KULR Know-how Group, Inc. (NYSE: KULR) introduced it has expanded its Bitcoin treasury to $101 million after buying roughly $10 million in extra bitcoin at a median worth of $108,884 per BTC.

The corporate’s complete bitcoin holdings have risen to 1,021 BTC, according to its Bitcoin treasury technique launched in December 2024, which commits as much as 90% of surplus money reserves to bitcoin as a major treasury asset.

“Bitcoin has outpaced each main asset class in 11 of the final 14 years, typically by a major margin,” stated the CEO of KULR Michael Mo. “The value cycles, nonetheless, will stay unpredictable, hash fee is unstable, and even vitality markets can shift quickly… In distinction, a dual-pronged mannequin permits KULR to seize the larger margin, whether or not from hash worth, coin worth, or each, all whereas strengthening our treasury resiliency.”

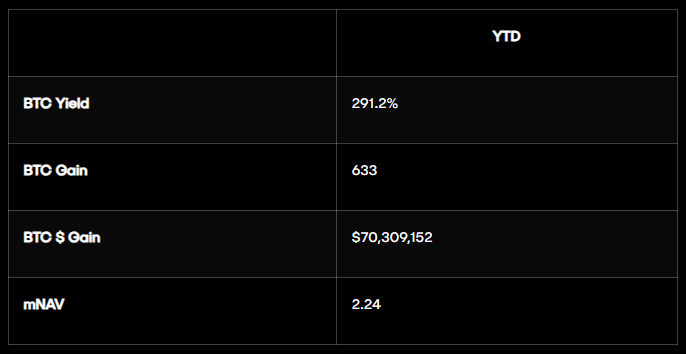

12 months up to now, KULR studies a BTC yield of 291.2%, reflecting the expansion in bitcoin per share by way of a mixture of surplus money, a Coinbase credit score facility, and its at-the-market (ATM) fairness program. The corporate’s BTC acquire stands at 633 BTC, valued at over $70 million, with a a number of of internet asset worth (mNAV) of two.24.

“BTC Yield is calculated as the proportion change period-to-period within the ratio of the Firm’s bitcoin holdings to its Assumed Absolutely Diluted Shares Excellent,” the corporate acknowledged. “This KPI helps assess the effectiveness of KULR’s bitcoin acquisition technique in a fashion KULR believes drives shareholder worth.”

“The buying and selling worth of KULR’s widespread inventory is influenced by a number of components past bitcoin holdings, and BTC Yield doesn’t predict or mirror the inventory’s market worth,” KULR stated. “Traders ought to contemplate this metric as a supplementary instrument and seek advice from the Firm’s monetary statements and SEC filings for added details about the Firm’s monetary place.”

The announcement comes someday after KULR revealed the profitable deployment of three,570 Bitmain S19 XP 140T mining machines in Asuncion, Paraguay. This improve brings KULR’s complete Bitcoin mining capability to 750 petahash per second (PH/s), with a goal of reaching 1.25 exahash per second (EH/s) by late summer season.

“We view our Bitcoin holdings as long run holdings and anticipate to proceed to build up bitcoin,” KULR acknowledged in its submitting. “We’ve not set any particular goal for the quantity of Bitcoin we search to carry.”