Solana (SOL) treasury exercise continues to attract institutional consideration after Nasdaq-listed client model firm Upexi Inc. introduced a brand new $500 million fairness line settlement on Monday. The ability, organized with A.G.P./Alliance International Companions, permits the corporate to difficulty widespread inventory at its discretion, topic to sure closing situations.

In a press launch, Upexi mentioned the funds can be used for normal company functions and to develop its Solana treasury technique, which has grown quickly for the reason that firm started accumulating SOL earlier this yr. The agency emphasised that the power contains “no dedication price” and was negotiated on “notably pleasant phrases,” providing what Upexi described as a sexy price of capital.

“The fairness line provides Upexi further means and suppleness to boost capital and improve its Solana place,” CEO Allan Marshall mentioned within the launch. “We now have a mess of instruments to boost capital in probably the most cost-effective and accretive method.”

The announcement follows Upexi’s July 21 disclosure that it had acquired one other 100,000 SOL — funded by a $200 million non-public placement — bringing its complete holdings to 1,818,809 SOL price roughly $331 million on the time. Greater than half of the tokens have been bought in locked type at a reduction, leading to an estimated $58 million unrealized acquire.

The corporate has since staked almost all of its SOL to earn yield, projecting as much as $26 million in annual staking income at present charges. Upexi has additionally launched a brand new benchmark, the “Fundamental mNAV,” which measures its market cap towards the greenback worth of its SOL holdings. As of July 18, that ratio stood at 1.2x.

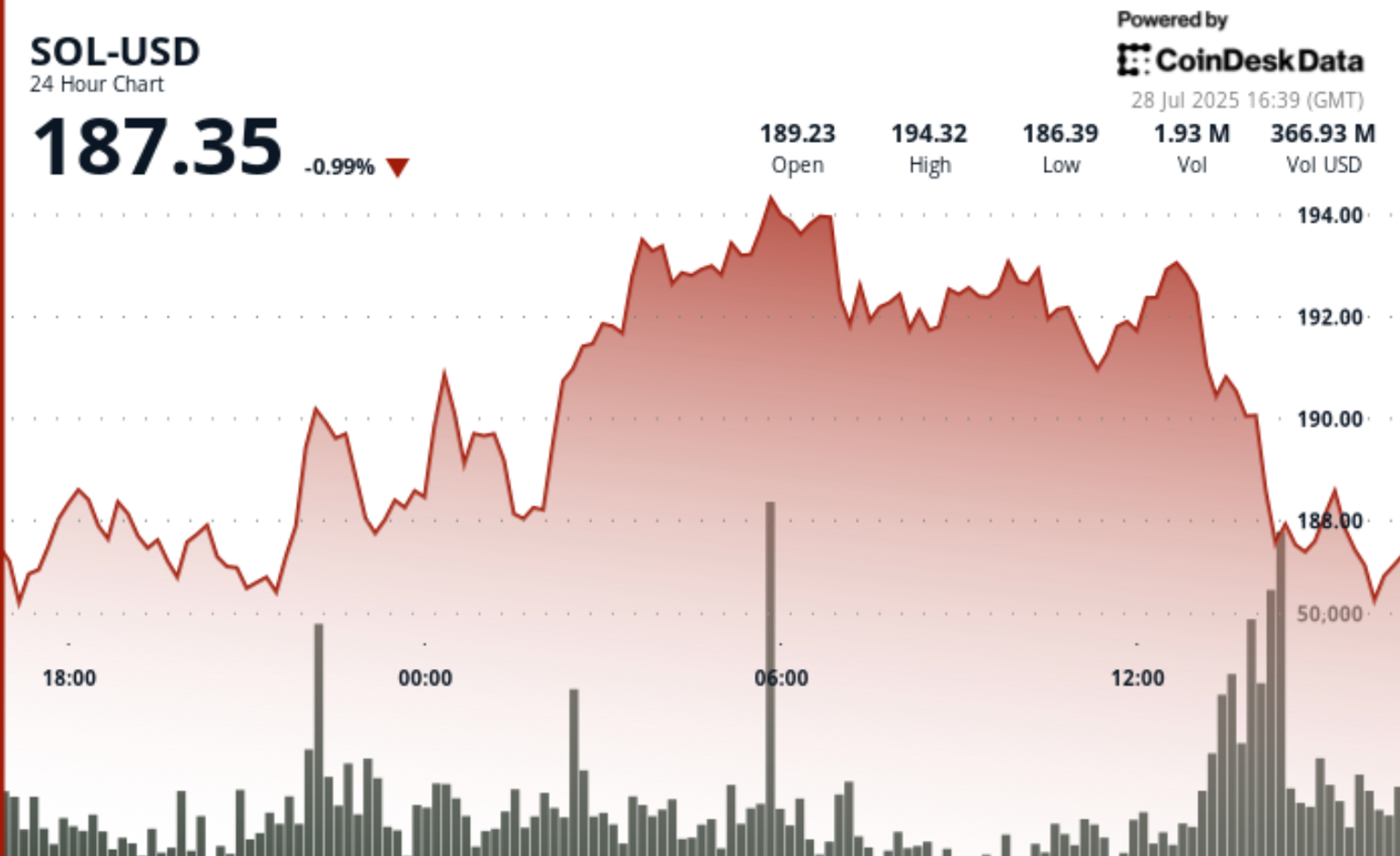

The inventory issuance association provides the corporate further room to scale its technique, doubtlessly giving it a bigger position in shaping market expectations round institutional altcoin accumulation. Nonetheless, Monday’s worth motion for SOL confirmed blended sentiment. In response to CoinDesk Knowledge, SOL declined 0.99% to $187.35 previously 24 hours.

The downturn adopted a pointy reversal from intraday highs, with heavy promoting stress rising through the afternoon session. Nonetheless, quantity spikes late within the day hinted at renewed curiosity from market members, probably positioning forward of additional treasury updates or macro catalysts.

Technical Evaluation Highlights

- In response to CoinDesk Analysis's technical evaluation knowledge mannequin, SOL traded inside a 24-hour vary of $186.38 to $194.99, a 4.47% swing, from July 27 at 16:00 UTC to July 28 at 15:00 UTC.

- The worth rallied from $186.42 to $194.99 by 05:00 UTC on July 28, gaining 4.59% earlier than encountering resistance.

- A pointy selloff adopted from 12:00 UTC to 14:00 UTC, as the worth dropped from $192.82 to $187.38 on heavy quantity exceeding 2.5 million items.

- Within the ultimate 60 minutes (14:35–15:34 UTC), SOL rebounded 0.78%, climbing from $187.34 to $188.81.

- Throughout this restoration, worth consolidated between $187.15 and $188.94 earlier than breaking above the $188.50 resistance at 15:22 UTC.

- Quantity spiked to 39,417 items at 15:32 UTC, indicating institutional accumulation and suggesting potential for additional features.

Disclaimer: Elements of this text have been generated with the help from AI instruments and reviewed by our editorial workforce to make sure accuracy and adherence to our requirements. For extra info, see CoinDesk's full AI Coverage.