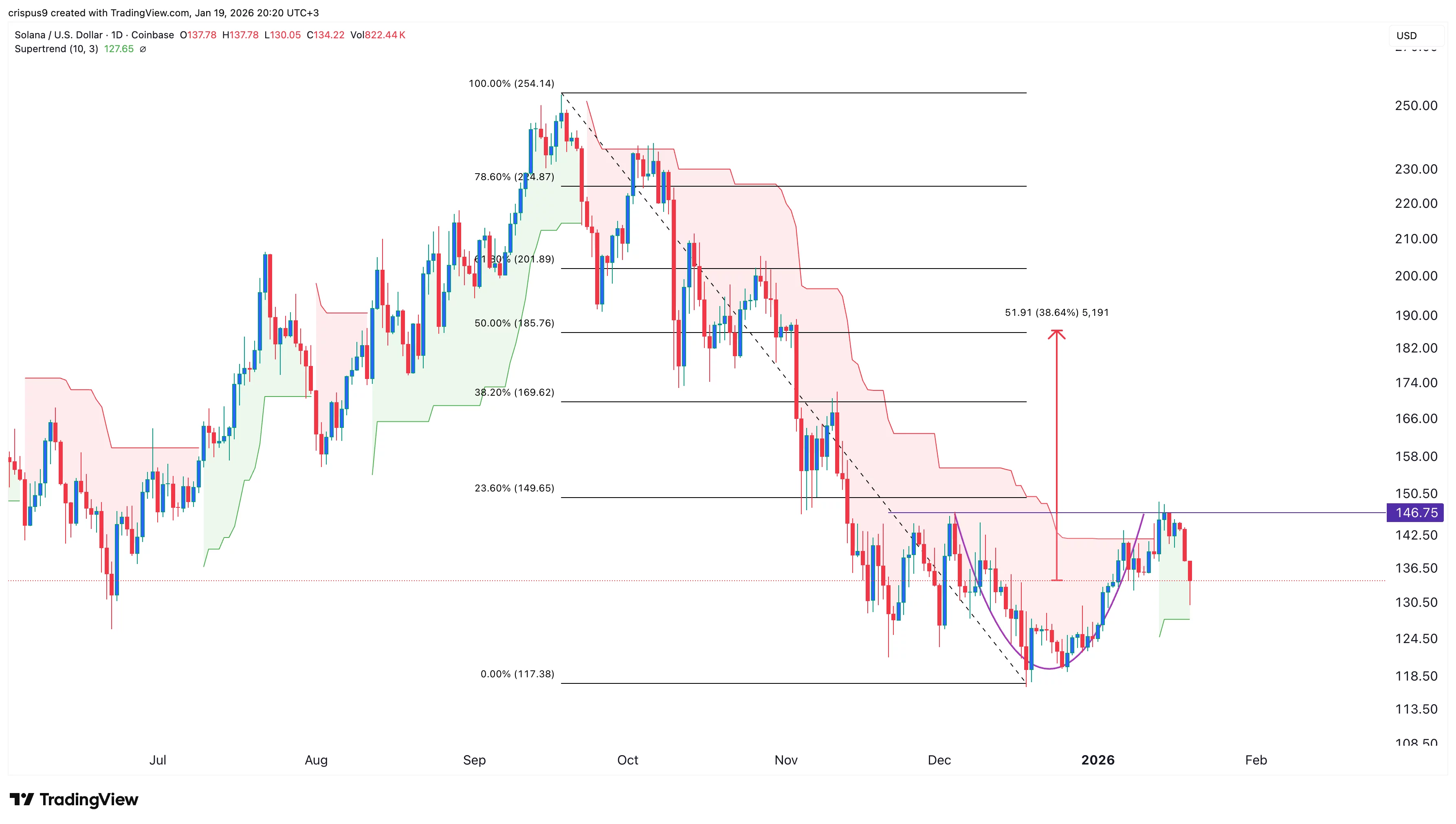

- Solana worth has fashioned a cup-and-handle sample on the day by day chart.

- The continuing decline is a part of the formation of the deal with part.

- Third-party knowledge exhibits that Solana transactions are hovering.

Solana (SOL) token retreated to a low of $130, down by 10% from its highest level this 12 months. This retreat introduced its market capitalization to $80 billion, making it the sixth-biggest cryptocurrency within the trade.

On the constructive facet, Solana has robust technicals and fundamentals which will assist help its restoration within the close to time period. For instance, Nansen knowledge exhibits that it’s the most actively used blockchain within the crypto trade.

It dealt with over 1.86 billion transactions within the final 30 days, a 1.8% improve. Its transaction prices had been a lot increased than these of different networks like Ethereum, BNB Chain, Tron, and Polygon mixed.

Solana additionally had over 72 million energetic addresses on this interval, an 18% improve. Its energetic addresses had been a lot increased than these of different common chains.

Moreover, Solana’s DEX quantity jumped to over $114 billion within the final 30 days, a lot increased than Ethereum, Base, and BSC Chain mixed. All these metrics led to a surge in community charges, which rose to $18.5 million.

Solana can be turning into a preferred chain in areas aside from meme cash. For instance, it has develop into a serious participant within the tokenized shares trade, with the whole worth locked rising to over $1.6 billion.

This development will probably speed up after the community launches the Alpenglow improve later this quarter. This improve will introduce new capabilities and better speeds.

In the meantime, spot Solana ETFs have continued their inflows this 12 months. They’ve added over $97 milion in inflows in January, with the whole property rising to $1.2 billion.

Solana worth technical evaluation

The day by day timeframe chart exhibits that the Solana token pulled again sharply after hitting the important thing resistance stage at $146, which was a couple of factors beneath the 23.6% Fibonacci Retracement stage.

This retreat is probably going a part of the deal with part of the cup-and-handle sample, a standard bullish continuation sample. The coin stays within the inexperienced, an indication that the rebound stays intact.

Subsequently, the coin will probably rebound to the 50% Fibonacci Retracement stage at $185, a 40% improve from the present stage.