Bitcoin funding agency Metaplanet is ready to lift ¥10.08 billion (roughly $70 million) by providing its eleventh sequence of inventory acquisition rights to all frequent shareholders.

In an Aug. 6 assertion, the Japanese firm outlined plans to allocate ¥8.5 billion (round $58.76 million) of this raised funds to buy extra Bitcoin.

The agency stated it will distribute one inventory acquisition proper per frequent share to shareholders, as recorded on Sept. 5. These rights allow shareholders to accumulate Metaplanet inventory at a value of ¥555 (round $4) between Sept. 6 and Oct. 15.

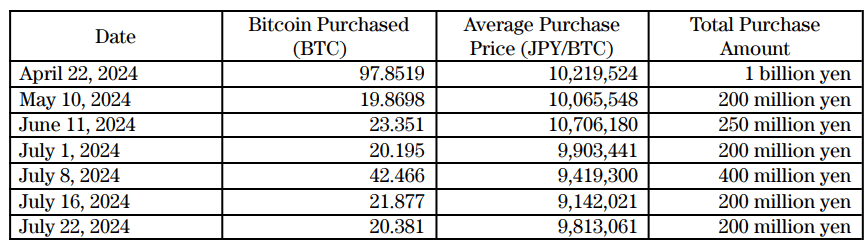

The brand new funding will allow the corporate to considerably broaden its Bitcoin holdings, aligning with its long-term progress technique. Metaplanet at the moment holds about 246 BTC, valued at round $13.4 million.

In the meantime, Metaplanet’s transfer is straight from the playbook of MicroStrategy, a enterprise intelligence agency that has collected over 220,000 Bitcoins via debt and fairness raises since 2020.

Bitcoin pivot

Metaplanet plans to make use of the funds raised primarily to accumulate Bitcoin and put money into associated sectors.

The agency restated its perception within the flagship digital asset’s long-term potential regardless of the current declines in Bitcoin costs.

Moreover, it highlighted BTC’s power as a hedge in opposition to foreign money depreciation, significantly the yen, which has lately depreciated massively in opposition to the US Greenback.

Metaplanet acknowledged:

“A rise in Bitcoin costs is anticipated to strengthen our stability sheet, improve asset worth, and positively contribute to our earnings.”

The corporate revealed that it was contemplating potential future enterprise ventures throughout the BTC ecosystem, including that it might generate extra revenue from its Bitcoin holdings by promoting coated calls on the flagship digital property.

Metaplanet’s shift in the direction of Bitcoin comes because it has strategically exited most of its lodge enterprise, which had suffered from declining income and recurring losses over 5 consecutive durations.

In the meantime, it advised that the lodge division may very well be rejuvenated by remodeling it to strategically cater to Bitcoin fans and companies whereas providing distinctive providers and producing extra income sources.