XRP superior modestly as buying and selling exercise spiked, although momentum indicators warn of near-term consolidation danger.

Information Background

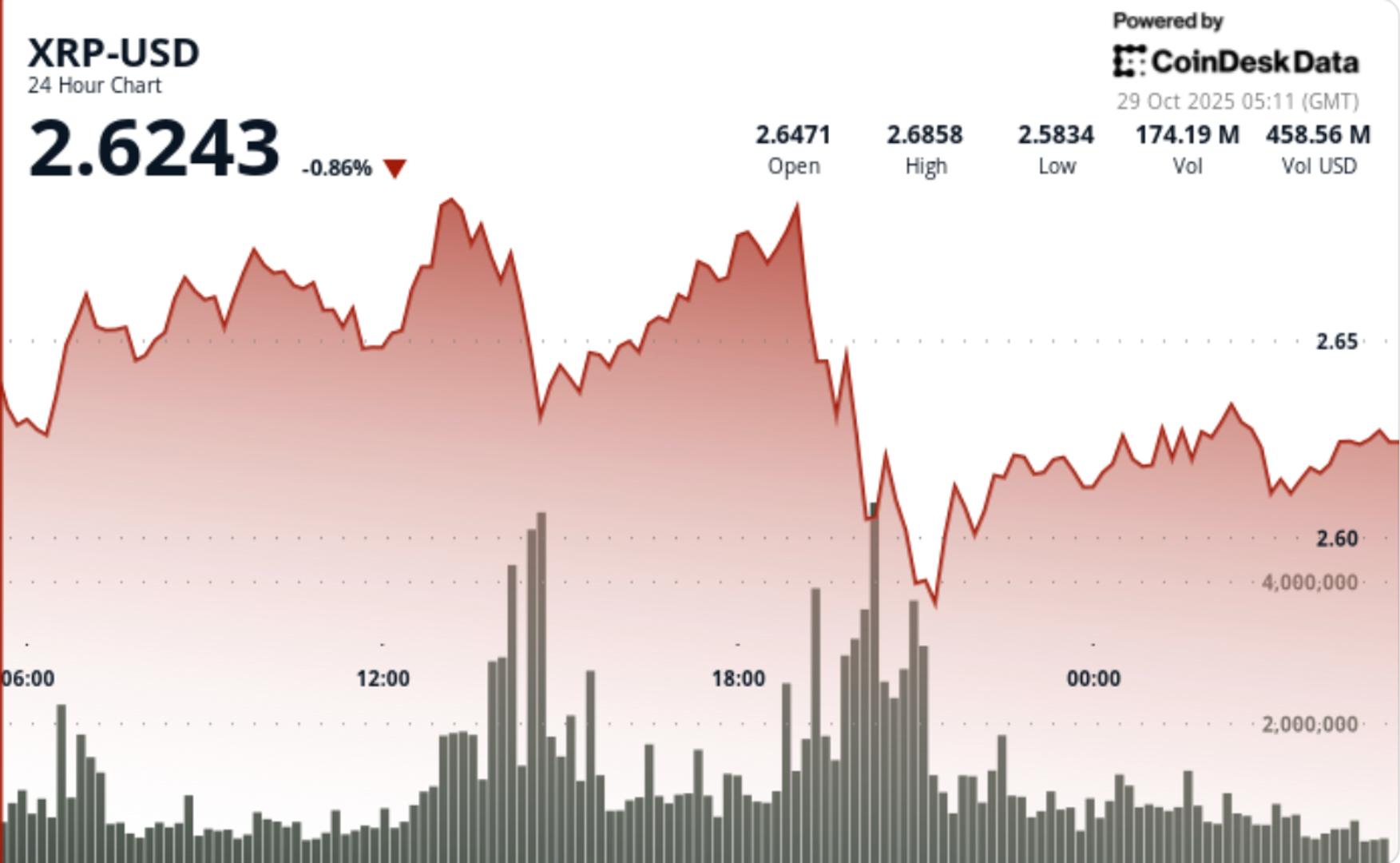

- XRP climbed 0.60% to $2.623 whereas buying and selling quantity surged about 47% above its seven-day common, indicating elevated institutional curiosity amid an absence of robust breakout catalysts.

- The token nonetheless faces resistance from a rejection close to $2.68 and a number of analysts warning that whereas bullish chart patterns exist, the latest momentum could also be capped.

Value Motion Abstract

- Over the session, XRP traded in an $0.11 vary, oscillating between ~$2.64 and ~$2.62.

- A peak quantity of ~167.3 million tokens (≈140% above the 24-hour common) was recorded through the failed breakout close to $2.68 resistance.

- The $2.60 psychological help degree held agency by a number of assessments. This worth motion displays managed accumulation slightly than a full breakout run.

Technical Evaluation

- The breakout try above $2.68 was rejected, confirming that resistance stays stiff.

- The help zone at ~$2.60 has demonstrated resilience, but momentum indicators—such because the TD Sequential—have triggered warning alerts.

- Chart construction exhibits consolidation between $2.60 and $2.67, which can kind the bottom of a future transfer but additionally warns of doable short-term pause.

- Quantity surge validates curiosity however the lack of a clear breakout suggests the transfer continues to be in setup mode.

What Merchants Ought to Know

- Merchants ought to monitor whether or not XRP can maintain the help band round $2.60-$2.63.

- A sustained shut above $2.65 coupled with renewed quantity would tilt the bias bullish and open targets close to $2.70-$2.90.

- Conversely, a break beneath ~$2.60 would expose a retest of ~$2.55 or decrease.

- The upcoming ETF choice window and institutional inflows stay key catalysts to look at.