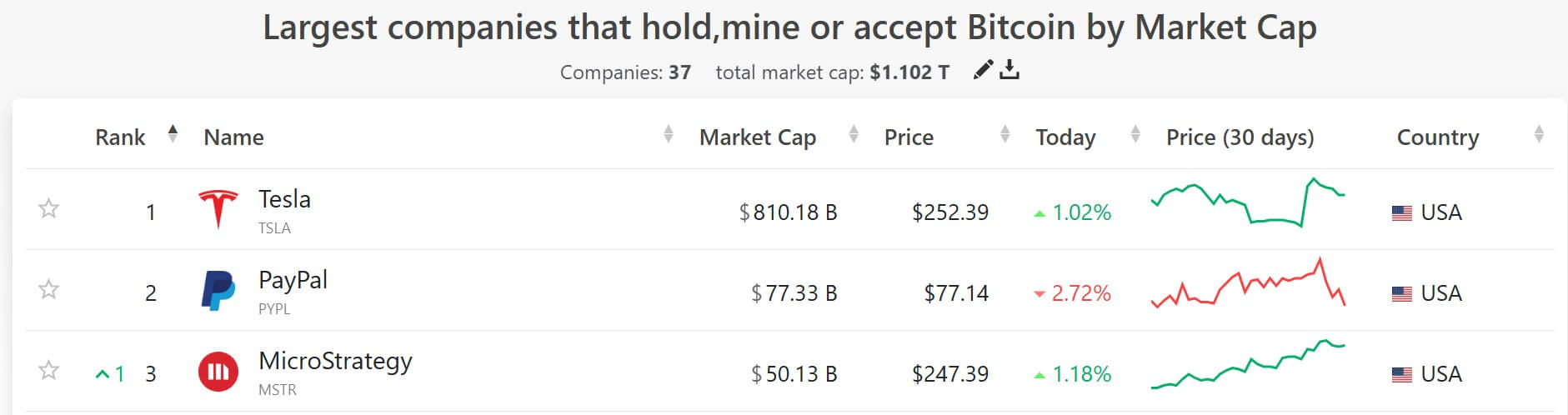

The market capitalization of MicroStrategy, the distinguished Bitcoin-focused funding agency, has now exceeded that of Coinbase, the biggest crypto alternate within the US.

In line with information from Yahoo Finance, MicroStrategy (MSTR) is presently valued at over $50 billion, surpassing Coinbase (COIN), which stands at roughly $46.5 billion.

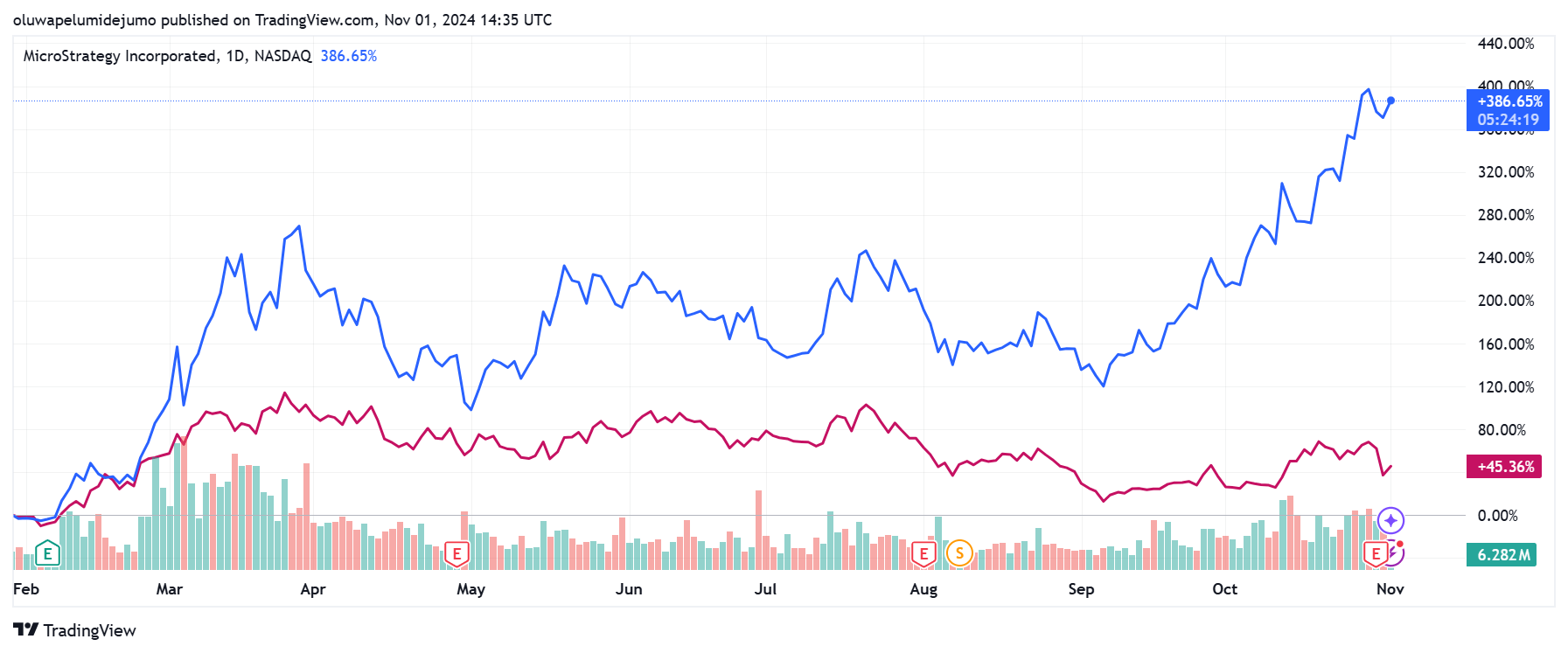

This shift isn’t a surprise, given MicroStrategy’s inventory’s exceptional efficiency. Over the previous yr, shares have surged by roughly 400% to a two-decade excessive of round $250.

In distinction, Brian Armstrong-led Coinbase has risen by a strong however comparatively extra modest 40% as a result of heightened competitors in North America. The alternate has lately misplaced market share to the quickly rising Crypto.com and has seen diminished buying and selling exercise because of the introduction of spot Bitcoin ETFs.

Additional, this modification displays the market’s response to the third-quarter earnings studies from each firms. MicroStrategy introduced an formidable plan to boost $42 billion to buy Bitcoin, whereas Coinbase revealed intentions for a $1 billion inventory buyback. Some crypto consultants argue that the alternate ought to have invested in Bitcoin somewhat than its personal shares.

General, MicroStrategy now ranks among the many prime three firms by market capitalization holding, mining, or accepting Bitcoin. It’s trailing solely digital automobile maker Tesla and fee big PayPal.