Ethereum is present process a notable correction after an explosive rally that noticed its value surge over 85% since late June. After reaching an area excessive close to $3,940, ETH has pulled again roughly 13%, sparking debate amongst analysts about whether or not it is a wholesome consolidation or a shift in market momentum. Whereas some view the retracement as a pure pause after a speedy uptrend, others warning that promoting stress and macroeconomic uncertainty might set off deeper draw back strikes.

Associated Studying

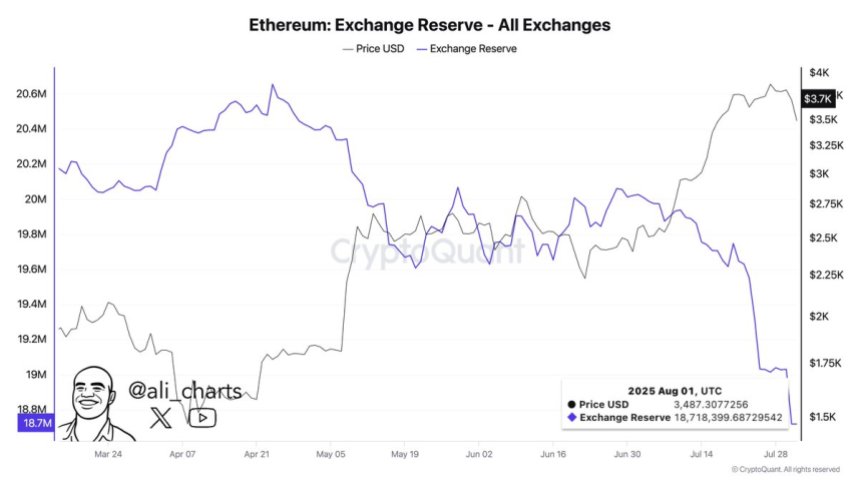

Nonetheless, on-chain information from CryptoQuant paints a special image beneath the floor. Regardless of the current value drop, a large quantity of Ethereum has been constantly withdrawn from exchanges over the previous few weeks. This pattern suggests aggressive accumulation by traders transferring their holdings into chilly storage, decreasing the liquid provide on buying and selling platforms.

Such outflows are sometimes interpreted as a bullish sign, indicating that holders are positioning for long-term features quite than making ready to promote. As Ethereum continues to guide in areas like DeFi, stablecoins, and Actual-World Asset (RWA) tokenization, this structural demand might present a robust basis for value stability and future rallies.

Ethereum Bullish Accumulation Development Continues

Analyst Ali Martinez has revealed that over 1 million Ethereum (ETH) have been withdrawn from exchanges up to now two weeks, signaling a robust accumulation pattern amongst traders. This large outflow reduces the liquid provide of ETH out there for buying and selling, which traditionally correlates with long-term bullish value motion. Regardless of Ethereum going through a 13% correction from its current excessive of $3,940, the constant withdrawal of cash means that traders are positioning for the subsequent leg up.

This accumulation pattern mirrors the investor conduct seen in Bitcoin over the previous 12 months. BTC skilled an analogous sample of alternate outflows all through 2024, which laid the groundwork for its large bull cycle. Analysts now consider that Ethereum might observe a comparable trajectory, as the basics supporting ETH stay sturdy, together with its dominance in DeFi, stablecoins, and Actual-World Asset (RWA) tokenization.

Whereas the market sentiment stays broadly bullish, some dangers persist. Current US job information launched on Friday sparked short-term panic, injecting volatility throughout crypto and conventional markets. Nonetheless, many analysts view Ethereum’s present correction as a wholesome retracement and a chance to build up ETH at a reduction earlier than the market resumes its upward pattern.

Associated Studying

ETH Testing Key Assist After Sharp Correction

Ethereum (ETH) is at present buying and selling round $3,391 after a pointy correction from its current excessive of $3,940. The 12-hour chart reveals that ETH has damaged under its short-term help and is now testing the 50-day SMA at $3,462, which might act as a near-term help degree. If bulls fail to defend this zone, the subsequent important help is positioned round $2,852, a key degree that beforehand acted as sturdy resistance in late June.

Quantity spikes in the course of the breakdown counsel elevated promoting stress, which aligns with current profit-taking actions by short-term holders. Nonetheless, regardless of this drop, Ethereum’s value construction stays in an total uptrend, with greater highs and better lows intact on the broader timeframe.

Associated Studying

The correction seems to be a retest of earlier breakout ranges, as ETH had surged over 85% since late June. Sustaining the $3,350-$3,450 vary is essential for bulls to regain management and try one other transfer towards the $3,860 resistance zone. Failure to carry might set off a deeper correction in the direction of the 100-day SMA at $2,972.

Featured picture from Dall-E, chart from TradingView