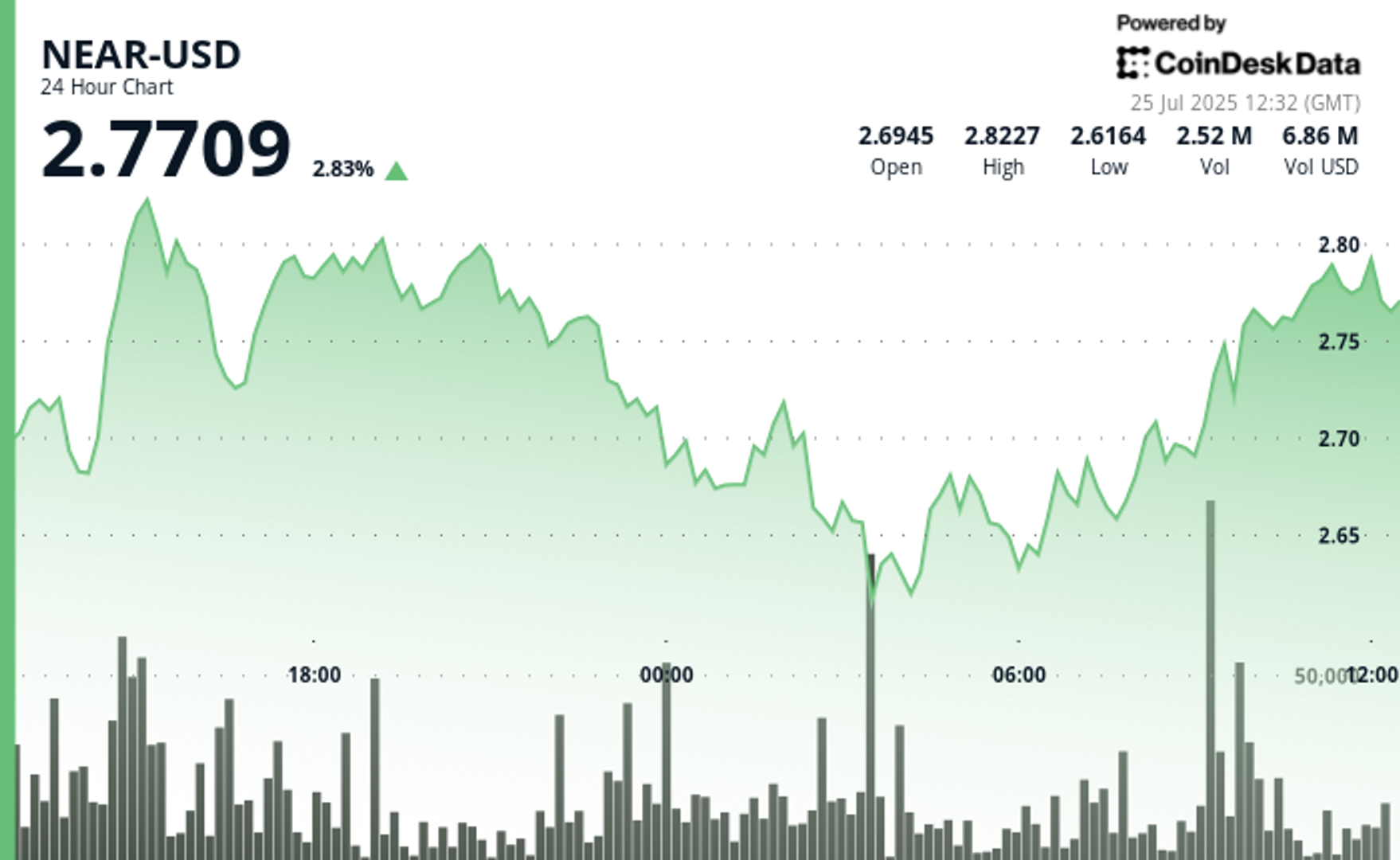

NEAR Protocol bounced 0.7% between 11:10 and 12:09 UTC on Thursday, erasing a quick $2.77 dip in a unstable buying and selling window marked by sudden institutional inflows. The token whipsawed from $2.79 to $2.77 earlier than reclaiming session highs, highlighting a two-phase transfer characterised by consolidation close to $2.78, adopted by a selloff and swift restoration.

The rebound was triggered by a pointy uptick in quantity, with greater than 123,000 items traded after 12:01, breaking by way of resistance ranges and signaling potential accumulation by massive gamers. The transfer capped a broader 6.9% rally from $2.61 in a single day help to a $2.79 shut through the July 24–25 buying and selling window, fueled by elevated volatility and revived bullish sentiment.

Analysts view the surge as a possible setup for a take a look at of the $2.83 resistance degree, with longer-term projections putting NEAR in a $1.95–$9.00 vary for 2025 and as excessive as $71.78 by 2030. Continued growth of cross-chain bridging with Solana and TON is cited as a catalyst for institutional curiosity and potential worth enlargement.

Technical Breakout Indicators Bullish Momentum

- $0.22 buying and selling vary represents 8.50% volatility between $2.83 most and $2.61 minimal throughout 23-hour interval.

- Robust $2.61 help degree confirmed with quantity exceeding 3.18 million day by day common.

- Restoration momentum from $2.69 to $2.79 shut targets $2.83 resistance zone breakthrough.

- $2.78 consolidation precedes sharp $2.77 help take a look at throughout mid-session volatility.

- Distinctive 123,000+ unit quantity throughout final-hour surge confirms institutional accumulation section.

- A number of resistance ranges damaged throughout restoration establishing new $2.79 session highs.

Disclaimer: Elements of this text have been generated with the help from AI instruments and reviewed by our editorial crew to make sure accuracy and adherence to our requirements. For extra info, see CoinDesk's full AI Coverage.