Este artículo también está disponible en español.

Solana continues to show that it’s one of many prime blockchains for this cycle. After its rally, which gained 35% over the previous 60 days, the favored Layer 1 blockchain is again within the information with extra on-chain actions.

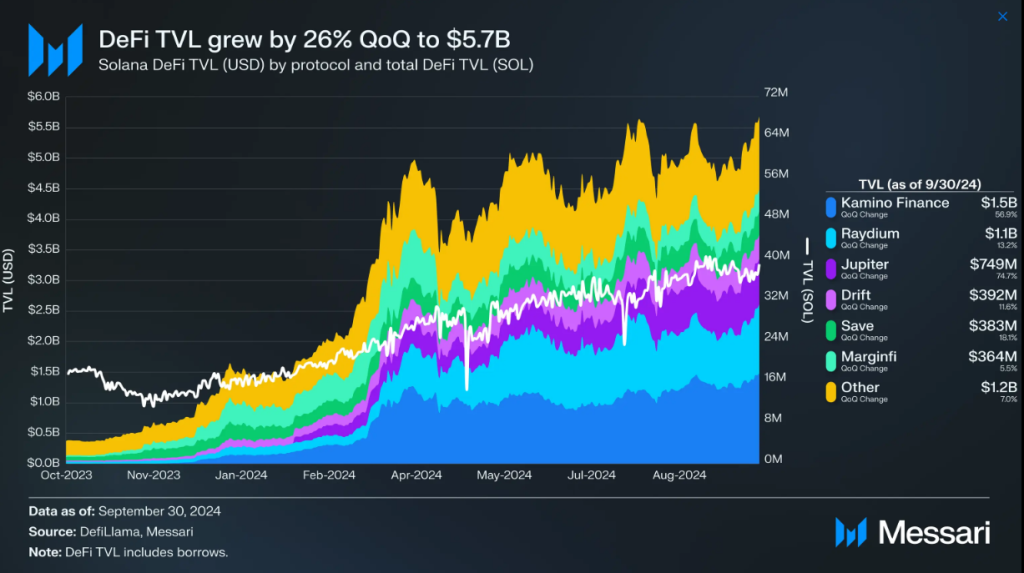

In keeping with latest knowledge, Solana’s DeFi Complete Worth Locked or TVL elevated to $5.7 billion within the third quarter, reflecting a 26% enchancment from the earlier quarter.

Associated Studying

Kamino, a crypto lending service, leads the depend with $1.5 billion in TVL and a powerful 7% Quarter-on-Quarter development, helped by jupSOL and PYUSD additions. Latest knowledge additionally means that Solana’s market cap is now $3.8 billion, an enchancment of 23%, boosted by the combination of PayPal’s PYUSD.

DeFI Continues To Drive Progress For Solana

Solana DeFi tops the chain’s actions with a complete locked worth, price $5.7 billion. This newest SOL knowledge displays a strong 26% development QoQ, pushing the blockchain to change into third largest on this metric, surpassing Tron.

In a Messari report, Solana’s TVL elevated as a result of elevated actions for Kamino, which accounted for $1.5 billion of the whole contracts locked. Kamino’s latest quarterly determine represents a 57% rise, due to the latest integration of jupSOL and PYUSD.

Apart from Kamino Finance, Solana’s blockchain featured locked property for Raydium, with $1.1 billion, and Jupiter, with $749 million. Kamino Finance’s spectacular efficiency is linked to its Kamino Lend V2 launch, providing a permissionless vault and market layer.

Analysts anticipate Kamino Finance to proceed its dominance by including new initiatives just like the Spot Leverage and Lending Orderbook.

Solana DEX Exhibits Indicators Of Slowing Down

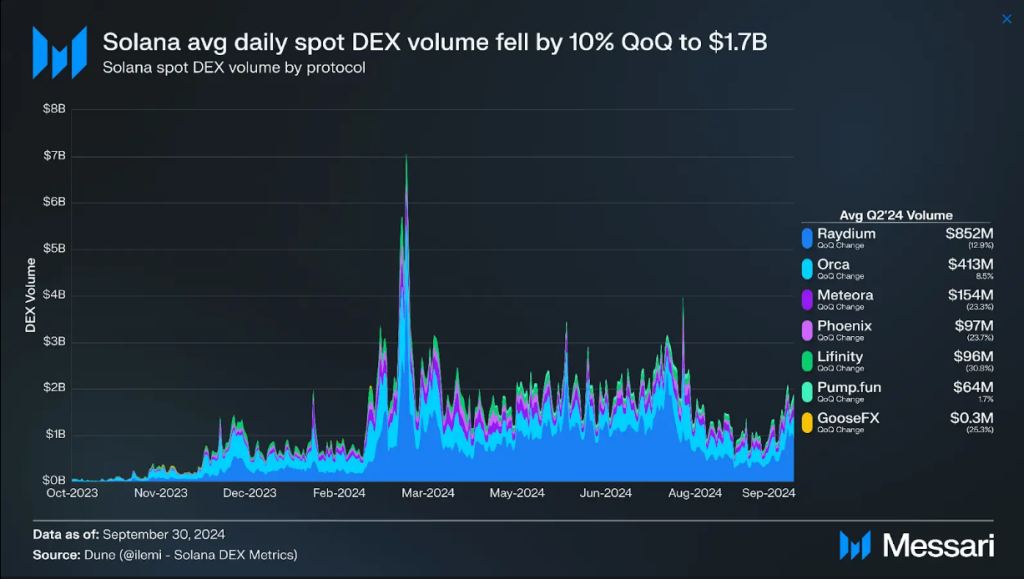

Solana’s DEX exercise was down 10% QoQ however rebounded a bit by October. The common day by day quantity on the blockchain’s alternate hit $1.7 billion, largely due to a fall in meme cash.

Raydium retains its dominance on Solana’s DEX, with a 51% market share, though its day by day common quantity dipped by 13% to $852 million. The amount elevated by $350 million with the discharge of Moonshot, a crypto cell buying and selling app.

Jupiter additionally stayed on the prime, cornering 43% of the whole spot alternate quantity. Latest developments, together with the discharge of Jupiter Cell and the combination of Google Pay and Apple Pay, helped the platform.

Associated Studying

SOL’s Stablecoins Get Assist From PYUSD

In the identical Messari report, PayPal’s PYUSD lifts SOL’s stablecoin market. The PYUSD was launched in Might in Solana, which is principally instrumental in its market cap development, which now stands at $3.8 billion. With thrilling options like programmable transfers and switch hooks, PayPal’s PYUSD turned immediately in style.

Apart from PYUSD, USDC additionally contributes to Solana’s stablecoins market. Circle’s integration of Internet 3.0 providers for SOL offers enterprise performance options like payment sponsorship and programmable wallets, permitting builders to combine multi-chain options shortly.

Featured picture from StormGain, chart from TradingView