Three publicly traded firms are shifting to carry XRP as a part of their money stash, placing actual cash behind their crypto bets. Webus Worldwide needs to put aside $300 million in XRP.

VivoPower plans to make use of roughly $121 million. Wellgistics Well being has earmarked $50 million. This marks a shift in how some companies take into consideration holding reserves, and it may change how they deal with funds down the highway.

Webus Worldwide Plans Enormous Reserve

In response to filings with the US Securities and Trade Fee, Webus Worldwide goals to boost $300 million by non-equity funding. The corporate will faucet its current money, credit score strains backed by establishments, and help from shareholders.

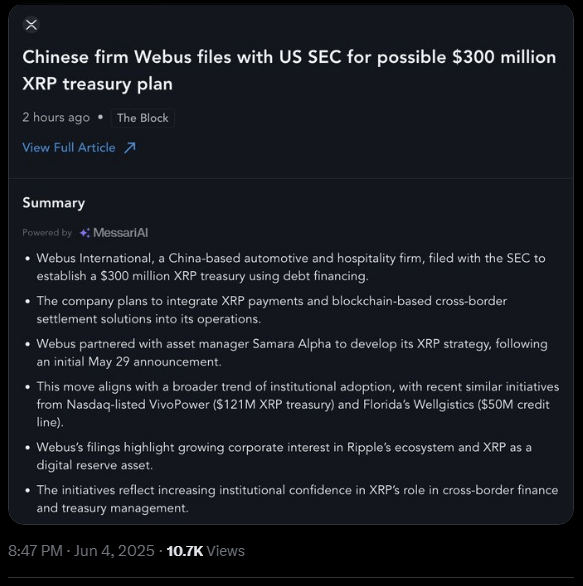

Corporations are exploring the XRP treasury technique:

– Webus Worldwide: $300M

– VivoPower: $121M

– Wellgistics: $50M pic.twitter.com/C9rldXDdDG— Messari (@MessariCrypto) June 4, 2025

As soon as the cash is in hand, Webus intends to purchase XRP and maintain it as a part of its treasury. The plan comes with a accomplice: Samara Alpha Administration. Webus says the altcoin will assist the agency with world cost companies. They suppose it might probably transfer worth rapidly throughout borders, and this treasury may again that.

VivoPower’s XRP Ambition

Primarily based on studies, VivoPower is setting apart about $121 million to construct its personal XRP stash. The general public announcement highlights a current non-public placement led by Prince Abdulaziz bin Turki Abdulaziz Al Saud of Saudi Arabia.

A lot of the $121 million raised will go straight into the coin. VivoPower even needs to rebrand itself because the world’s first firm targeted on XRP. That’s a daring aim for a agency listed on Nasdaq. If all the things goes to plan, XRP would play a giant function in how VivoPower manages cash and transactions.

Wellgistics Well being Joins Pattern

Wellgistics Well being, a healthcare firm you may not anticipate to dive into cryptocurrency, has its personal $50 million put aside for XRP. The money got here in final month and is supposed for PX (buy and maintain XRP) and to make use of XRP for real-time funds.

Wellgistics says it needs to chop out delays and costs that include outdated‐faculty cost strategies. By sending and receiving XRP, the corporate believes it might probably transfer cash quicker when it pays distributors or will get paid by clients. It’s an indication that even outdoors tech or finance, companies see worth in holding crypto.

Rising Curiosity Amongst Corporations

This trio isn’t alone. In December, Worksport mentioned it will purchase each XRP and Bitcoin, utilizing 10% of its working money to construct reserves. Extra just lately, Ault Capital Group pledged $10 million to XRP this 12 months to spice up its transfer into monetary companies.

On high of that, the US authorities talked about XRP as one of many belongings it’d add to a digital asset stockpile. That’s a sign to personal firms that holding XRP is price a glance.

Featured picture from Unsplash, chart from TradingView