On-chain knowledge exhibits the Bitcoin spot exchange-traded funds (ETFs) have seen three waves of main inflows from the veteran fingers on this cycle to date.

Bitcoin Coin Days Destroyed Shot Up Alongside Earlier ETF Web Inflows

As defined by CryptoQuant writer Maartunn in a brand new submit on X, Bitcoin has been observing main reshuffles associated to outdated tokens and the spot ETFs. The spot ETFs check with funding autos that commerce on conventional platforms and permit buyers to realize publicity to an underlying asset like BTC with out having to instantly personal the asset.

The BTC spot ETFs launched within the US in January 2024. Since then, the funds have usually loved progress, with a couple of intervals involving a very sharp burst of inflows. The principle attraction of the ETFs is that buyers unfamiliar with the cryptocurrency world can make investments into BTC in a type that’s handy to them.

When a dealer invests into such a automobile, the fund buys an equal quantity of the cryptocurrency on the consumer’s behalf. This displays as an on-chain motion into the wallets related to the ETF.

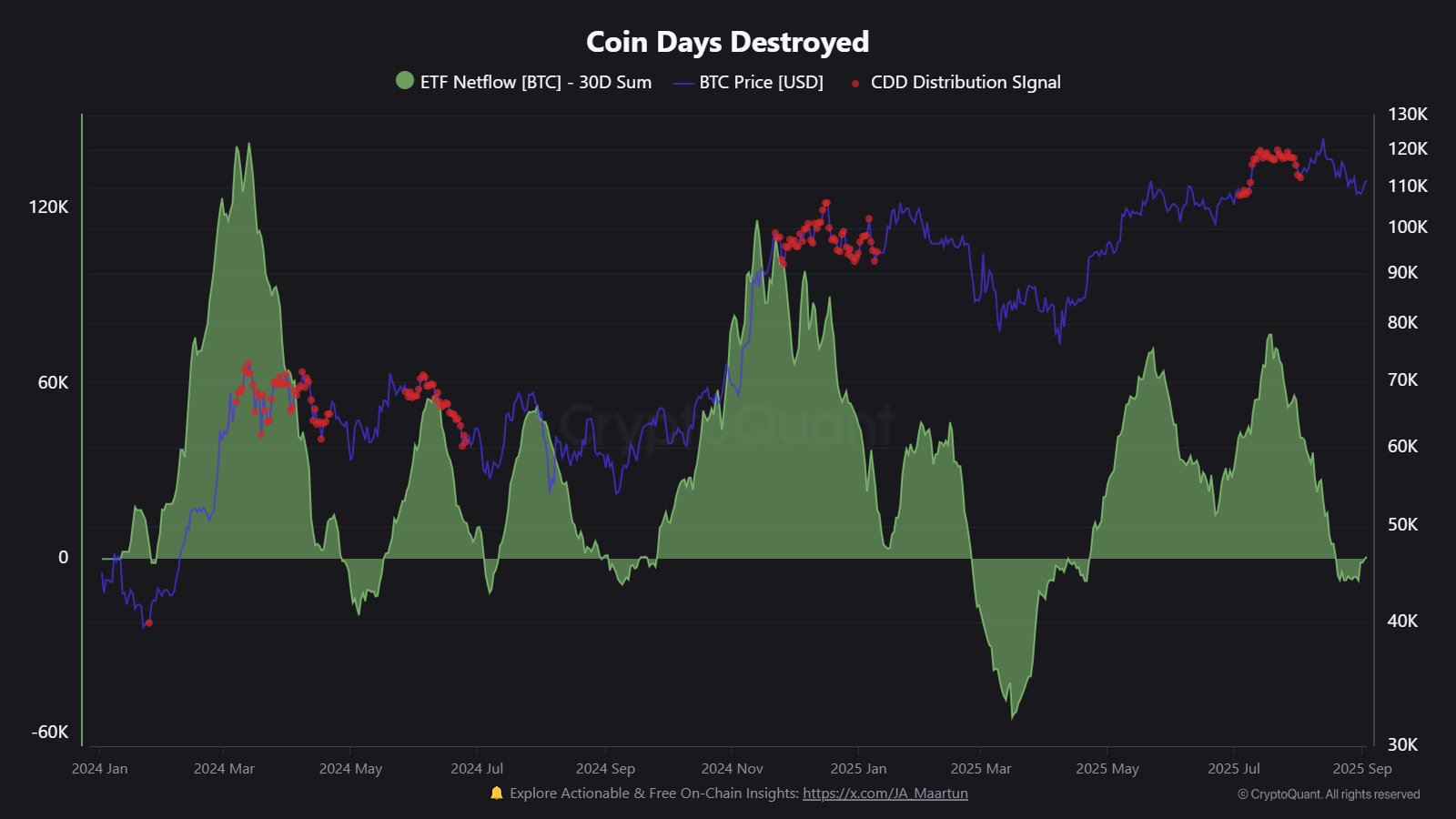

Beneath is the chart shared by Maartunn that exhibits the pattern within the 30-day Bitcoin spot ETF netflow for the reason that begin of 2024.

As displayed within the graph, the Bitcoin spot ETF netflow has seen a couple of phases of extraordinarily constructive values. These naturally correspond to a excessive quantity of demand for the ETFs.

Curiously, there’s a sample frequent amongst these giant waves of inflows. From the chart, it’s seen that the Coin Days Destroyed (CDD) gave distribution alerts alongside the netflow spikes.

The CDD is an on-chain indicator that measures the whole variety of coin days which can be being “destroyed” in transactions throughout the BTC community. A coin day is a amount that one BTC accumulates after staying dormant on the blockchain for at some point. When a token dormant for some quantity days is moved, its coin days counter returns again to zero. The coin days that it had beforehand been carrying are mentioned to be destroyed.

Typically, spikes on this metric correspond to exercise from the diamond fingers of the community. These HODLers are inclined to accumulate a large quantity of coin days with their persistence, so once they lastly break their silence, large-scale destruction of coin days takes locations.

The three main Bitcoin ETF internet influx waves of Summer time 2024, Fall 2024, and Summer time 2025 all accompanied a distribution sign from the CDD, which suggests a rotation of cash occurred from the veteran fingers to new demand coming by way of these autos.

Because the newest such wave, the ETF netflow has calmed all the way down to the impartial stage, that means demand has gone chilly. “ETF inflows are key,” notes Maartunn. “With out robust new demand, promoting stress from new holders may enhance.”

BTC Worth

On the time of writing, Bitcoin is buying and selling round $110,500, up 2% over the previous week.