Hedera (HBAR) emerged as a standout performer within the second quarter (Q2) of the 12 months, reversing the downward development confronted by many initiatives. The most recent report from analysis agency Messari highlights Hedera’s progress throughout key monetary indicators.

Hedera Q2 Momentum

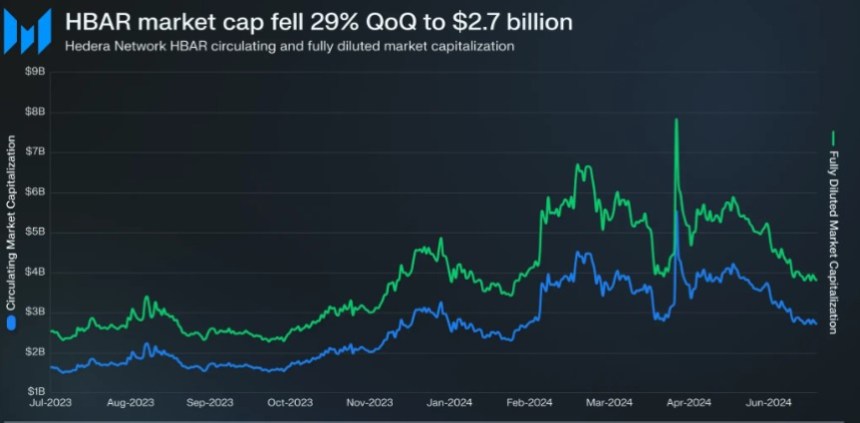

One of many pivotal highlights of Hedera’s Q2 was the development in essential monetary metrics. Regardless of a 29% quarter-over-quarter (QoQ) dip in circulating market cap to $2.7 billion, HBAR managed to climb six spots from 36 to 30 amongst all tokens, surpassing equally priced cryptocurrencies.

Per the report, income additionally grew to become a beacon of success for Hedera throughout Q2, with the community witnessing a 26% uptick in USD income, reaching $1.4 million. Furthermore, income in HBAR surged by 19% quarter-over-quarter to 14.6 million.

Associated Studying

The tempo of HBAR issuance and circulation remained a spotlight, with 72% of the full 50 billion HBAR in circulation on the finish of Q2. The quarterly distribution of HBAR indicated the discharge of a further 1.5 billion HBAR within the upcoming quarter, with a major allocation of 94% earmarked for ecosystem and open supply improvement initiatives.

Whereas day by day accounts created elevated 31% sequentially to 11,100, day by day energetic addresses declined 37% to 10,600, reflecting a combined image of progress and engagement inside the community. Transaction exercise rebounded in Q2, as common day by day transactions elevated 46% to 132.9 million, pushed primarily by the Hedera Consensus service.

Staking Surge And DeFi Fluctuations

The report additional highlighted Staking within the community, which emerged as a major development inside the ecosystem, with 62.2% of the circulating provide staked, signaling a excessive degree of engagement from entities like Swirlds and Swirlds Labs.

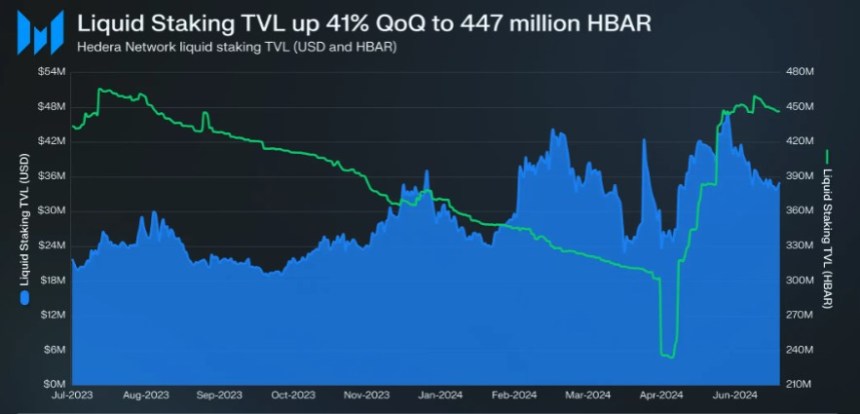

Nonetheless, the decentralized finance (DeFi) panorama on Hedera witnessed fluctuations in Q2, with Whole Worth Locked (TVL) experiencing a decline in each USD and HBAR metrics.

Nonetheless, Messari asserts that initiatives just like the HBAR Basis’s DeFi TVL progress program have injected vitality into the ecosystem, driving liquidity and consciousness. Liquid staking however, noticed a resurgence in Q2, with Stader’s TVL growing by 41% in HBAR phrases.

Associated Studying

Lastly, Hedera’s decentralized change (DEX) volumes additionally noticed a dip within the second quarter after a bullish first quarter, in keeping with Messari, but it surely has remained robust year-over-year (YoY).

On the time of writing, HBAR data a major 22% drop in worth over the previous month, presently buying and selling at $0.050 amid the overall market uncertainty led by elevated volatility of the biggest cryptocurrencies available on the market Bitcoin (BTC) and Ethereum (ETH).

Moreover, CoinGecko information reveals that the token has seen a notable lower in buying and selling quantity over the previous 48 hours, dropping by 35%. Most significantly, HBAR continues to be 91% beneath its all-time excessive of $0.056 reached in September 2021.

Featured picture from DALL-E, chart from TradingView.com