Technique has launched a $2.1 billion At-The-Market (ATM) fairness program for its Strife (STRF) most well-liked inventory, marking one other step within the agency’s long-term technique to construct a Bitcoin-backed monetary structure.

The announcement was made by CEO and President Phong Lee throughout an investor replace alongside Govt Chairman Michael Saylor. Based on Lee, sturdy year-to-date outcomes from the agency’s Bitcoin-linked securities Strike (STRK) and Strife (STRF) gave Technique the boldness to increase its fundraising technique.

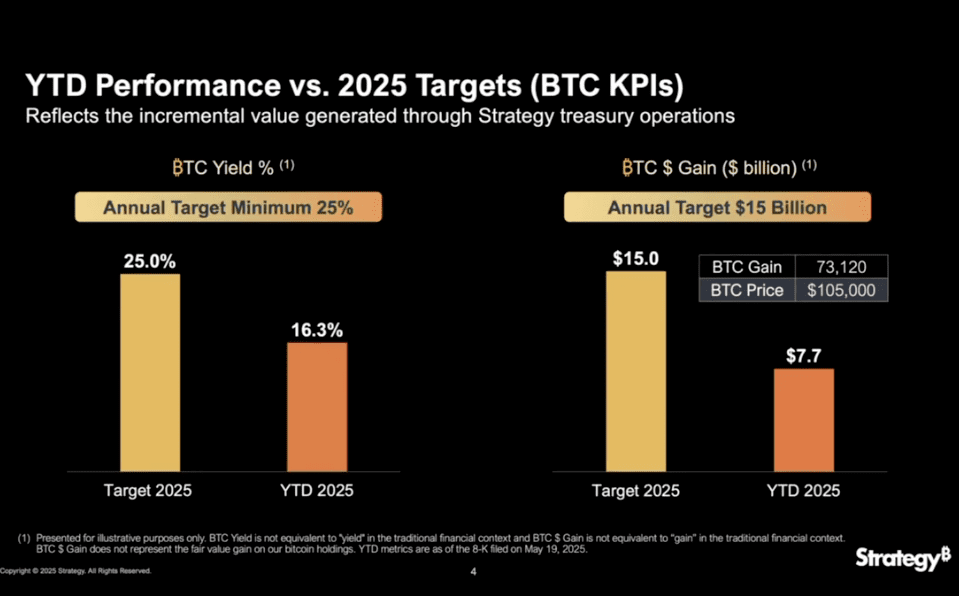

“We’re presently at 16.3% BTC yield for the yr, towards a 25% goal,” Lee mentioned. “BTC greenback acquire is $7.7 billion to this point, on monitor towards our $15 billion goal.”

Each devices have outperformed expectations since launch. Strike is up 24% from its preliminary worth of $80 to just about $100. Strife, which was priced at $85 simply two months in the past, now trades round $98.80, a 16% enhance. By comparability, equally structured preferreds available in the market have declined by 3–5% over the identical interval.

Within the final 30 days alone, Strike rose 17% and Strife 12%, bringing each near par worth. Lee emphasised the liquidity profile of those devices, citing common each day buying and selling volumes of $31 million for Strike and $23 million for Strife. “That’s 60x what we usually see in comparable preferreds,” he famous.

The corporate beforehand issued $212 million by way of Strike’s ATM, with no antagonistic pricing stress. Based mostly on the buying and selling quantity and investor demand, Lee mentioned the corporate believes the $2.1 billion Strife ATM will be executed similarly.

Strife is a perpetual most well-liked inventory with a ten% coupon and sits on the prime of Technique’s capital stack. Saylor described it as “the crown jewel” of the corporate’s most well-liked choices. “We’re going to be ten instances as cautious with Strife,” he mentioned. “Our purpose is for it to be seen as investment-grade fastened revenue — a high-quality instrument with strong protections.”

Strike, in contrast, is positioned for what Saylor known as “Bitcoin-curious” traders. It carries an 8% coupon and consists of upside by way of Bitcoin conversion. “Consider it like a Bitcoin fellowship with a stipend,” Saylor mentioned.

Technique now operates three ATM applications: $21 billion every for MSTR fairness and Strike, and $2.1 billion for Strife. These are rebalanced each day, with issuance adjusted based mostly on market situations, volatility, and investor demand. Based on Saylor, this dynamic construction permits the corporate to optimize Bitcoin acquisition and capital deployment throughout altering market environments.

Behind this technique sits Technique’s Bitcoin treasury, now totaling 576,230 BTC — roughly $60 billion in worth. “That everlasting capital is the muse for every thing we’re constructing,” Saylor mentioned.

Whereas spot Bitcoin ETFs cater to traders in search of direct worth publicity, Technique continues to supply a extra nuanced set of devices — every concentrating on totally different ranges of danger, return, and compliance. The Strife ATM is the most recent transfer in that broader technique.