Ripple president Monica Lengthy says the corporate’s newest $500 million fairness increase is being put to work on integrating a run of acquisitions and increasing Ripple’s push into regulated stablecoin infrastructure.

In an interview with Bloomberg Crypto on Jan. 6, Lengthy addressed investor questions across the fundraising phrases, Ripple’s plans for RLUSD beneath a brand new US regulatory regime, and whether or not the corporate is transferring any nearer to an IPO.

What Ripple Is Actually Doing With Its $500M Warfare Chest

The increase, carried out within the fourth quarter at a reported $40 billion valuation, introduced in main names together with Citadel and Fortress, alongside a lot of crypto native funds. The deal reportedly permits traders to promote shares again to Ripple at a assured worth and return, plus preferential remedy in main occasions similar to a sale or chapter.

Lengthy didn’t dwell on the precise mechanics, however framed the construction as favorable for Ripple and positioned the investor combine as strategic for the place the corporate needs to go subsequent.

“So the general construction for the fundraiser could be very, very constructive, very favorable for Ripple,” Lengthy mentioned. “We had been actually happy to welcome Fortress and Citadel onto our cap desk along with a lot of different crypto native premier funds. And what they actually noticed was that our enterprise is working, you recognize, our technique of making digital asset infrastructure for companies and monetary establishments alongside the inflection level that secure coin funds hit final 12 months was one thing that they wished to be part of.”

Lengthy added that as Ripple seems to be “extra towards making use of these applied sciences to the world of capital markets,” traders like Citadel and Fortress will be “nice strategic companions on that entrance.”

Pressed on whether or not the investor protections had been essential to safe the valuation and shut the deal, Lengthy supplied restricted extra element, saying solely that “to my data, they had been excited to be part of to be traders in Ripple,” and that Ripple was “very happy with how the phrases of the deal panned out.”

Lengthy mentioned the cash is supporting an organization that’s nonetheless in build-and-integrate mode after an acquisitive 12 months. “You understand, 2025 was an enormous 12 months for Ripple for each our natural development after which additionally inorganic,” she mentioned, including Ripple “had acquired 4 corporations final 12 months with the fundraise as properly,” and is now targeted on “integrating these companies [Hidden Road, Rail, GTreasury and Palisade] and persevering with to develop.”

Lengthy additionally described Ripple’s broader effort to diversify worth creation past the corporate’s XRP holdings by constructing what she referred to as the “connective tissue” wanted to make tokenized belongings usable for establishments, custody, compliant on- and off-ramps, and regulatory permissions. She mentioned Ripple has taken a “compliance first” method and has acquired “70 plus licenses world wide” to assist buyer flows.

Lengthy additionally outlined how current acquisitions match Ripple’s product roadmap. She pointed to “including elements like MPC custody by Palisade,” strengthening the stablecoin providing “with rail,” and shopping for complementary companies that may eat Ripple’s infrastructure, citing GTreasury, which she mentioned serves “a thousand corporates,” and Ripple Prime, which she mentioned serves “tons of of hedge funds,” as Ripple pushes into use instances like collateral mobility.

Ripple President Monica Lengthy on transferring past #XRP, acquisitions & the way forward for blockchain in tradfi

The Huge Nov fundraise (w/ Citadel & Fortress), plans, acquisitions forward, & embracing regulation to legitimize the area pic.twitter.com/1o3AnvISmY

— 𝗕𝗮𝗻𝗸XRP (@BankXRP) January 6, 2026

What Ripple Is Not Doing With The Increase

Regardless of including new massive traders, Lengthy reiterated Ripple’s stance on staying personal. She mentioned the corporate nonetheless has “no plan, no timeline for an IPO,” arguing Ripple can fund development and acquisitions with its current steadiness sheet power and private-market curiosity slightly than pursuing public-market liquidity.

Requested whether or not Ripple may purchase a centralized trade, Lengthy referred to as exchanges “undoubtedly key companions” however mentioned Ripple doesn’t plan an acquisition in that class, whereas noting the rise of decentralized exchanges and a broader pattern of “verticalization” amongst main crypto companies.

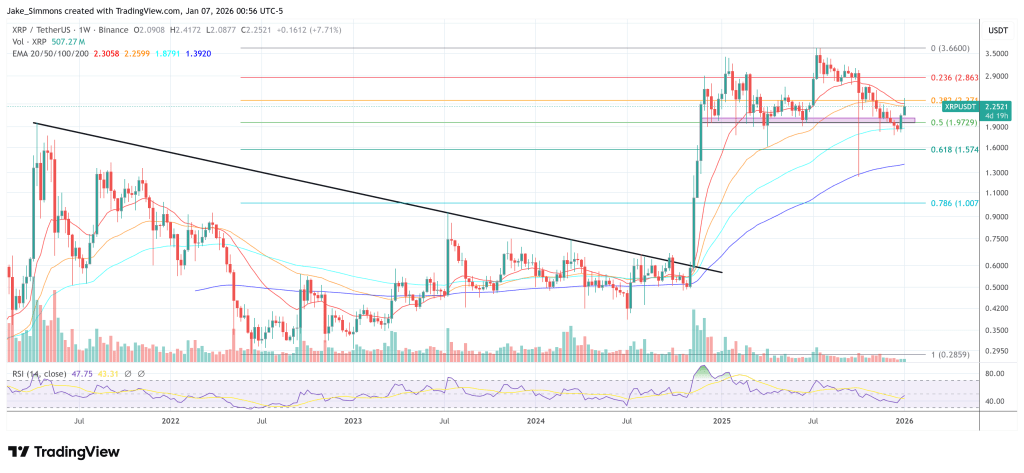

At press time, XRP traded at $2.25.

Featured picture from YouTube, chart from TradingView.com

Editorial Course of for bitcoinist is centered on delivering totally researched, correct, and unbiased content material. We uphold strict sourcing requirements, and every web page undergoes diligent assessment by our staff of prime know-how consultants and seasoned editors. This course of ensures the integrity, relevance, and worth of our content material for our readers.