Este artículo también está disponible en español.

Solana (SOL) is presently buying and selling at an important demand stage close to $163, following a retrace from native highs round $183. This worth is a important assist space that would decide the path of SOL’s upcoming worth motion. Dropping this stage might sign a deeper correction, which might intensify promoting strain and probably push SOL to retest decrease assist ranges.

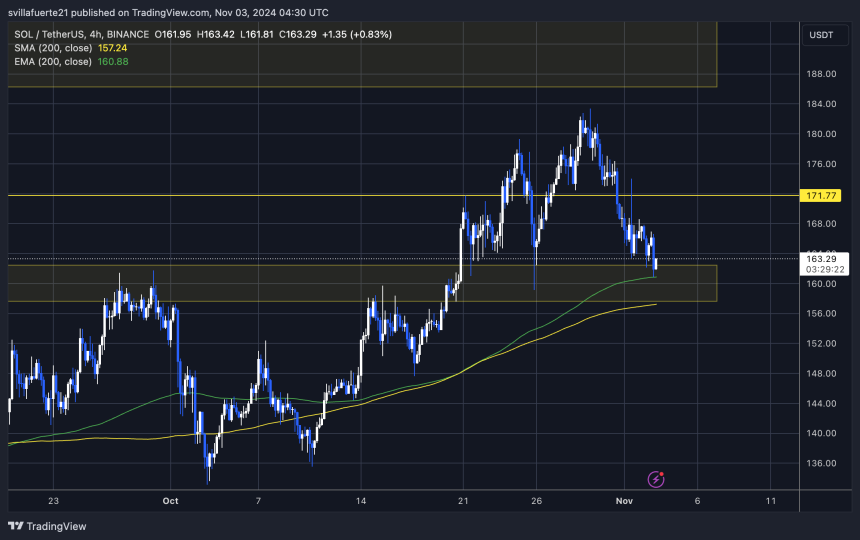

Nevertheless, prime analyst Daan shared a technical evaluation suggesting that if SOL can maintain this “inexperienced zone” round $160, it might pave the best way for a rebound. Daan notes that in essentially the most optimistic state of affairs, SOL might maintain this assist and begin a gradual climb, in the end aiming to check the downtrend line that has stored it in test. This setup would preserve SOL’s bullish construction intact, creating a possible entry level for traders eyeing a bounce.

Associated Studying

With the broader crypto market exhibiting volatility and Solana dealing with this pivotal stage, the subsequent few days shall be essential. Merchants and traders are intently watching to see if this demand zone can assist a reversal, probably main SOL again towards latest highs.

Solana Holding Sturdy Regardless of Uncertainty

Solana (SOL) has managed to carry above the important thing assist stage round $160, regardless of the latest market volatility and uncertainty. This stage is essential for SOL’s worth construction, because it’s a robust demand zone that would act as a basis for the subsequent upward transfer.

Crypto analyst Daan just lately shared his perspective on X, revealing that SOL’s “most bullish case” could be for it to carry this “inexperienced zone” round $160, permitting it to regularly grind again up towards the descending trendline that has capped latest positive aspects.

In Daan’s view, the subsequent try at this trendline might seemingly lead to a profitable breakout, with the potential to push SOL’s worth above $200. He means that ready for affirmation of this breakout may very well be a sound technique for cautious traders, as there’s nonetheless ample room for upside even after a confirmed reversal. His evaluation highlights a assured outlook on SOL’s potential restoration, seeing this accumulation zone as a promising shopping for alternative.

Nevertheless, Daan additionally acknowledges that there’s nonetheless a level of draw back threat. If SOL fails to carry above this $160 stage, a deeper correction might comply with, probably driving SOL to check decrease assist ranges.

Associated Studying

For now, the market will watch this assist stage intently as a important indicator of SOL’s short-term development. Holding above it might sign energy and open the door for a possible rally, whereas a breakdown might result in a extra prolonged bearish section. As the general market sentiment stays blended, Solana’s subsequent strikes shall be important for merchants and traders alike.

SOL Value Motion

Solana is presently buying and selling at $163 after tagging the 4-hour 200 exponential transferring common (EMA), a important indicator of short-term energy. Holding above this EMA indicators a bullish outlook for SOL, suggesting that patrons are stepping in to assist the worth at this stage. If SOL can keep momentum above the 200 EMA, it might construct a basis for a possible rally to new native highs, probably difficult the latest peak round $183.

Nevertheless, the $160 stage stays an important assist space. Dropping this assist would seemingly set off important promoting strain, probably driving SOL all the way down to the $150 vary, the place additional demand could emerge. This zone could be intently watched by traders searching for potential accumulation alternatives, as a dip might present favorable entry factors for long-term holders.

Associated Studying

In distinction, a robust push above the present demand stage would affirm renewed bullish momentum, paving the best way for SOL to focus on and probably surpass latest highs. As SOL hovers round this key technical zone, merchants shall be looking ahead to any decisive motion that would sign the subsequent path, whether or not or not it’s a continued uptrend or a retracement to decrease demand ranges.

Featured picture from Dall-E, chart from TradingView