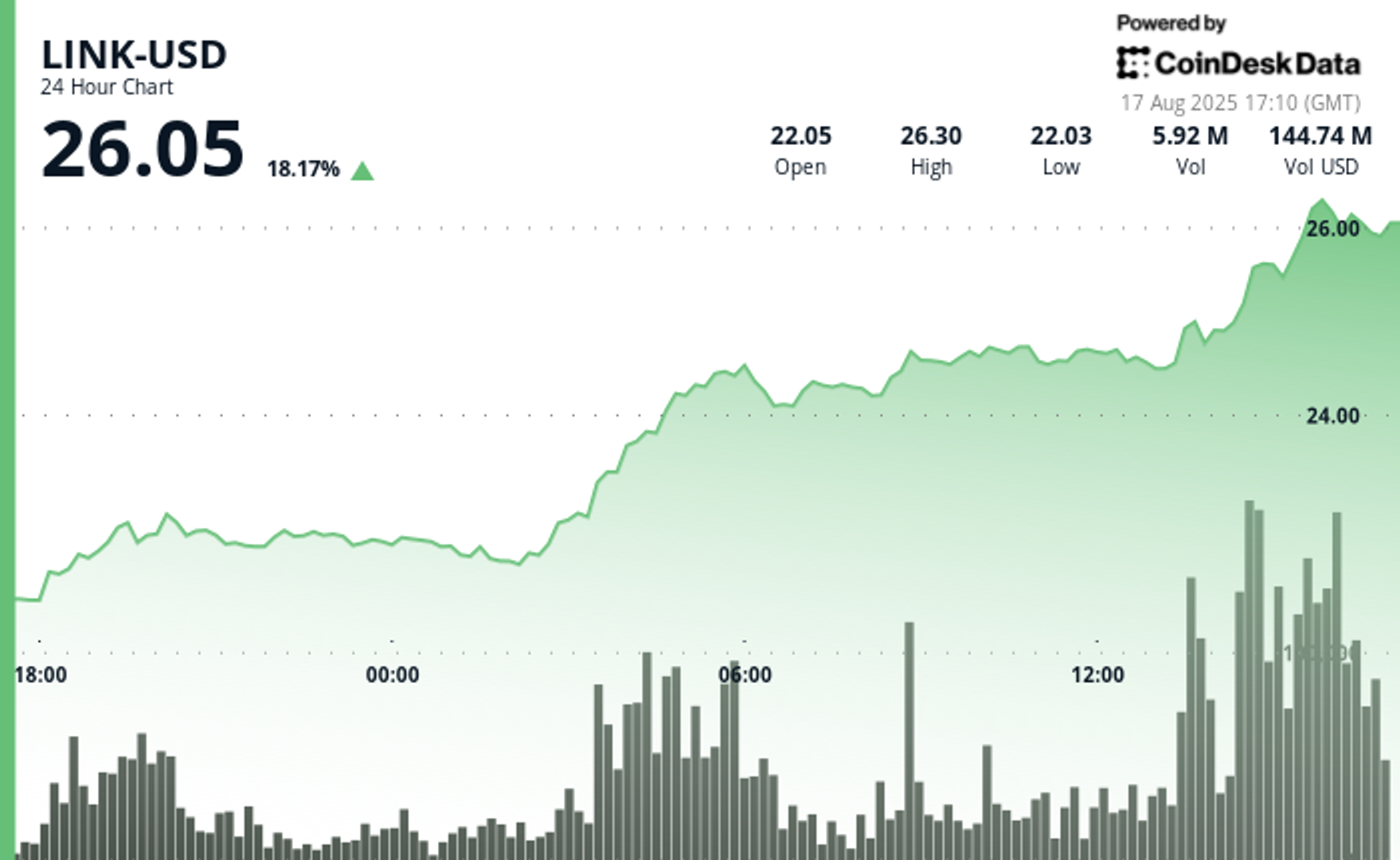

Chainlink’s LINK token jumped 18% to $26.05 on Sunday, in line with CoinDesk Information, pacing the highest 50 cryptocurrencies by share acquire as analysts and merchants cited momentum and up to date basic catalysts.

What Analysts Are Saying

Altcoin Sherpa described LINK as “probably the greatest cash proper now,” pointing to chart power that might carry towards $30. He defined that round-number ranges like $30 typically act as psychological boundaries the place sellers take earnings, so merchants needs to be cautious about chasing the transfer too late.

Zach Humphries, one other analyst, argued that LINK stays “very undervalued” at present costs. He emphasised that Chainlink underpins a lot of decentralized finance by delivering the worth feeds and cross-chain companies many protocols depend on. From his perspective, the token needs to be handled as a guess on essential infrastructure fairly than simply one other speculative asset.

Milk Street highlighted the robust buying and selling backdrop. The publication famous a 66% surge in 24-hour buying and selling quantity and mentioned LINK’s clear breakout above $24.50 added conviction for momentum merchants. They tied the bullish tone again to 2 key August developments: the launch of Chainlink’s new onchain reserve and its information partnership with Intercontinental Trade (ICE).

Chainlink Reserve

On Aug. 7, Chainlink launched the Chainlink Reserve, a sensible contract treasury designed to steadily accumulate LINK over time. The mechanism works by changing the venture’s income — paid in stablecoins, gasoline tokens, or fiat — into LINK after which locking these tokens onchain for a number of years.

The conversion course of, referred to as Cost Abstraction, automates this workflow. It makes use of Chainlink’s personal companies — worth feeds for truthful conversion charges, automation to set off transactions, and CCIP to consolidate charges from completely different chains — earlier than swapping into LINK by way of decentralized exchanges.

Chainlink says the Reserve has already collected greater than $1 million value of LINK, with no withdrawals deliberate for a number of years. It additionally earmarks 50% of charges from staking-secured companies corresponding to Sensible Worth Recapture to feed the Reserve, making a recurring stream of inflows.

The initiative serves two strategic functions.

First, it strengthens the hyperlink between adoption and token demand by making certain utilization revenues convert straight into LINK.

Second, it offers transparency: anybody can view inflows, balances, and the timelock at reserve.chain.hyperlink.

Chainlink has framed the Reserve as one piece of a broader financial design that features user-fee development and value reductions by way of the Chainlink Runtime Surroundings. For traders, the sensible takeaway is that community development can now translate into regular, programmatic accumulation of LINK on the open market.

Chainlink’s dashboard reveals the reserve now holds about 109,663 LINK tokens, with a market worth of roughly $2.8 million. The information additionally highlights that the common price foundation of those holdings is $19.65 per token, underscoring this system’s early accumulation technique.

ICE Partnership

On Aug. 11, Chainlink introduced a partnership with Intercontinental Trade (ICE), the operator of the New York Inventory Trade. The collaboration integrates ICE’s Consolidated Feed, which offers foreign-exchange and precious-metals charges from greater than 300 venues, into Chainlink Information Streams.

ICE is considered one of a number of blue-chip contributors to those datasets, that are aggregated by Chainlink to create quick, tamper-resistant information feeds to be used onchain. By incorporating ICE’s market protection, Chainlink goals to make its feeds extra engaging for banks, asset managers, and builders constructing tokenized property or automated settlement methods.

Chainlink Labs described the combination as a watershed second for institutional adoption. The pondering is that conventional finance gamers want confirmed, high-quality information to work together with blockchain functions, and bringing ICE’s feeds onchain helps meet that normal.

The partnership marked one of many clearest examples but of a serious Wall Avenue market information supplier partaking with blockchain infrastructure. By giving decentralized functions direct entry to ICE’s monetary information, it positioned Chainlink as a bridge between conventional markets and decentralized finance.

Trying Forward

Analysts spotlight LINK’s robust development, undervaluation and accelerating momentum, suggesting the token is able of power as traders digest Chainlink’s current strategic strikes.