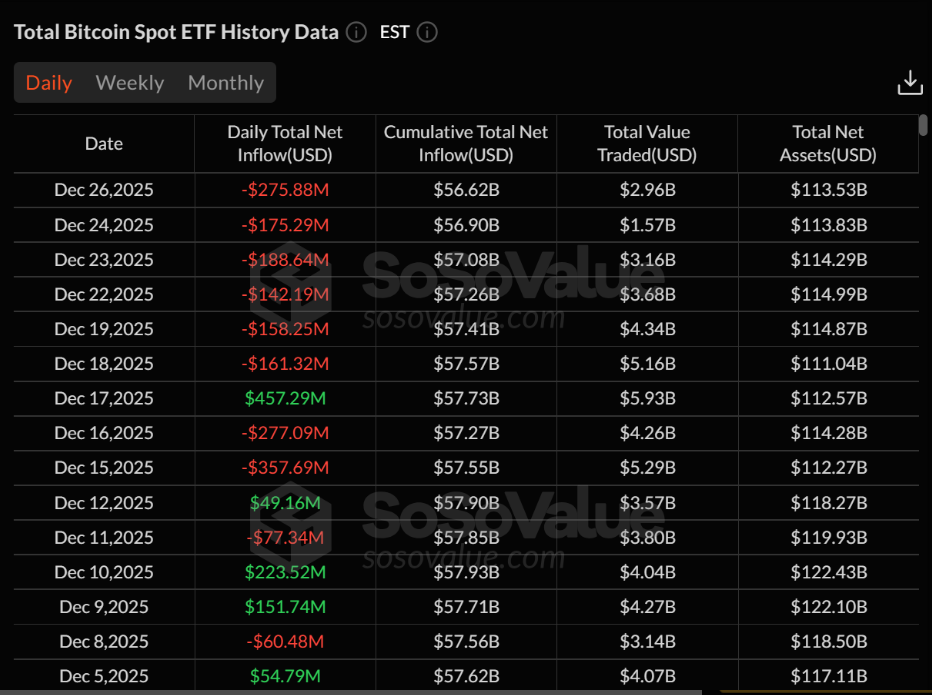

Spot Bitcoin ETFs suffered heavy withdrawals over the Christmas week as traders pulled about $782 million from the merchandise, in response to information from SoSoValue.

Bitcoin’s market worth stayed roughly close to $87,000, even because the funds misplaced money. The drop trimmed whole internet property in US-listed spot Bitcoin ETFs to about $113.5 billion, down from ranges above $120 billion earlier in December.

Main Funds Lead The Withdrawals

Friday was the worst single day of the stretch, when ETFs recorded a mixed $276 million in internet outflows. BlackRock’s IBIT accounted for almost $193 million of that exit, whereas Constancy’s FBTC misplaced about $74 million.

Grayscale’s GBTC noticed extra modest redemptions throughout the identical interval. Friday additionally marked the sixth straight day of outflows — the longest streak since early autumn — with greater than $1.1 billion draining out throughout that run.

December sees heavy outflows from spot Bitcoin ETFs. Supply: SoSoValue

Seasonal Stress Or A Larger Shift

In line with Vincent Liu, chief funding officer at Kronos Analysis, vacation strikes and skinny market depth may cause short-term withdrawals as desks shut for the vacations.

He expects institutional flows to return again when buying and selling desks reopen in early January and thinks a shift towards Fed easing in 2026 — markets are pricing roughly 75–100 bps of cuts — may raise demand for ETFs.

Based mostly on stories from Glassnode, nonetheless, the development seems broader than vacation noise: the 30-day shifting common of internet flows into US spot Bitcoin and Ether ETFs has been unfavorable since early November, signaling sustained outflows by institutional gamers.

BTCUSD buying and selling at $87,823 on the 24-hour chart: TradingView

Metals Take Middle Stage

In the meantime, gold and silver loved a banner run whereas crypto noticed pullbacks. Gold futures climbed above $4,550, hitting a number of data this 12 months. Silver topped $75 per ounce and has gained about 150% year-to-date.

That rally has prompted some traders to reallocate away from crypto. Market consultants like Louis Navellier stated that with central banks lively within the steel markets and volatility decrease, gold has attracted flows which may in any other case have gone into digital property.

Outspoken critic Peter Schiff wrote on social media that Bitcoin’s lack of ability to rise alongside different danger property raises doubts about its near-term upside.

What This Means For Institutional Demand

ETFs are extensively watched as a proxy for institutional urge for food. Based mostly on the newest figures, establishments seem like pulling again after a interval once they had been a key driver of crypto markets.

The divergence between rising valuable metals and a modest decline in Bitcoin — about 6% year-to-date — has bolstered that view. Among the promoting possible displays rebalancing and money wants through the holidays. A few of it might replicate a rethinking of danger allocation by massive allocators.

Studies counsel flows may normalize when buying and selling exercise returns to regular after the vacation break. If price markets proceed to cost in easing and bank-led crypto infrastructure turns into simpler for large traders to make use of, ETF inflows may resume. For now, the circulation information factors to a cautious institutional stance, at the same time as Bitcoin’s worth holds at elevated ranges.

Featured picture from Shutterstock, chart from TradingView

Editorial Course of for bitcoinist is centered on delivering totally researched, correct, and unbiased content material. We uphold strict sourcing requirements, and every web page undergoes diligent evaluate by our staff of prime know-how consultants and seasoned editors. This course of ensures the integrity, relevance, and worth of our content material for our readers.

December sees heavy outflows from spot Bitcoin ETFs. Supply: SoSoValue

December sees heavy outflows from spot Bitcoin ETFs. Supply: SoSoValue