The native token of oracle community Chainlink bounced 3.6% on Friday, reversing a few of Thursday’s losses as merchants stepped in round key assist degree.

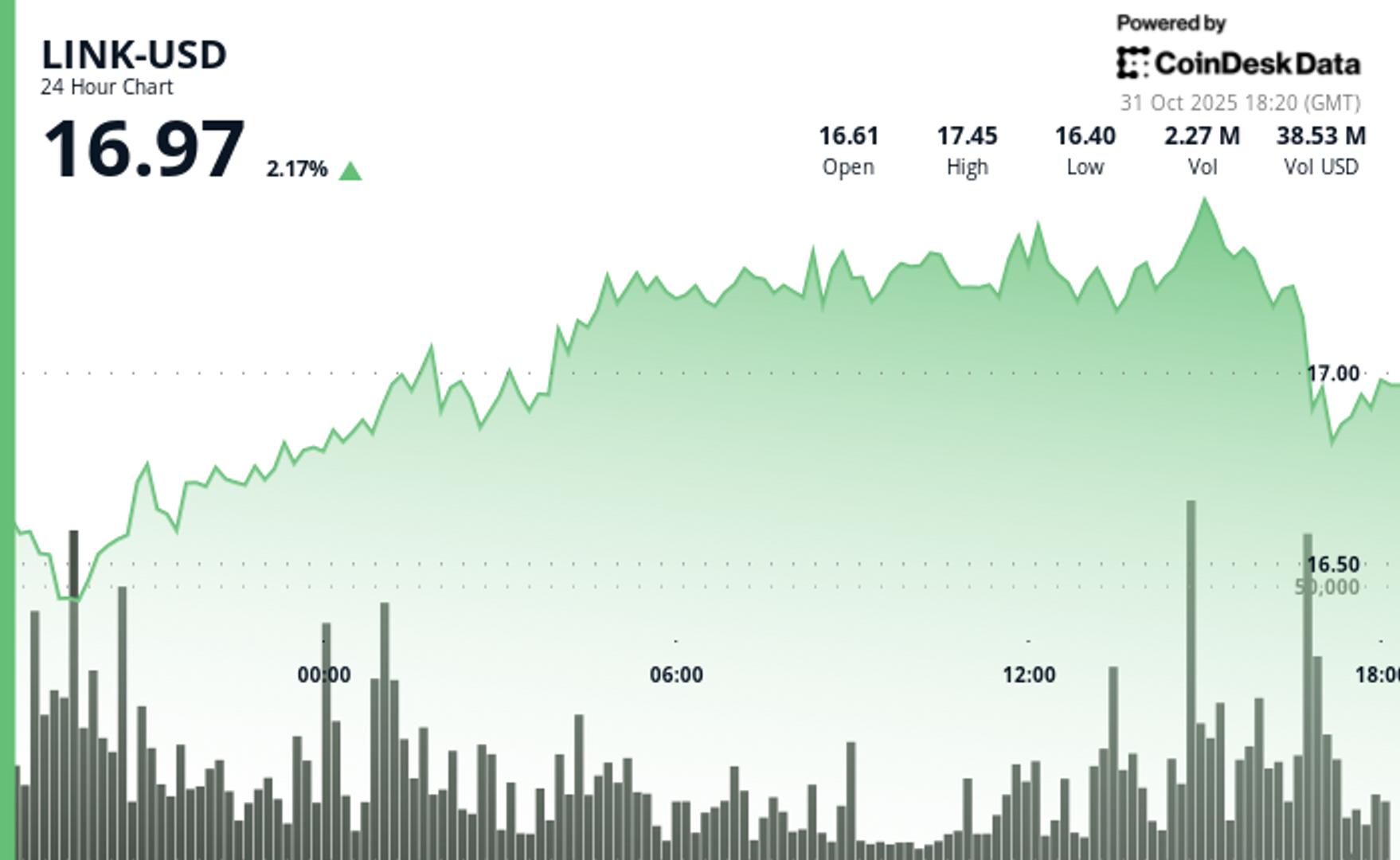

LINK briefly cleared the $17 degree with a surge in buying and selling quantity — some 3 million tokens modified arms throughout a morning breakout up —, pointing to renewed accumulation, CoinDesk Analysis’s market perception device instructed. Nonetheless, weak spot in the course of the U.S. buying and selling hours drove LINK again under $17. Lately, the token traded at $16.96.

On the information entrance, payments-focused Stellar (XLM) introduced to combine Chainlink’s Cross-Chain Interoperability Protocol (CCIP), Information Feeds, and Information Streams. The transfer permits builders and establishments constructing on Stellar to entry real-time knowledge and trusted cross-chain infrastructure for tokenized property.

With over $5.4 billion in quarterly RWA quantity and a fast-growing DeFi footprint, Stellar’s adoption of Chainlink tooling indicators increasing demand for safe, interoperable monetary infrastructure.

Key technical ranges to look at:

LINK now holds near-term assist at $16.37 with upside targets at $17.46 and $18.00. Whether or not the token can construct on Friday’s rebound could depend upon broader market flows and follow-through from dip-buying.

- Help/Resistance: Strong assist holds at $16.37 after a number of profitable checks, whereas $17.46 resistance reveals repeated rejection patterns.

- Quantity Evaluation: 78% quantity surge throughout breakout try confirms institutional curiosity, explosive promoting quantity signifies place rebalancing.

- Chart Patterns: Late-session flush-out sample creates basic oversold setup for accumulation methods.

- Targets & Threat/Reward: Holding above $16.89 targets $17.46 retest with upside to $18.00, draw back danger restricted to $16.37 assist.

Disclaimer: Elements of this text had been generated with the help from AI instruments and reviewed by our editorial group to make sure accuracy and adherence to our requirements. For extra data, see CoinDesk’s full AI Coverage.