Solana’s worth rally reached a brand new milestone on Monday. SOL traded at $195.50 per coin, pushing the overall valuation to over $105 billion for the primary time since January 25.

That bounce displays rising optimism across the token. Quick‑time period beneficial properties have been sturdy, however questions stay about how deep the restoration actually runs.

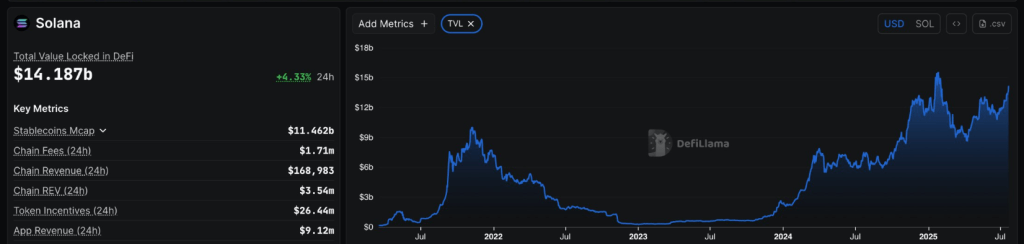

DeFi TVL Rises With Value

Primarily based on experiences, Solana’s complete worth locked in DeFi hit $14.18 billion. That’s the very best stage in six months, again to the place it stood in January when SOL first reached its all‑time excessive.

An enormous chunk of that acquire comes from the token’s personal worth climbing. When SOL strikes up, each coin locked in lending swimming pools and vaults will get price extra on paper. Customers haven’t wanted to hurry in and lock contemporary tokens to spice up TVL numbers.

The general ecosystem feels bigger. But true utilization development could also be slower than these headline figures counsel. Specialists are holding a detailed eye on what number of new deposits truly present up. In spite of everything, token worth and actual‑world demand don’t all the time rise on the similar tempo.

DEX Buying and selling Exercise Reveals Uptick

Between July 14 and July 20, Solana’s decentralized exchanges dealt with over $22 billion in buying and selling quantity. That’s up from near $19 billion the week earlier than.

Raydium led with $8.4 billion, adopted by Orca at nearly $6 billion and Meteora at $5.3 billion. Primarily based on knowledge, merchants are coming again. However weekly volumes nonetheless sit far beneath the $98 billion peak set in mid‑January.

That hole indicators a market that’s warming up however not but boiling over. Quantity beneficial properties present renewed curiosity amongst lively customers. It additionally hints that contemporary methods and new tokens could also be discovering toes after a slower spell.

Staking Dominates Community Safety

In line with on‑chain figures, about 355 million SOL stay staked with validators. That stake is price roughly $69 billion, or about 65% of all tokens in circulation.

These cash aren’t counted in DeFi TVL or in DEX volumes. As an alternative, they’re busy securing the community and validating transactions.

In the meantime, SOL is predicted to extend one other 3.50% and hit $210 by August 21, 2025. Sentiment is at present bullish whereas the Concern & Greed Index is at 71 (Greed).

Up to now 30 days, SOL skilled 19/30 inexperienced days and eight.61% worth fluctuations, indicating each power and volatility in at the moment’s market, knowledge from CoinCodex exhibits.

Featured picture from Meta, chart from TradingView