Prediction market platforms Polymarket and Kalshi spend quite a lot of money and time convincing regulators they’re not playing.

Outdoors of the U.S. authorities are viewing prediction markets as synonymous with playing. Taiwan, France, and now Singapore have all made strikes to dam customers from accessing Polymarket on the ISP stage, calling the prediction market platform an unlicensed playing operation of some kind.

Prediction markets are funding instruments, the place merchants take a place on the end result to a query.

Events and counter-parties have differing opinions on value the the competing sides of the query, and the market engages in value discovery. Ought to the occasion happen, every share can be price $1, or $0 if the occasion fails to materialize.

This is not a sport of probability. Prediction markets aren’t thought of playing (within the U.S.) as a result of they’re designed as instruments for forecasting outcomes primarily based on chances, slightly than video games of luck. The home does not set the percentages, or win. It is all about market members.

Within the U.S., the Commodities Futures Buying and selling Fee views its function as regulating prediction markets as a result of it views the markets as a set of occasion contracts, just like climate derivatives – not a brand new invention – utilized by farmers to hedge in opposition to crop loss by shopping for into contracts that pay out within the occasion of freak climate. Local weather change has made this a profitable area.

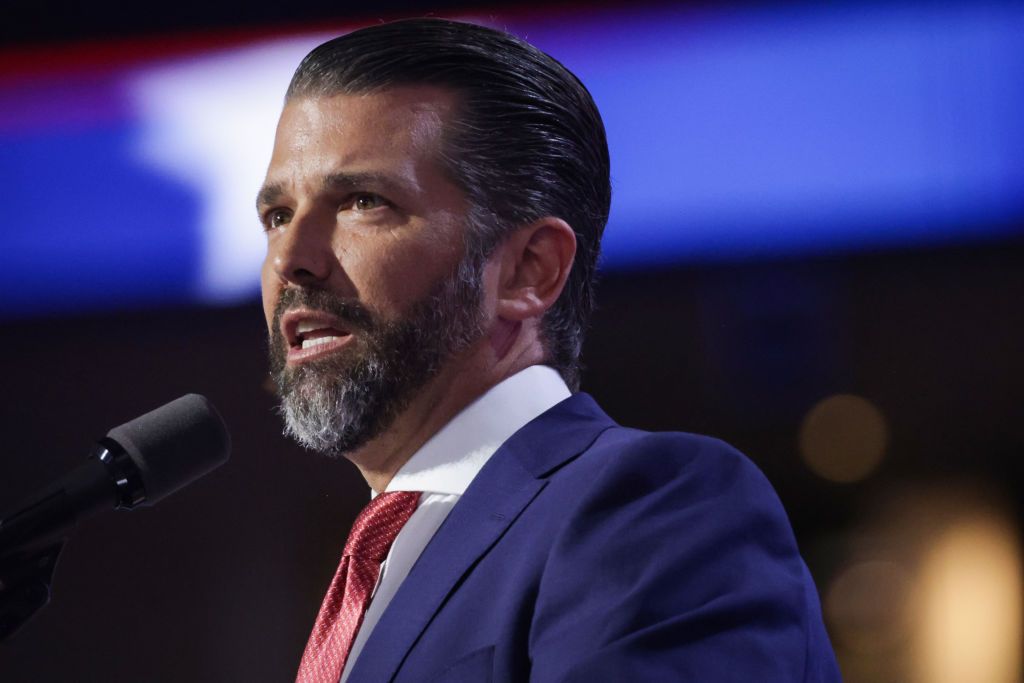

Each Polymarket and Kalshi have had their very own fights with the CFTC. Polymarket settled, Kalshi gained. Kalshi, consequently, now has permission to supply election-based occasion contracts; Polymarket should block U.S. customers from accessing its platform. Kalshi additionally now has Donald Trump Jnr. as an advisor, serving to its case with regulators.

Election-based occasion contracts had been a giant enterprise throughout the 2024 election. Wanting again at how the market responded to Donald Trump’s eventual victory, you possibly can see them as monetary devices to organize for a post-election market.

Contemplating bitcoin’s “Trump Bump,” a major value correction is likely to be anticipated if his rival Kamala Harris gained, thus crypto merchants would need to hedge their holdings with prediction market positions.

Polymarket’s naysayers guess wrongly concerning the platform’s demise post-election. Knowledge confirmed that by all accounts the platform was doing simply nice after the election: $1.6 billion in month-to-month quantity.

Shayne Coplan: He Took Prediction Markets Mainstream

However quite a lot of this quantity comes from sports activities themed prediction market contracts. Knowledge from Polymarket Analytics exhibits that there is at present over $1.1 billion in quantity guess on the end result of the NFL Tremendous Bowl; $740 million on the end result of the Champion’s League; and $700 million on the winner of the NBA Finals.

There isn’t any macro-level significance to the end result of a sports activities occasion. Not like an election, a warfare, or a call by a Fortune 500 firm to accumulate a rival (or add bitcoin to its steadiness sheet), there are not any broader monetary or societal penalties to the end result of the NFL Tremendous Bowl.

In different phrases, this seems lots like on-line sports activities betting, which took a herculean effort to legalize and has its personal set of stringent licensing necessities. On-line gaming operators spent a substantial sum establishing – and legalizing – this market, with conventional casinos like MGM enjoying catch-up.

In jurisdictions like Singapore which have on-line, licensed sportsbooks that supply sports activities betting, the case it clear to instigate a ban. Within the U.S., state-level gaming regulators is likely to be the subsequent to have a look, maybe prompted by on-line sports activities gaming giants that legalized an trade that was as soon as banned.

That is to not say there is not room for sports-themed prediction market contracts.

The NFL’s broadcasting rights are price over $100 billion and streamers like Amazon and Netflix try to get in on sports activities, which makes prediction market contracts about NFL scores, for instance, a great tool for fairness holders of media firms to find out if an funding into broadcast rights was price it.

The chances are infinite.

Or, perhaps Polymarket ought to simply transfer to Canada, as Ontario permits each political and sports activities betting. Typically the neatest guess is on a change of surroundings, and there is not a prediction marketplace for that.