Ethereum is buying and selling confidently above the $3,100 stage after breaking by way of this key resistance with power, signaling a possible shift in market dynamics. Whereas Bitcoin experiences a short-term pullback from its all-time highs, Ethereum’s upward transfer highlights rising momentum throughout the altcoin sector. Bulls are more and more optimistic, viewing this divergence as an indication that capital could also be rotating into ETH and different high-conviction altcoins.

Associated Studying

Fueling this optimism is a mixture of enhancing technicals and strengthening fundamentals. One of the notable developments got here right this moment, as SharpLink Gaming—one of many first Nasdaq-listed firms to undertake an Ethereum-focused treasury technique—bought a further $19,560,000 value of ETH.

The mixture of robust worth motion, growing company curiosity, and supportive on-chain metrics means that Ethereum could possibly be main the subsequent leg of the altcoin rally, particularly if Bitcoin continues to consolidate and traders shift focus to undervalued alternatives throughout the ecosystem.

SharpLink Turns into Largest Company Holder Of Ethereum

SharpLink Gaming has formally grow to be the biggest company holder of Ethereum, with a complete of 280,706 ETH now held in its treasury, valued at roughly $840 million at present market costs. The corporate’s aggressive accumulation technique indicators a brand new part in institutional Ethereum adoption, reinforcing the rising notion of ETH as a long-term strategic asset.

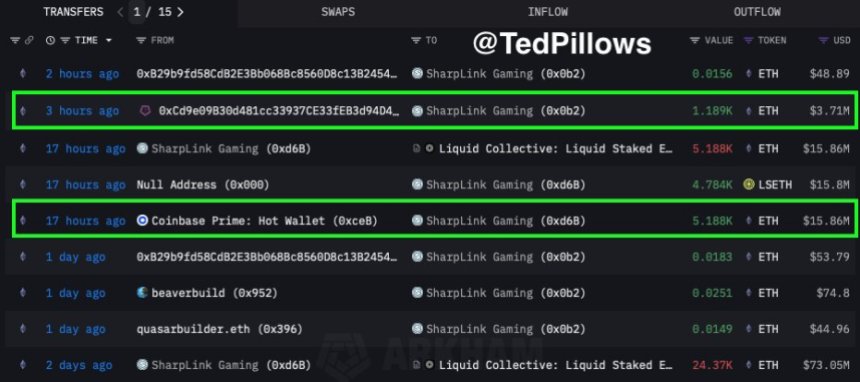

Prime analyst Ted Pillows confirmed SharpLink’s newest buy utilizing on-chain knowledge, which exhibits that the ETH was acquired by way of a Coinbase Prime scorching pockets—a platform generally utilized by establishments for large-scale crypto transactions. In line with a press launch, SharpLink raised $413 million by way of the issuance of over 24 million new shares between July 7 and July 11, capital it promptly deployed into the crypto market.

In complete, the agency acquired 74,656 ETH over the previous week at a mean worth of $2,852 per coin. This aggressive shopping for spree not solely displays SharpLink’s treasury technique but in addition highlights a broader development amongst institutional gamers of turning to ETH as a core asset.

As conventional firms search alternate options to money and authorities bonds, Ethereum’s maturing ecosystem and rising staking participation make it an more and more compelling possibility. SharpLink’s daring transfer might encourage different public corporations to discover ETH as a reserve asset.

Associated Studying

ETH Weekly Chart Indicators Development Reversal

Ethereum is exhibiting robust bullish momentum on the weekly chart. The worth is presently buying and selling at $3,155.21, up over 6% for the week. The breakout above the important thing resistance zone at $2,850 is now confirmed. Marking a big shift in market construction after months of consolidation and bearish stress. This transfer pushes ETH to its highest weekly shut since early 2024.

Technically, Ethereum has reclaimed all main shifting averages: the 50-week SMA ($2,645), 100-week SMA ($2,659), and 200-week SMA ($2,427). This alignment helps a longer-term bullish reversal and confirms that momentum has shifted in favor of patrons. The clear break above the earlier resistance provides power to the transfer. And units the stage for a possible rally towards the $3,600–$3,800 vary within the coming weeks.

Associated Studying

The reclaim of $2,850—a zone that had acted as robust resistance for months—now flips into assist. If Ethereum continues to carry this stage on a weekly closing foundation, it would probably appeal to extra institutional consideration.

Featured picture from Dall-E, chart from TradingView